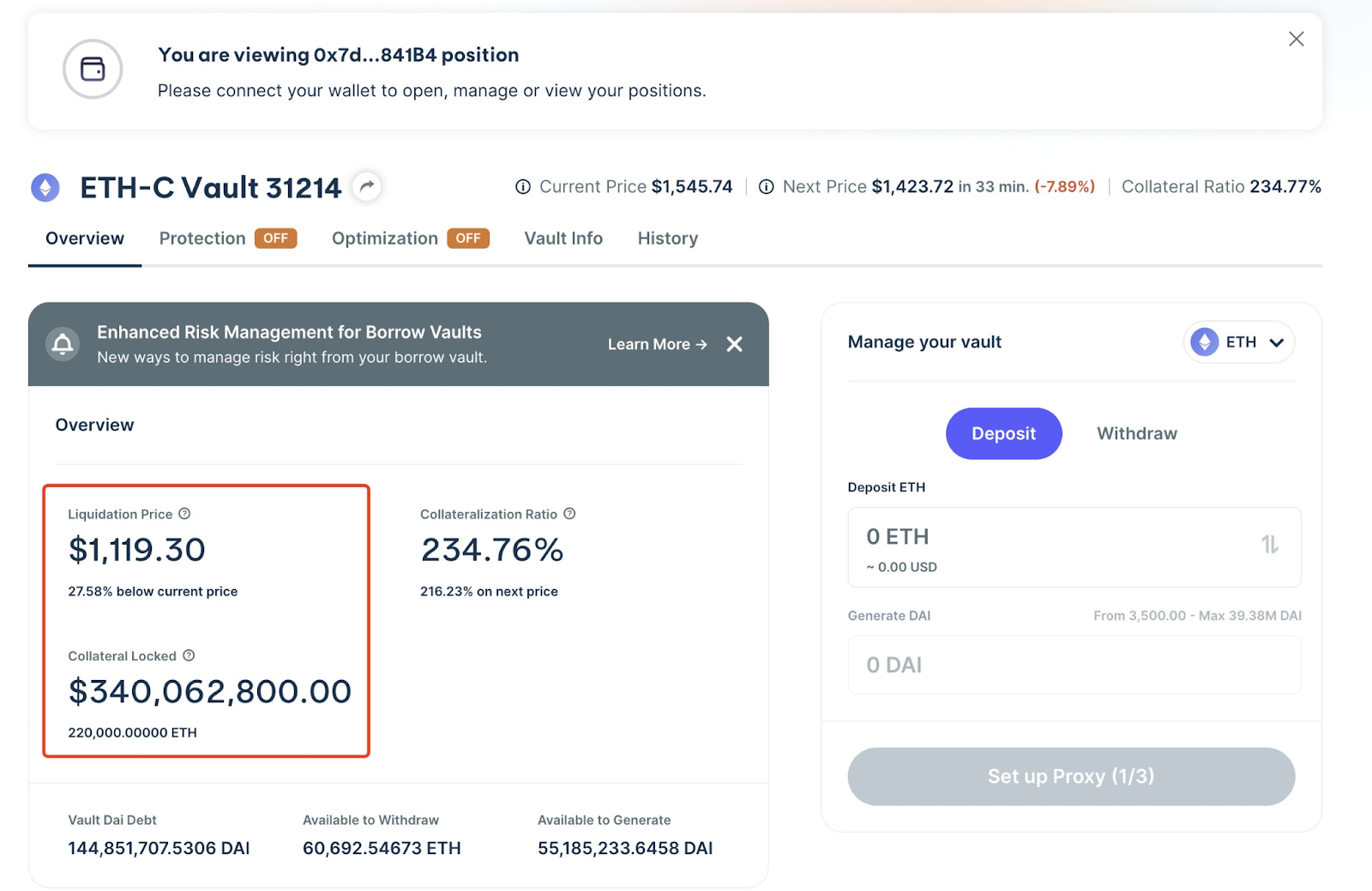

A whale made an emergency investment of millions of dollars to prevent a $340 million position from being liquidated if Ether drops to $1,119.

Whale Raises Liquidation Price

The whale deposited 10,000 ETH ($14.5 million) and 3.54 million Dai on the MakerDAO platform to raise the liquidation price, protecting a 220,000 ETH position. It was stated that the position would be liquidated if Ether drops to $1,119.3. This development came after another Ether investor was liquidated for $106 million on the decentralized finance (DeFi) platform Sky.

Sky platform requires users to deposit at least 150% collateral. In this system, users need to deposit at least $150 worth of ETH to borrow 100 DAI. On April 6, the investor lost 67,000 ETH after a 14% drop in ETH.

A major downturn occurred in the crypto markets, but the announcement regarding tariffs on April 2 may end investor uncertainty. Crypto strategy experts say that this uncertainty could lead to a new flow of investments into crypto assets. The likelihood of a recovery in the crypto markets is estimated to be 70%.

Expected Recovery After Huge Loss in Crypto Market

A major crash occurred in both crypto and traditional markets following U.S. President Donald Trump’s announcement on import tariffs. The S&P 500 lost $5 trillion after the announcement. However, it is suggested that tariffs could end global uncertainty and trigger a new investment movement towards crypto markets.

Michaël van de Poppe stated that the new tariffs represent the peak of uncertainty and that the end of tariff uncertainty could increase the likelihood of investors shifting towards digital assets. Additionally, the crypto intelligence company Nansen predicts a 70% chance that the market will bottom by June.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.