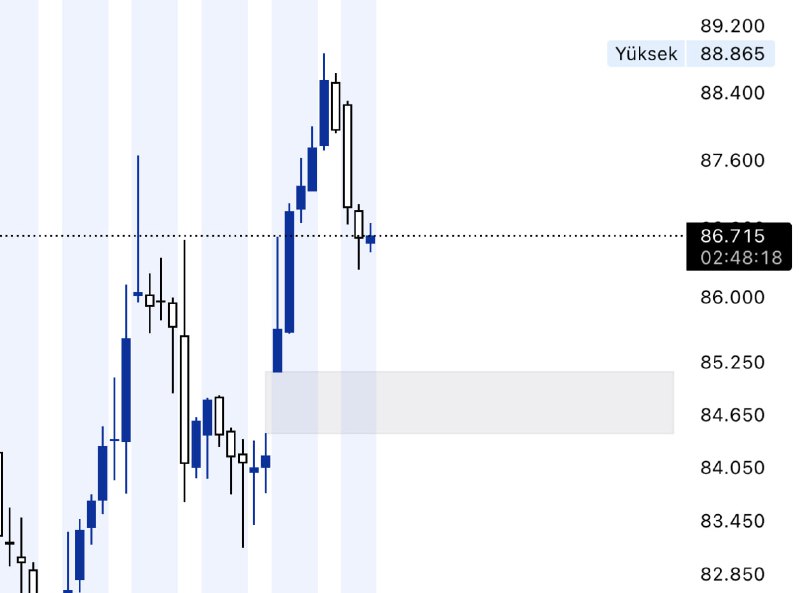

The price gap between $84,000 and $85,000 in Bitcoin CME futures increases expectations for a short-term pullback.

Bitcoin CME Futures Price Gap: Pullback Expected Between $84,000 and $85,000

As spot Bitcoin (BTC) surged over the weekend, reaching $87,800 on Monday, another price gap emerged between the CME futures closing price on Friday and the start of the new week’s trading.

CME futures closed at $84,190 at the end of last week and opened about $1,000 higher at $85,160. This signals the possibility of a pullback due to Bitcoin’s tendency to fill gaps in CME futures.

By mid-March, Bitcoin had filled the most recent gap created during the November rally following President Donald Trump’s election victory. This gap was fully closed when Bitcoin dropped to $76,700 in mid-March.

Price gaps occur because spot Bitcoin trades 24/7, while CME futures only trade 23 hours a day from Sunday to Friday. When significant price movements occur during the CME’s off-hours, a gap forms between the previous close and the next day’s open.

Historically, Bitcoin has often retraced to fill such gaps. Based on this pattern, Bitcoin is likely to revisit the $84,000 – $85,000 range in the near term.

This content does not constitute investment advice. Cryptocurrency markets are highly volatile and carry significant risks. It is important to conduct your own research before making any investment decisions.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.