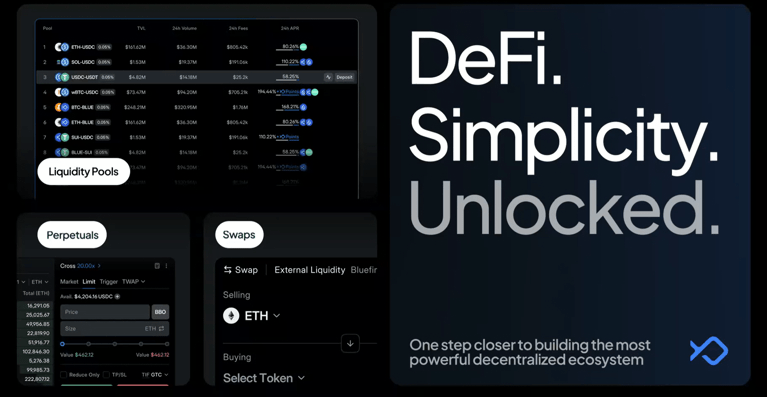

Bluefin (BLUE) is a decentralized order book-based exchange designed for both professional and first-time traders. It focuses on security, transparency, and redefining the user experience of on-chain trading platforms. Let’s take a detailed look at what Bluefin (BLUE) is and what it does.

What is Bluefin (BLUE)? What Does it Do?

Bluefin (BLUE) is a decentralized spot and derivatives trading platform operating on the SUI blockchain. It provides users with fast, low-cost, and secure transactions. The BLUE token is used for transaction fees, staking, and governance.

Using smart contracts, it enables users to engage in spot and derivatives trading. Leveraging the speed and low transaction costs of SUI, it offers a secure and efficient trading experience. BLUE tokens are utilized for transaction fees and governance, allowing users to contribute to the platform’s development.

Bluefin supports various Web3 wallets such as Suiet, Martian, Stashed, Nightly, and Surf Wallet, which are supported by the SUI blockchain. Among the popular options are the Sui Wallet and Google account connection (enabled with ZK technology).

By using a Google account, users no longer need to manage private keys, and the public key created for the account becomes unique to Bluefin. This allows users to connect to Bluefin from any device using the same Google account, with their general address remaining the same across devices.

What Can Be Done on Bluefin (BLUE)?

- Deposit USDC and Start Perpetual Contracts Trading: On Bluefin v2, you can trade perpetual contracts using wUSDC (USDCeth) tokens as collateral. This can be done through an integrated bridge facilitating asset transfer between Ethereum and SUI.

- Use Asset Bridge: Assets can be bridged from Ethereum to SUI and vice versa. Bluefin uses the Wormhole bridge to ensure smooth transfers across networks.

- Swap Assets: If you hold different assets (e.g., SUI or Native USDC), you can swap them with wUSDC (Ethereum) using Bluefin’s Spot CLMM Swap feature. This ensures better price differences via Bluefin’s liquidity pools.

- Deposit Funds and Account Financing: To trade on Bluefin, you can link your Sui wallet, deposit USDC, and fund your account.

- Wallet Connection and Account Management: By linking your Sui wallet, you can trade on Bluefin and synchronize your wallet across all devices. Additionally, using a Google account allows you to manage your account without dealing with private keys.

Click here to get project’s X account.

Perpetual Swaps and Their Advantages:

Perpetual swaps allow investors to contractually trade an asset at a future time, either buying or selling it. When the asset used in the trade (e.g., USD) is used as collateral, perpetual swaps mimic the payment structures of the underlying assets traded on the spot market (referred to as Linear Perpetual Contracts). This feature allows perpetual swaps to offer access to digital assets from a single platform, enabling efficient trades without storage costs or excessive transaction fees.

- Leverage Trading Ease: Perpetual swaps facilitate leverage trading, allowing investors to open larger positions with smaller collateral.

- No Need to Store Collateral Assets: In this type of trade, there is no need to store the underlying assets. Trading is done directly on the swap contract, eliminating extra costs related to storage and security.

- Position Continuity: Perpetual swap contracts can remain open indefinitely, meaning positions can theoretically stay open forever.

- Easy Short Position Opening: Perpetual swaps also make short positions easier to open, allowing investors to sell assets in anticipation of price drops, thus enabling more diverse trading strategies.

Bluefin Concentrated Liquidity Market Maker (CLMM) – What Is It?

Bluefin’s Concentrated Liquidity Market Maker (CLMM) protocol! It’s an innovative protocol designed to optimize capital efficiency, deepen liquidity, and provide a seamless trading experience. Whether you’re a novice investor or an experienced trader, Bluefin’s CLMM offers powerful tools to enhance your decentralized trading strategies.

Key Benefits of Bluefin’s CLMM:

- Enhanced Capital Efficiency: Concentrate liquidity in specific price ranges to maximize potential returns.

- Reduced Slippage: Enjoy smoother trades with minimal price impact, influenced by the platform’s overall liquidity.

- Seamless Integration: The CLMM integrates with Bluefin’s derivatives platform to create a unified trading ecosystem.

- Rewarding Liquidity Mining: Earn BLUE, SUI, and other potential rewards by contributing liquidity to our pools.

Spot vs. Perp Account on Bluefin

Bluefin offers two distinct trading options: Spot Trading and Derivatives (Perps) Trading. Understanding the differences is crucial for making informed decisions based on your strategy.

Spot Trading:

- Immediate Settlement: Spot trades settle instantly on-chain.

- CLMM Liquidity Pools: Trade token pairs using concentrated liquidity pools for improved efficiency and reduced slippage.

- Wallet-Based Trading: Spot trading is directly tied to your connected wallet, allowing seamless trading and liquidity provisioning without separate deposits.

Perps Trading:

- Leverage Positions: Trade with up to 20x leverage, amplifying potential gains (and losses).

- Wormhole USDC Only: Currently, derivatives trading supports only Wormhole USDC as collateral. Native USDC integration is in progress.

- Separate Account: Derivatives trading requires separate deposits into your derivatives account, independent of the wallet balance used for spot trades.

Click here to get project’s white-paper.

Token Distribution and Release Schedule

The First Steps Toward Decentralization

The upcoming token generation event (TGE) and initial BLUE distribution are key steps toward a decentralized governance model. Bluefin’s strategy is designed to align incentives across users, contributors, and stakeholders, ensuring long-term ecosystem growth and platform integrity.

- Token Symbol: BLUE

- Max Supply: 1,000,000,000

- Initial Circulating Supply: 150,385,000

- Vesting: Investors and the team have a 3-year vesting period, with a 1-year lockup after TGE. The ecosystem and community will vest over 5 years, with a portion of launch incentives, liquidity reserve, and listings allocation available at launch.

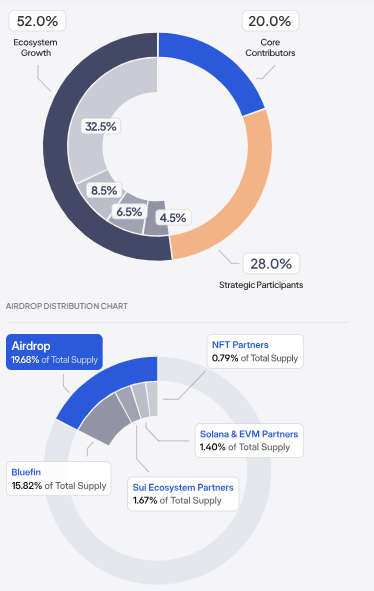

Token Distribution:

- Ecosystem Growth – 52.0%: Fully unlocked after 5 years

- User Incentives – 32.5%: Vested over 5 years

- 19.68% for the Bluefin Airdrop (early users and new users).

- 12.82% for post-launch incentives (trading, liquidity provisioning).

- Protocol Development – 8.5%: ⅓ unlocked at TGE, ⅔ over 2 years

- Treasury – 6.5%: 3-month cliff, 36-month vesting

- Liquidity Reserve – 4.5%: Unlocked at TGE

- Strategic Participants – 28.0%: 3-year vesting, 1-year cliff

- Core Contributors – 20.0%: 3-year vesting, 1-year cliff

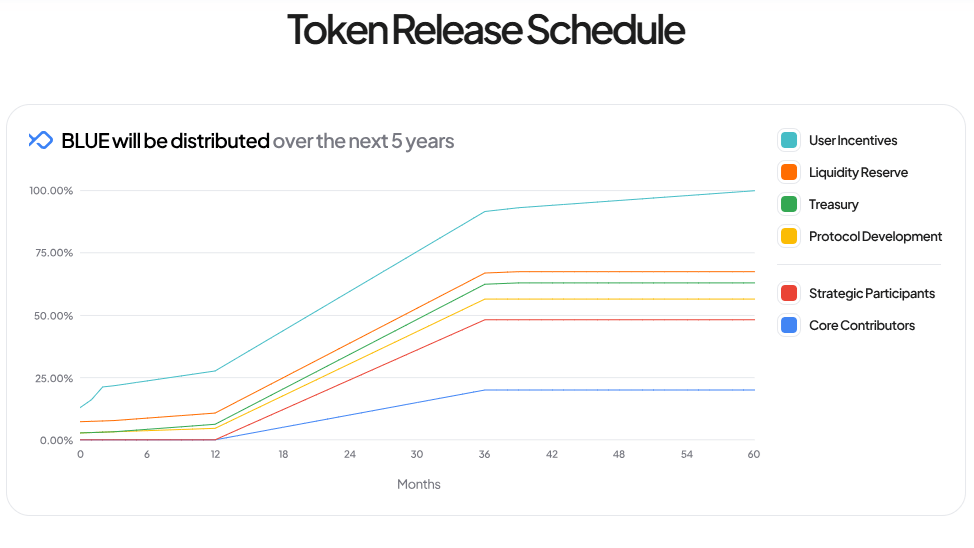

Token Release Schedule:

- TGE: Initial distribution

- 1st Year: Vesting for strategic participants and core contributors starts

- Long-term Unlocks: Over 5 years

Token Release Schedule

Where Can BLUE Token Be Traded?

BLUE token can be bought and sold on the following centralized exchanges and Bluefin Spot CLMM:

- Bluefin

- Bitget

- Kucoin

- Gate.io

- MEXC

Additionally, perpetual futures contracts for BLUE token are available on these platforms:

- Bybit Perps

- Bluefin Perps

Founding Team

Bluefin’s leadership team comes from renowned companies such as Meta, Goldman Sachs, Amazon, and NYSE. Founder Rabeel Jawaid is a research scientist at the Singh Nanotechnology Center at the University of Pennsylvania and has also worked as an investment analyst at Optimus Capital Management.

- Rabeel Jawaid – Founder

- Ahmad Jawaid – Co-Founder

- Yameen Malik – CTO (Chief Technology Officer)

- Zabi Mohebzada – Co-Founder

In the comment section, you can freely share your comments about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.