What does World Liberty Financial (WLFI), a DeFi project supported by Donald Trump and his family, hold in its portfolio? What are they investing in?

World Liberty Financial (WLFI), a DeFi project supported by Donald Trump and his family, has garnered attention within the decentralized finance sector. The platform allows users to borrow, lend, and invest in cryptocurrencies. The project’s goal is to make America the hub of the crypto financial ecosystem while ensuring the broader acceptance of the U.S. Dollar within the crypto world. So, what is the current portfolio distribution of World Liberty Financial?

What is WLFI Investing In?

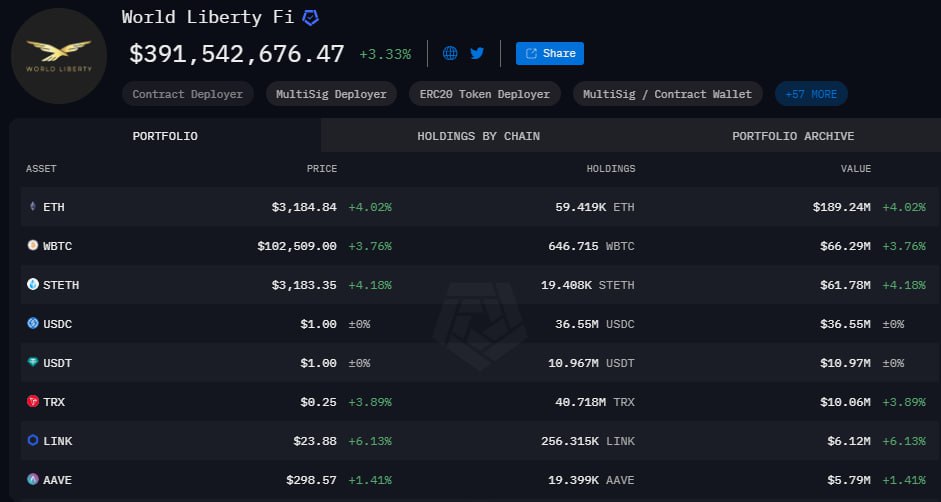

The portfolio begins with 59,419 $ETH (approximately $189.25 million), indicating that the platform holds a strong position in Ethereum within the crypto market.

Additionally, there are significant holdings such as 646,715 $WBTC (worth $66.29 million) and 19,408 $STETH (worth $61.78 million), showing that WLFI is also investing in key digital assets like Bitcoin and staked Ethereum versions.

- 59,419 $ETH (worth $189.25 million)

- 646,715 $WBTC (worth $66.29 million)

- 19,408 $STETH (worth $61.78 million)

- 49.718 million $TRX (worth $10.06 million)

- 256,315 $LINK (worth $6.12 million)

- 19,399 $AAVE (worth $5.79 million)

- 5.778 million $ENA (worth $4.16 million)

- 134,216 $ONDO (worth $177.17 thousand)

In addition, WLFI still has $47.52 million available for further coin acquisitions, bringing their total assets to $391.5 million.

Moreover, WLFI capitalized on the recent market dip by purchasing $10 million worth of Ethereum. At a price of $3,079 per ETH, they acquired 3,247.3 ETH, strengthening their portfolio with this strategic move. This action reflects the project’s diversification strategy within the crypto market.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.