Bedrock (BR) is the world’s first multi-asset liquidity restaking protocol that provides liquidity protection solutions to users. Bedrock (BR) aims to simplify DeFi, making it accessible and rewarding for everyone. Now, let’s explore in detail what Bedrock (BR) is and what it does.

What is Bedrock (BR)? What Does It Do?

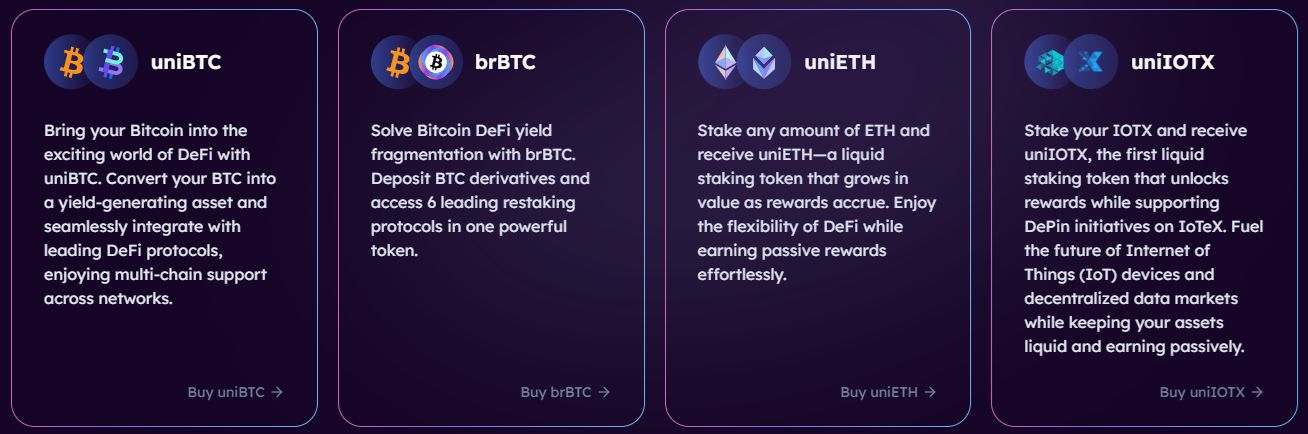

Bedrock (BR) is a multi-asset liquidity restaking protocol designed in partnership with RockX, a provider of blockchain infrastructure and staking services with a strong history in the industry. It offers a solution for users to “maximize yield while preserving liquidity.” The protocol enables restaking and staking with support for multiple assets, including:

- brBTC: Specifically designed for Bitcoin holders to participate in next-generation DeFi opportunities. Bedrock manages these assets across multiple trusted yield sources, including Babylon, Kernel, Pell, and Satlayer.

- uniBTC: A restaking protocol that accepts wrapped BTC tokens, with a partnership with the Bitcoin staking protocol Babylon Chain. The first supported wrapped BTC token is wBTC, which enables wBTC holders to benefit from both staking rewards and Ethereum network security.

- uniETH: Designed for native restaking with added yield from EigenLayer, providing both institutional-grade security and additional rewards for liquid ETH staking.

- uniIOTX: A liquid staking solution for the IoTeX blockchain, removing some of the drawbacks associated with Delegated Proof of Stake (DPoS) on IOTX.

What Does Bedrock (BR) Offer?

Bedrock offers a product package with Liquid Restaking Tokens (LRT) for assets like Wrapped BTC, ETH, and IOTX.

Bedrock unlocks liquidity for PoS tokens such as wBTC, ETH, and IOTX using the uni standard, maximizing their value through liquid staking tokens like uniBTC, uniETH, and uniIOTX.

Bedrock’s Universal Token Model Includes:

- Staked PoS tokens in Bedrock.

- All future staking rewards earned by staking on-chain.

- Babylon, EigenLayer, and Bedrock Diamond Points.

The uniToken follows a Non-Rebasing Model, meaning the token’s quantity does not increase over time, but its value increases, reflecting its growing worth alongside rewards from EigenLayer and Bedrock.

Security

Bedrock is committed to maintaining high functionality and security standards by continuously improving its products and services. All security measures, including smart contract audit reports, are published in the security section.

Click here to get project’s white-paper.

How Does LRT Work in Bedrock?

uniETH is an LRT token with an advanced system flow and mainnet restaking service. Ethereum holders can secure the Ethereum network and benefit from restaking to earn sustainable income opportunities.

The protocol will initially enable native restaking through uniETH, which is staked and restaked through Eigenpod. This design is flexible enough to support future restaking delegations and allows users to select the best validator sets for yield opportunities.

When the liquid restaking limit is lifted, a vault will be enabled to accept ETH and other LSTs, distributing rewards through EigenLayer, offering long-term returns for ETH holders in a single solution.

After one year, uniETH will upgrade from LST to LRT, providing continuous high yields.

Click here to get project’s X account.

BTCFI: Beyond HODLing

BTCFI allows Bitcoin holders to generate additional value from their assets while preserving security and sovereignty. It combines staking, lending, and BTC-backed stablecoin protocols to convert idle Bitcoin assets into financial tools.

BTCFI 2.0: Unlocking Bitcoin’s Full Potential

BTCFI 2.0 offers sustainable yield opportunities for Bitcoin holders. Innovations include:

- Advanced Security: Layer 2 solutions that preserve Bitcoin’s security.

- Multiple Yield Options: Staking, lending, and liquidity provision.

- Risk-Managed Stablecoin Integration: Using BTC-backed stablecoins.

- Flexible Yield Optimization: Automated yield strategies with different protocols.

Restaking Rewards

Rewards come in five parts:

- Ethereum native staking rewards accumulated within uniETH.

- EigenLayer restaked points and future airdrops.

- Potential rewards from restaking through AVS.

- Bedrock points and future airdrops.

- A referral program (coming soon).

What is EigenLayer?

EigenLayer is a protocol that introduces the concept of restaking on Ethereum. Users can participate in EigenLayer smart contracts by restaking their ETH or liquid staking tokens (LST), securing additional applications in the network and earning rewards.

EigenLayer enables Ethereum stakers to secure multiple services simultaneously, reducing capital costs and increasing security guarantees. It allows decentralized services to leverage Ethereum’s security while promoting free-market governance.

Features of EigenLayer:

- Decentralization through Restaking

- Custom Penalty Mechanisms

- Operator Delegation

What Does EigenLayer Offer?

EigenLayer’s ecosystem includes four main components:

- Active Verified Services (AVS): Provides decentralized services by leveraging Ethereum’s security.

- Ethereum Stakers: Stakeholders restake their ETH to secure multiple networks, earning additional rewards but with the risk of slashing if conditions are not met.

- Node Operators: Provide computational resources for decentralized applications and services.

- EigenLayer Protocol: Facilitates cooperation between stakers, operators, and services through smart contracts.

What About Babylon?

Babylon is a Bitcoin staking protocol that offers three key security features when used with a PoS (Proof of Stake) chain:

- Slashable PoS Security: In case of a security breach, 1/3 of the Bitcoin stake is slashed, and 2/3 is kept alive according to PoS protocol.

- Staker Security: Each Bitcoin staker has the right to withdraw their funds in compliance with PoS protocol.

- Staker Liquidity: Unbonding staked Bitcoin is fast and secure without needing social consensus.

Babylon Bitcoin Staking

Babylon solves two critical needs in the crypto market:

- PoS Capital Dependency: PoS chains rely on the value of staked assets for security. Babylon allows smaller PoS chains to rely on external blockchain security.

- PoW Capital Dormancy: PoW blockchains do not yield for Bitcoin holders while securing the network. Babylon introduces a system where BTC holders can earn yield.

Babylon offers a non-custodial system that enforces PoS slashing rules without requiring third-party services for Bitcoin staking.

Bedrock Tokenomics

The token distribution is as follows:

- Public Sale: 5% (50.00M)

- Strategic Reserve: 27%

- Founding Team: 20%

- Marketing & Partnerships: 20%

- Future Airdrops & Incentives: 18.5%

- Other: 14.5%

This distribution ensures investments are made into various areas to sustain long-term growth and the project’s viability.

Bedrock (BR) Partners

Bedrock collaborates with various projects to build a strong and reliable ecosystem. These partnerships include Curve, Timeswap, Penpie, Manta, Scroll, Linea, Arbitrum, Celer, Pendle, Lyve, and Equilibria. These strategic collaborations allow Bedrock to offer more opportunities and innovative solutions to its users.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.