During the period leading up to the U.S. elections, the cryptocurrency markets are closely monitoring the possibility of Donald Trump’s re-election. For DeFi (decentralized finance) projects and cryptocurrencies like Ethereum, this period is seen as potentially a very positive one. Trump’s campaign promise to make the U.S. a major hub for cryptocurrencies is increasing these expectations, especially driving movement in well-established projects like Ethereum. Ethereum, which has risen by 10% in the last 24 hours, surpassed the $2,800 mark, reflecting investor optimism about these developments.

Impact of U.S. Elections on DeFi

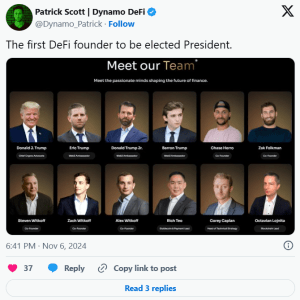

Trump’s campaign promises to turn the U.S. into a crypto hub are strengthening growth expectations for DeFi projects. This promise suggests that the regulatory framework in the U.S. may become more flexible, allowing crypto projects to operate with greater freedom. A regulation that enables DeFi platforms to operate more freely in the U.S. could lead to growth in their user base and allow new projects to focus more on innovation. This would increase investor confidence, contributing to the rise of established platforms like Ethereum.

Trump’s crypto-friendly approach could lead to a relaxation of industry regulations and the classification of tokens as commodities rather than securities. Arthur Cheong, founder of DeFiance Capital, describes this as a new “Renaissance” period for DeFi. According to Cheong, DeFi projects will not only grow but also mature by building a stronger user base and income streams. The current period, with key projects like Aave seeing record revenues, shows that DeFi is maturing.

Social Media and Market Sentiment

Social media plays a crucial role in shaping investor sentiment in the crypto markets. On the social media platform X (formerly Twitter), analyses show that DeFi and cryptocurrencies are among the most talked-about topics in light of Trump’s potential victory. According to Mindshare data, DeFi projects have garnered significant attention in the last 24 hours in discussions about crypto and financial innovation. This interest reflects investor optimism that DeFi could continue to grow under future regulations.

Ethereum’s Rise

With these positive expectations surrounding the election, Ethereum (ETH) rose by 10%, surpassing $2,800, while many major DeFi indices also showed increases. According to CoinGecko data, large DeFi indices gained an average of 22% in the past 24 hours. This surge indicates growing demand for DeFi projects and highlights how Trump’s crypto-friendly policies are resonating positively in the market.

Hope for Flexibility in Cryptocurrency Regulations

The optimistic expectations surrounding Trump’s potential victory are continuing to drive activity in the DeFi and broader cryptocurrency markets. It’s expected that Trump’s crypto-friendly policies will give DeFi and Ethereum more room to grow and attract more investor interest. Additionally, these developments in the U.S. could have a global impact, with other countries potentially adopting similar policies.

If Trump wins, DeFi projects and strong altcoins like Ethereum may enter a long-term bull market. Especially with regulatory relief in the U.S. and crypto-friendly policies fostering innovation in the industry, this could support the overall rise in the cryptocurrency market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.