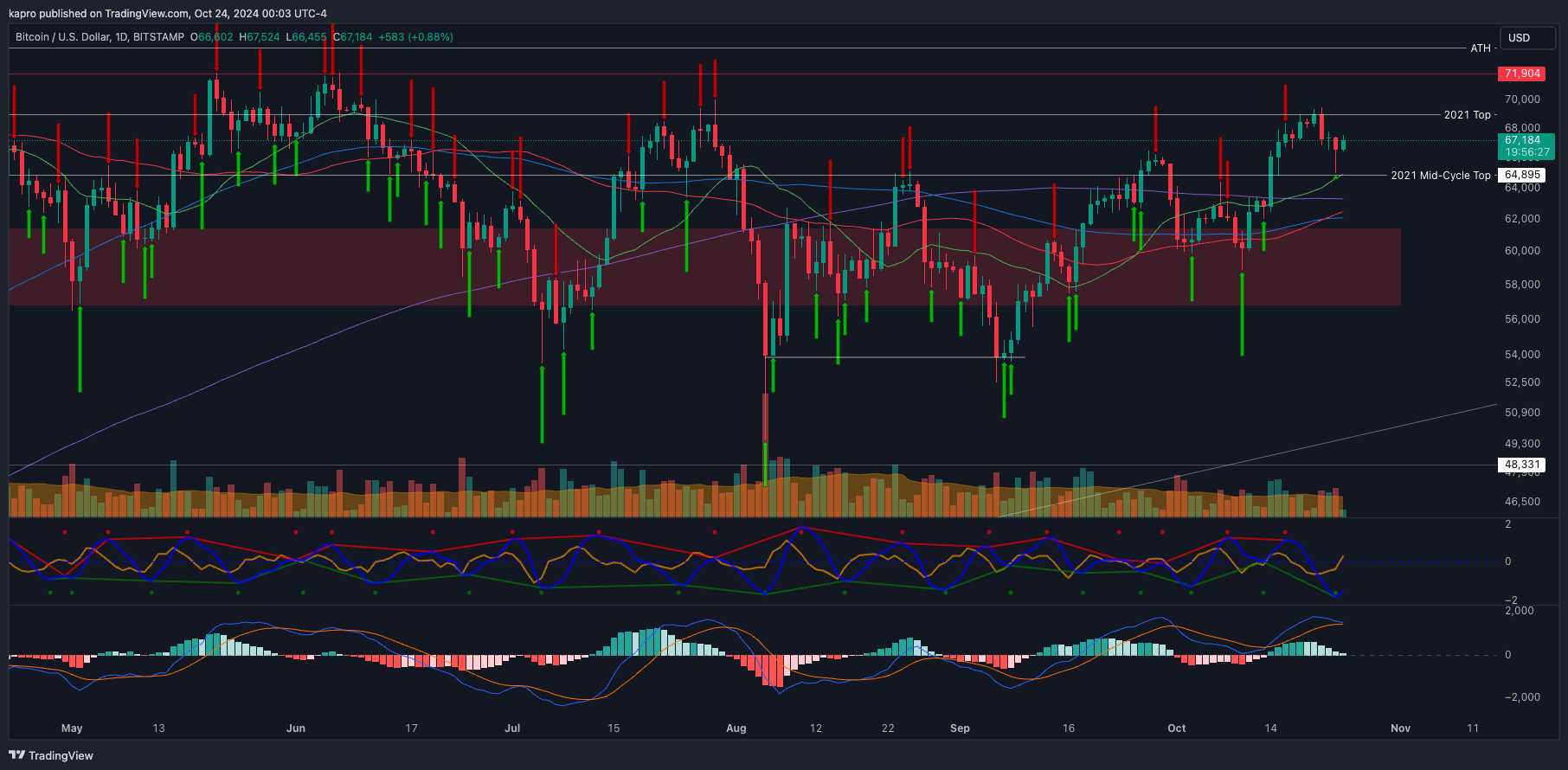

Bitcoin is currently at a pivotal point, with two crucial price levels to maintain as support after bouncing back from a 10-day low of $65,000. The price briefly fell after reaching $69,000 earlier in the week, driven by stop-loss orders and selling pressure. However, bulls regained control, pushing the price back above $67,000.

According to Keith Alan, co-founder of Material Indicators, Bitcoin needs to hold above $65,000, which corresponds to its April 2021 all-time high. Furthermore, it must avoid dropping below the 21-week simple moving average (SMA), currently at $62,700. Holding above these levels would signal that the short-term uptrend is intact.

Market analysts and traders are closely watching for Bitcoin to maintain its upward momentum. Michaël van de Poppe, a crypto analyst, predicts that the worst of the correction is over and anticipates Bitcoin will retest its all-time high within the next two to four weeks. However, U.S. macroeconomic events, including the Federal Reserve’s upcoming interest rate decision and job market data, could still influence Bitcoin’s price movements in the short term.

Might interest you: What is BabyDoge?

>If Bitcoin successfully holds these key levels, traders are optimistic about its trajectory, with some suggesting that the recent dip was just a temporary setback.

You can join our Telegram channel to not miss the news and stay informed about the crypto world.