Decentralized finance (DeFi) is evolving rapidly, bringing innovative platforms like Aerodrome Finance (AERO) to the forefront. Built on the Base network, Aerodrome aims to address key challenges in liquidity management and token trading. The platform rewards liquidity providers with its native token, AERO, while ensuring a seamless user experience for effortless token swaps. So, what is Aerodrome Finance (AERO), and what is its purpose? Let’s dive in.

What is Aerodrome Finance (AERO) and What Does It Do?

Launched on the BASE network on August 28, 2023, Aerodrome Finance is a next-generation AMM designed to serve as a central liquidity hub for the Base ecosystem. It features a robust liquidity incentive mechanism, a vote-lock governance model, and a user-friendly interface. The platform builds upon the latest features of Velodrome V2, offering an advanced DeFi experience.

Aerodrome Finance aims to solve one of the biggest challenges in the DeFi ecosystem—liquidity fragmentation—by bringing liquidity providers and investors together in a mutually beneficial manner.

Additionally, by inheriting Velodrome V2’s advanced features, Aerodrome ensures high efficiency in liquidity management. It incentivizes liquidity providers with AERO token rewards while maintaining an optimal balance between liquidity supply and user incentives, making it a key player in the Base ecosystem.

How Does Aerodrome Finance Work?

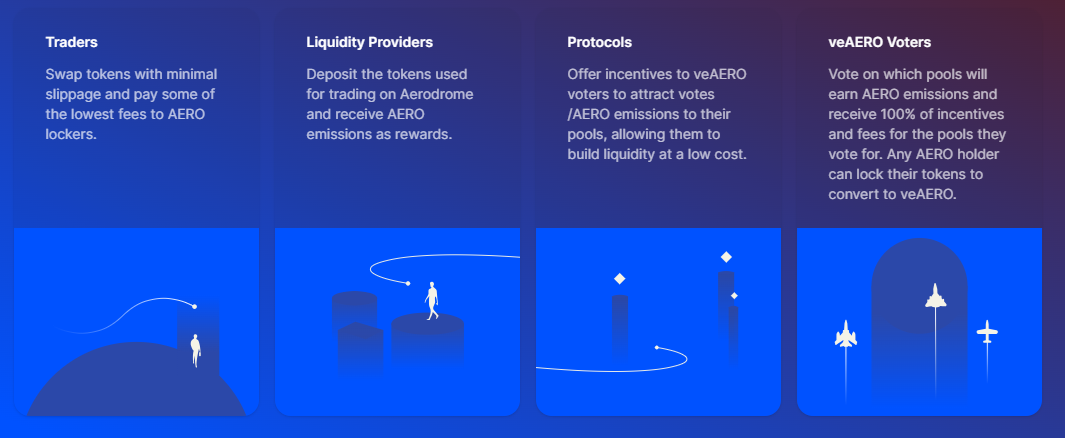

Aerodrome Finance operates as an AMM where users provide liquidity by depositing their tokens into liquidity pools. This model enables investors to swap tokens without relying on a traditional order book system or searching for direct buyers or sellers. The key differentiator of Aerodrome is its dynamically adaptive liquidity reward system, ensuring that liquidity providers are fairly compensated based on their contributions while maintaining the system’s sustainability.

The platform also features a decentralized governance mechanism, allowing users to participate in decision-making regarding the ecosystem’s future. Users who stake AERO tokens gain voting power in governance decisions and earn additional AERO tokens. This ensures that Aerodrome’s development is community-driven and supports long-term growth.

With its strong liquidity management, community-focused governance structure, and scalable infrastructure, Aerodrome Finance presents an ideal platform for both individual investors and decentralized applications. As it continues to introduce new features, it aims to become the leading centralized liquidity platform within the DeFi ecosystem.

Click here to check project’s white-paper.

AERO and veAERO

AERO is the core utility token of the Aerodrome Finance ecosystem, designed to support liquidity provision and platform governance. It incentivizes liquidity providers and follows a distribution model that encourages user participation and long-term growth within the ecosystem.

veAERO, on the other hand, serves as Aerodrome’s governance token and is issued as an ERC-721-based NFT. Users can obtain veAERO by locking their AERO tokens for a specified period, with longer lock durations providing increased voting power. The maximum lock period is four years, granting the highest level of governance influence.

veAERO holders have the authority to vote on key decisions such as reward distribution, protocol updates, and ecosystem developments, giving them the power to shape the platform’s future.

Aerodrome’s long-term vision is to enhance liquidity incentives and strengthen its decentralized governance model, establishing itself as a more sustainable and efficient liquidity hub within the DeFi ecosystem.

Clich here to get project’s X account.

How to Use Aerodrome Finance?

Aerodrome Finance (AERO) is a decentralized liquidity hub built on the BASE network, designed to facilitate token swaps and attract liquidity. Here are the key aspects of how it works:

- Token Swaps: Aerodrome enables users to trade tokens with low slippage and minimal transaction fees, ensuring a more efficient and reliable trading experience.

- Liquidity Incentives: Liquidity providers can deposit tokens into trading pairs and earn AERO token rewards, encouraging participation and contribution to the platform.

- Governance: AERO token holders can lock their tokens to receive veAERO NFTs. These NFTs grant voting rights, allowing users to influence the platform’s governance and future direction.

- Epoch-Based Rewards: Rewards are distributed periodically (epochs), and liquidity providers earn a share of AERO emissions based on the votes their liquidity pools receive.

By combining advanced AMM functionalities with a decentralized governance structure, Aerodrome Finance offers a robust platform for both users and investors.

Token Economy

Aerodrome Finance manages its utility and governance functions through two tokens:

- $AERO: The protocol’s ERC-20 utility token.

- $veAERO: The governance token issued as an ERC-721 NFT (non-fungible token).

$AERO is distributed to liquidity providers through emissions.

$veAERO, on the other hand, is used for governance. Any $AERO holder can lock their tokens to receive $veAERO (also known as Lock or veNFT). Additional tokens can be added to an existing $veAERO NFT.

The lock duration can be up to 4 years, following this linear relationship:

- Locking 100 $AERO for 4 years results in 100 $veAERO.

- Locking 100 $AERO for 1 year results in 25 $veAERO.

The longer the lock duration, the greater the voting power (vote weight) of the locked balance.

Additionally, Aerodrome Locks (veNFTs) can utilize the Auto-Max Lock feature, which extends the lock period to a maximum of 4 years without decreasing voting power over time. The Auto-Max Lock feature can be toggled on or off for each Lock (veNFT).

Aerodrome (AERO) Founding Team

Aerodrome Finance was launched by Velodrome, a major decentralized exchange (DEX) on the Optimism network. One of Velodrome Finance’s core members, Alex Cutler, played a key role in the creation of Aerodrome.

Aerodrome Finance distributes $AERO tokens as rewards to liquidity providers while utilizing $veAERO for governance. Users can lock $AERO to obtain $veAERO, granting them voting rights within the platform. The longer they lock their tokens, the greater their voting power.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.