As other countries have no clear legislation, the United Kingdom has recently reasserted its position as a ‘global hub’ for cryptocurrency in order to lure enterprises that are unsatisfied. There is quick progress in plans in that direction, and they may be realized by summer.

However, the nation is also hesitating on another matter: the UK has been contemplating for many years the creation of a digital currency, the control of which would be in the hands of the central bank (CBDC). It is so unlike cryptocurrencies that there is even an unofficially CBDC “Britcoin”—making a pun, isn’t it?

The Bank of England has recognized the requirement for a digital pound in the wake of the increased reliance of Britons on digital payments, but the institution has not come up with a conclusion about this topic. Economists are now engaged in the development of a prototype after discussing and considering both the merits and demerits of a digital currency issued by the central bank.

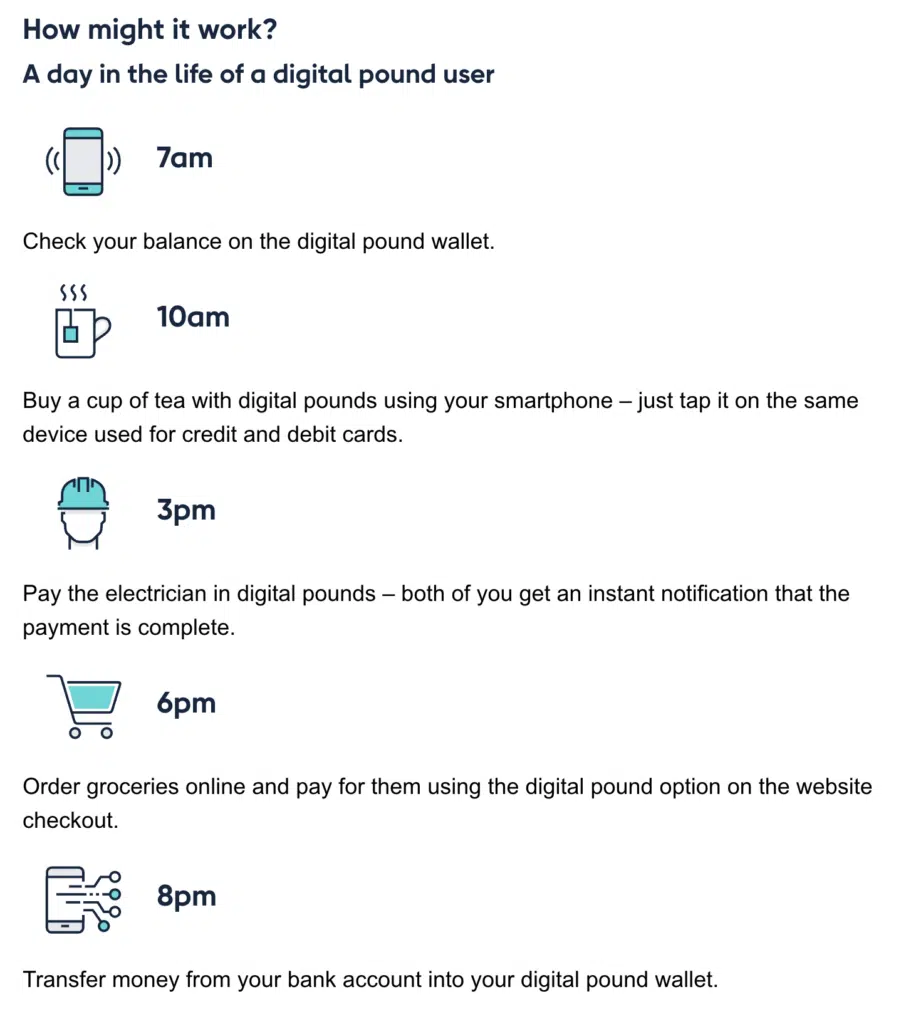

The Bank of England has gone to great lengths to outline the possible advantages, including the creation of a visual representation of how it could supplant traditional currency.

Among the other rumored advantages are the option to release funds only upon delivery of products and services, as well as quicker and cheaper payments for both customers and merchants.

It is important considering the stance of Labour, the party predicted to emerge victorious, regarding Britcoin, considering that a general election must be conducted by January 2025—and the Conservatives’ defeat appears imminent. It expressed its financial policies in a recent document, which stated:

“Labour fully supports the Bank of England’s work in this area, and wants to ensure that issues such as threats to privacy, financial inclusion and stability are effectively mitigated.” Labour Party

That one line sums up the main points made by Britcoin naysayers.

One concern voiced by lawmakers and business leaders is the possibility of spending controls or other restrictions imposed on goods and services such as red meat and air travel if a digital pound were to become widely used. A representative from the Electronic Money Association cautioned before the House of Commons Treasury Committee in written testimony:

“The prospect of having one’s every transaction observed, stored and analysed in perpetuity is dystopian, and yet within reach. Users’ right to conduct their lives in a modicum of privacy must be maintained in an open civil society, with compromises made only where the financial crime risk warrants such transparency.” Electronic Money Association

While some may perceive this as fear mongering and exaggeration, China has exemplified its approach. Beijing has unveiled the digital yuan before the industrialized nations, as acknowledged by People’s Bank of China governor Yi Gang that it will offer controllable anonymity.

One other challenge is financial inclusion. More than 3 million British cash shoppers exist on a daily basis. However, the number of cash machines is declining, and some institutions no longer accept cash. Age UK states that 2.7 million over-65s are not internet users, so a digital pound won’t benefit them. A central bank digital currency could speed up the cashless society despite the Bank of England’s promise that coins and banknotes would still exist.

According to the Treasury Committee, Britcoin would “heighten the probability of bank crashes” given that it would be easy to withdraw funds from failing banks. CBDC balance constraints would help in this.

The clear advantage of Britcoin over contactless payments is receiving little coverage. The report from the Treasury Committee asked if CBDC was “still a solution in search of a problem.”

A recent CFA Institute survey found that most respondents worldwide did not want their central bank to establish a digital currency and would not use it if they did:A recent CFA Institute survey found that most respondents worldwide did not want their central bank to establish a digital currency and would not use it if they did.

Britcoin may not appear for years. We need a massive awareness campaign, massive infrastructure investment, and substantial work to appease detractors to achieve general adoption.

With the U.S. and EU failing to commit to digital dollars and euros, privately produced stablecoins might fill that gap and dominate the market.