Berachain is a high-performance EVM-Identical Layer 1 blockchain built on top of BeaconKit, utilizing the Proof-of-Liquidity (PoL) consensus mechanism. It is designed to address the misalignment of incentives found in traditional blockchain systems, particularly in Proof-of-Stake (PoS) models. Let’s dive into what Berachain is and how it works in more detail.

What is Berachain (BERA)?

Berachain is a new blockchain created to solve the issue of incentive misalignment in consensus mechanisms. In traditional Proof of Stake (PoS) blockchains, users are required to lock up their assets to participate in the security model and earn staking rewards. This results in an incentive misalignment between projects that want activity and transaction volumes on the blockchain, and the staking security mechanism, which requires assets to be locked.

In an efficient market, users are less likely to engage with financial applications built on the blockchain if they can earn more by staking their assets with less risk.

Berachain aims to solve this problem using the Proof of Liquidity (PoL) consensus mechanism. PoL is an extension of PoS with restructured incentive mechanisms designed to promote DeFi (Decentralized Finance) activity over asset lockup, while still adding security and decentralization to the network.

Click here to review the project’s white-paper document.

What Does Berachain (BERA) Do?

Use Cases and Incentive Mechanisms: Berachain starts with three native assets: $BERA, $BGT, and $HONEY, each offering different opportunities for Berachain participants.

$BERA: This is the native utility token used for transaction fees, similar to how ETH functions on Ethereum. BERA holders can also earn governance rights by staking in reward vaults.

$BGT: Known as the Berachain Governance Token, BGT allows holders to vote on network proposals and updates. It’s a non-transferable token earned through staking BERA and other accepted assets. BGT powers governance decisions within Berachain’s DAO, where decisions about accepted assets, protocol upgrades, and key platform changes are made. Holders can either vote directly or delegate their vote.

$HONEY: Berachain’s native stablecoin, HONEY, is pegged to the US dollar and supports transactions across the network. Minted through a collateral-backed process, HONEY aims to offer stability within the ecosystem, functioning in lending, trading, and other DeFi operations.

To view the project’s X account, click here.

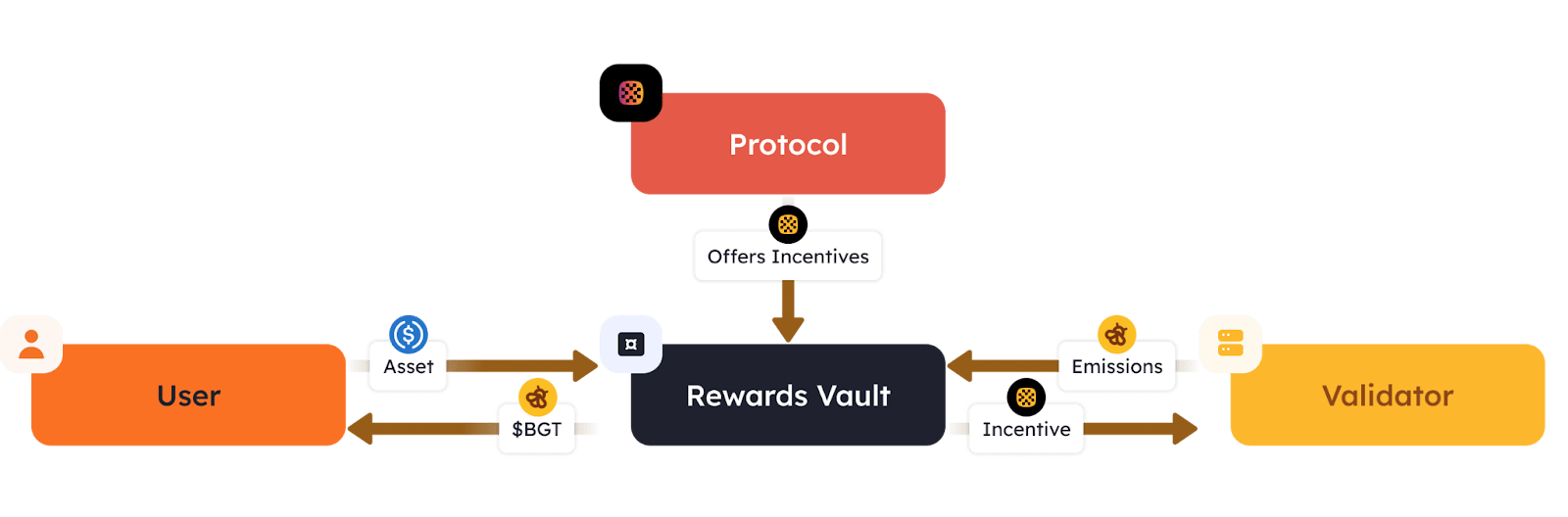

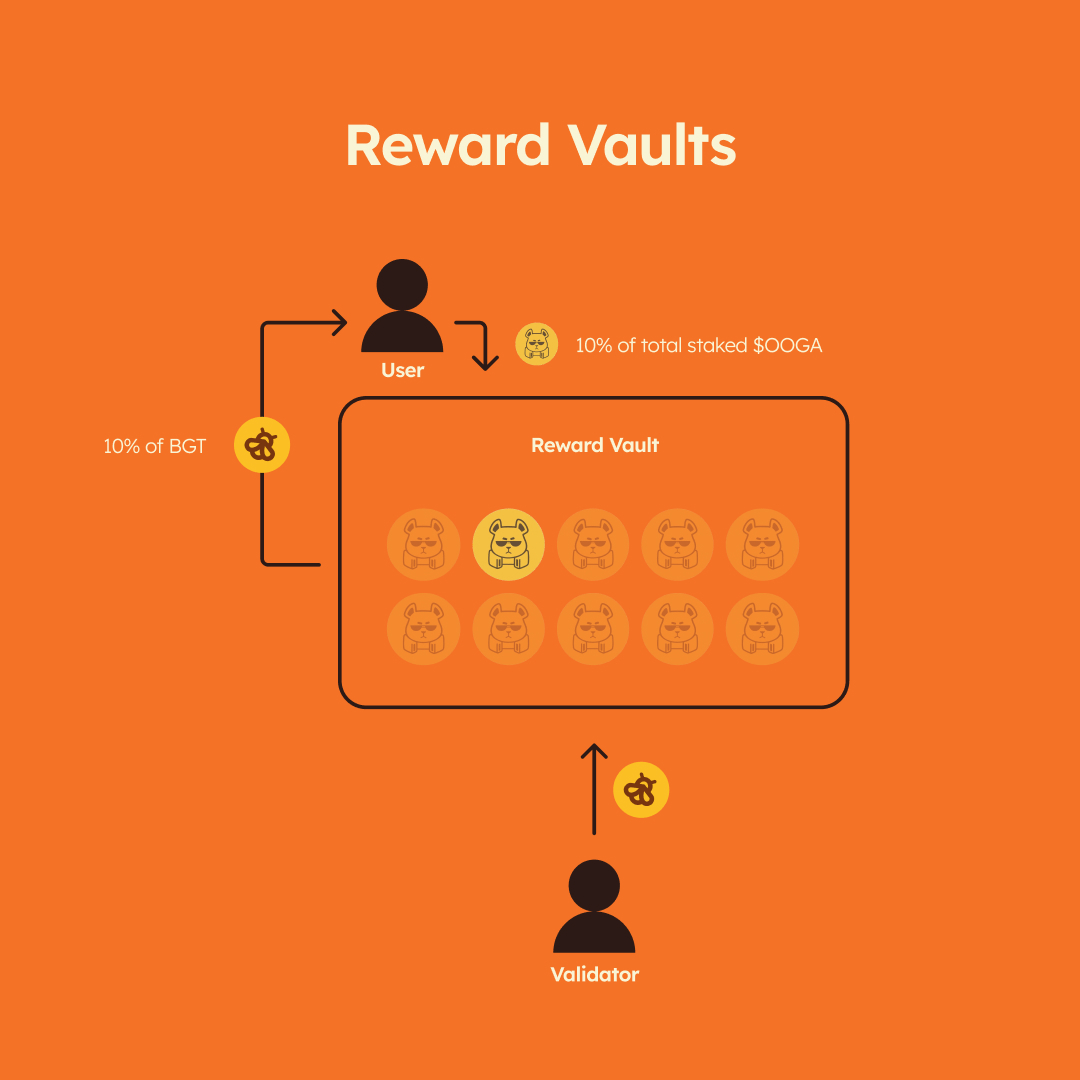

In traditional PoS, validators earn rewards directly from the blockchain as they validate transactions, and delegators to these validators receive a percentage of the total rewards based on how much they stake. In Berachain, validators earn $BGT, but the difference is that validators must direct most of the $BGT they earn to an application’s reward vault, rather than keeping it for themselves (validators still keep 0.5 $BGT per block).

This structure allows applications to compete by offering bribes to validators—the more attractive the bribe, the more likely validators are to direct their $BGT to that application (the bribe is typically in the form of the application’s native asset, but can be any token).

The other side of this incentive mechanism is the end user. For example, users can provide liquidity to the HONEY–USDC liquidity pool on the native DEX (BEX) to earn LP fees. The user will then receive LP tokens representing their position, which they can deposit into the BEX HONEY–USDC reward vault to earn $BGT on top of their LP fees.

What is Proof of Liquidity (PoL)?

Berachain’s Proof of Liquidity (PoL) model provides a system where validators, liquidity providers, and the broader user base all play a role in creating a liquidity-rich network. In the PoL system, users contribute assets to “reward vaults,” allowing these assets to continue being used in DeFi protocols while earning governance tokens.

Validators decide how to allocate BGT rewards to these vaults, creating a marketplace where applications offer incentives for BGT distribution. This structure creates a powerful incentive system, aligning liquidity provision with network security.

EVM Compatibility: Berachain’s execution layer is identical to Ethereum’s EVM, meaning it uses unmodified EVM clients like Geth and Nethermind to run smart contracts. This setup ensures seamless integration for dApps on Ethereum, enhancing Berachain’s flexibility and providing immediate compatibility with Ethereum ecosystem upgrades.

Berachain Team

Berachain was founded by individuals named Papa and Smokey, who have not publicly disclosed their identities. At this time, their identities remain unknown.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.