Clearpool (CPOOL) is a leading DeFi lending market that is a pioneer in Real-World Asset (RWA) lending. Let’s explore what Clearpool (CPOOL) is and what it does in detail, as it has recently been added to Binance Alpha projects.

What is Clearpool (CPOOL)? What does it do?

Clearpool is a platform that transforms Real-World Asset (RWA) lending within the DeFi ecosystem. It has provided over $640 million in credit to institutions such as Wall Street firm Jane Street and crypto market makers like Wintermute.

The protocol was launched on the Ethereum mainnet and has since expanded to multiple networks. Clearpool allows institutions to access unsecured liquidity from DeFi markets through its permissionless protocol, while Clearpool Prime is a permissioned platform designed to meet compliance requirements. Additionally, Clearpool aims to expand the RWA ecosystem with its Layer 2 solution called Ozean.

Clearpool offers unsecured liquidity to institutional borrowers within the DeFi ecosystem and rewards liquidity providers (LPs). The platform features dynamic interest rates, risk management tools, and the CPOOL token, which enables governance for the community.

Clearpool Prime and Ecosystem Components

Clearpool Prime is a non-custodial marketplace designed for institutional investors. It provides access to globally compliant KYC and AML networks and offers risk-adjusted returns to investors without any lock-up periods.

Clearpool’s Oracle network regulates the system’s operations by voting on the parameters that determine interest rates. Users contribute to the interest rate-setting process by staking CPOOL tokens and earn additional returns.

How Does Clearpool (CPOOL) Work?

USDX: Combining Reliability and Flexibility

USDX is a stablecoin developed by HT Digital Assets and Hex Trust within the Real-World Asset (RWA) ecosystem. Combining reliability and flexibility, USDX aims to shape the future of the stablecoin world.

Advantages of USDX for Lenders

Flexibility: You can invest USDX without any lock-up period and withdraw at any time. Maximum Yield: Earn approximately 5% APY treasury returns with USDX and increase your earnings further with additional FLR rewards.

Earnings and Reward Mechanism

Invest USDX and receive cUSDX: To earn returns, you deposit your USDX assets into the Treasury Pool and receive cUSDX tokens in return. Earn and Withdraw Rewards: After investing USDX, you automatically start earning rewards. Rewards accumulate with every block, and you can track your earnings instantly via the Clearpool app and withdraw whenever you like. Convert cUSDX back to USDX: If you wish to withdraw your USDX, you can convert your cUSDX tokens to USDX at a 1:1 ratio at any time.

cUSDX & Rewards

cUSDX is equivalent to an LP (Liquidity Provider) token commonly used in various DeFi protocols, representing your USDX investment at a 1:1 ratio. Users who invest USDX not only earn returns on USDX but can also benefit from FLR token rewards. Users can request USDX and FLR rewards at any time without withdrawing their initial investments.

Click here to get project’s white-paper.

Clearpool Prime

Clearpool Prime is the world’s largest KYC & AML compliant network for wholesale borrowing and lending of digital assets.

Secure and Compliant Environment: All borrowers and lenders participating in Prime undergo comprehensive KYC (Know Your Customer) and AML (Anti-Money Laundering) processes. Customized Pools: Borrowers can create lending pools with personalized terms. Institutional-Level Yield Opportunities: Lenders can earn returns by transacting with high-quality institutional counterparties in a secure and regulatory-compliant environment.

Clearpool Prime operates exclusively on the Polygon network and is available only to whitelisted institutions. Participation requires the KYB (Know Your Business) process via SecuritizeID.

Borrower Whitelisting and Credit Evaluation

Institutional borrowers seeking unsecured liquidity on Clearpool must first be whitelisted.

Initially, this process will be managed by the Clearpool team, but in the future, it will be governed by CPOOL token holders through a governance mechanism.

Whitelisting requirements:

- Complete KYC & AML (Know Your Customer & Anti-Money Laundering) procedures

- Accept Clearpool’s Terms and Conditions

- Stake a certain amount of CPOOL tokens

Whitelisted institutions undergo a credit risk evaluation by X-Margin.

X-Margin Credit Evaluation System

X-Margin uses secure computation and cryptographic proofs to:

- Track borrowers’ real-time risk status privately

- Evaluate KYC & financial condition

- Assign a risk score and borrowing capacity to the borrower

Once all steps are completed, the borrower’s liquidity pool can be launched.

X-Margin Credit Scoring System

X-Margin evaluates borrowers’ creditworthiness through three main components, each with a specific scoring system.

- Maximum credit score: 1000

- Based on the evaluation, borrowers’ risk profiles are determined, ensuring a safer and more transparent borrowing process within the Clearpool ecosystem.

Liquidity Pools and cpTokens

Clearpool’s liquidity pools are continuous and specific to each borrower. Interest rates dynamically increase or decrease based on pool utilization.

Once a borrower successfully passes whitelisting, their pool becomes visible on the Clearpool protocol’s main dashboard and can be funded by liquidity providers (LPs). Anyone can become a liquidity provider.

Liquidity providers receive cpTokens when they supply liquidity. These tokens represent the amount of liquidity provided by the provider.

What are cpTokens and How is Liquidity Used?

cpTokens represent the liquidity provided by a liquidity provider to a pool. They earn interest with every Ethereum block and reflect the borrower’s credit profile. As long as sufficient liquidity is available, cpTokens can be redeemed at any time. They are transferable, tradable, and programmable assets. They provide new opportunities for the DeFi community and simplify risk management.

Once the pool is funded, the borrower can utilize the liquidity. The liquidity ratio reflects the amount of liquidity the borrower has used. Interest rates rise as the liquidity ratio increases and fall as the borrower repays the liquidity.

LPs earn higher interest as the risk increases and lower interest as the risk decreases. The interest rate and pool size are balanced for each borrower.

Click here to get project’s X account.

Clearpool: Interest Rates, cpTokens, and Thematic Pools

Clearpool bases its interest rates on liquidity utilization. As the liquidity ratio increases, the interest rate rises, and when it decreases, the interest rate falls. cpTokens represent the funds and risks provided by liquidity providers, earn interest with each Ethereum block, and can be bought and sold on secondary markets. This offers LPs additional liquidity and risk trading opportunities.

Thematic Pools offer liquidity to multiple borrowers, and LPs earn interest by acquiring cpTokens. Thematic Pool cpTokens represent the combined risk of all borrowers and can be initiated through on-chain governance.

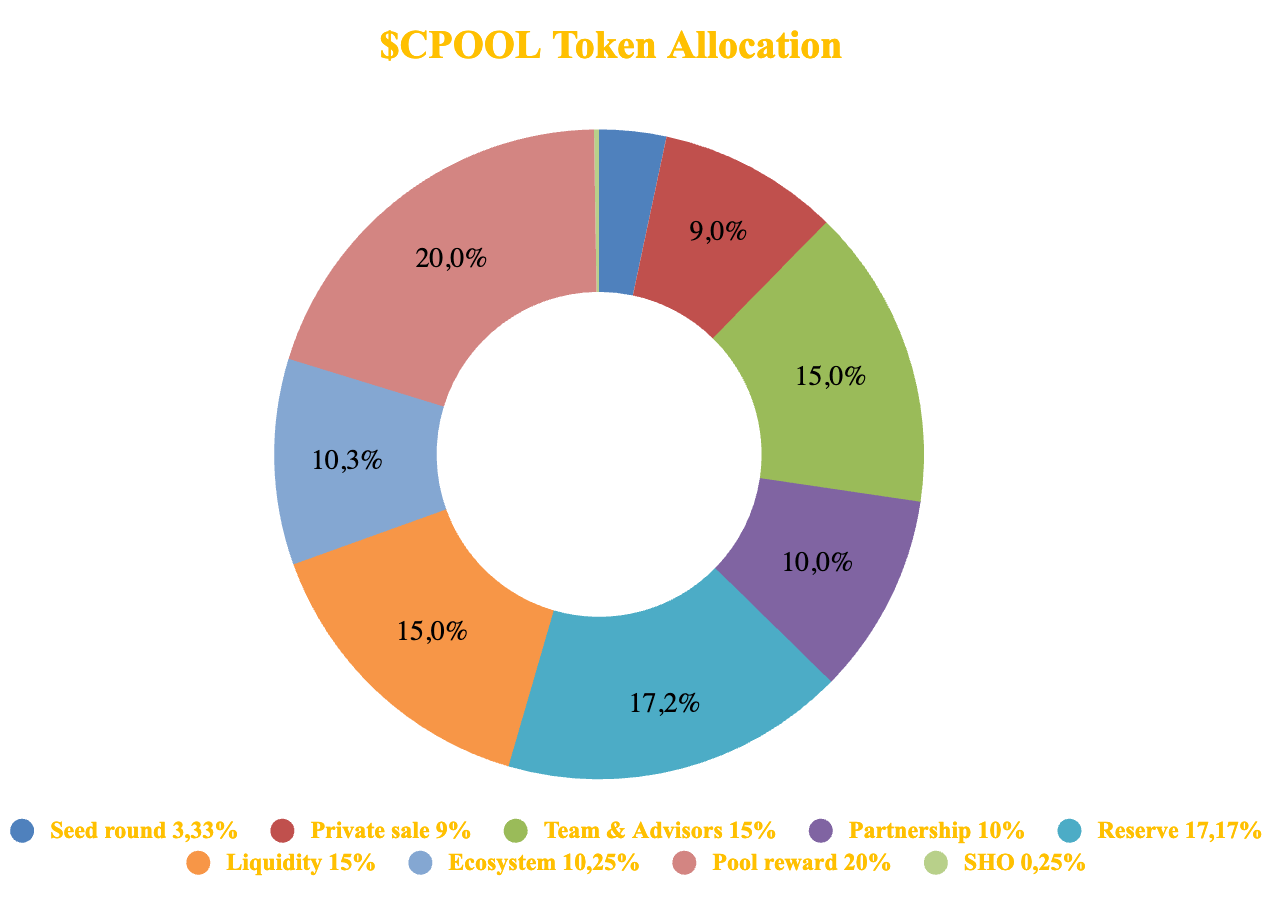

Clearpool Tokenomics

The CPOOL token was launched on October 28, 2021. Investor tokens enter circulation when claimed from the vesting contracts. Public round tokens are fully vested and in circulation.

Investment Phases:

- Seed Round: 3.33% (12-month linear vesting) – FDV: $15m

- Private Round: 9% (3-month cliff, 12-month linear vesting) – FDV: $30m

- Public Round: 0.35% (50% unlocked, 50% after 6 months) – FDV: $40m

Team tokens enter circulation when removed from multi-sig cold storage and account for 15% of the total supply.

Treasury tokens are released into circulation across various categories:

- Ecosystem: 10.15%

- Partnerships: 10%

- Rewards: 20%

- Liquidity: 15%

- Reserves: 17.17%

Clearpool Governance Model

Clearpool aims to establish a decentralized and censorship-resistant governance model in the long term. CPOOL token holders can propose, vote on, and implement changes related to the protocol’s future. Voting power is determined by the amount of CPOOL tokens held (1 token = 1 vote).

Token holders can either use their voting rights themselves or delegate them to another CPOOL holder. Votes remain open for a set period, and once the minimum vote count is reached, the results are recorded. Before any changes are implemented, a monitoring and cancellation process begins. Initially, governance will be managed by the Clearpool core team via a multi-signature approval mechanism.

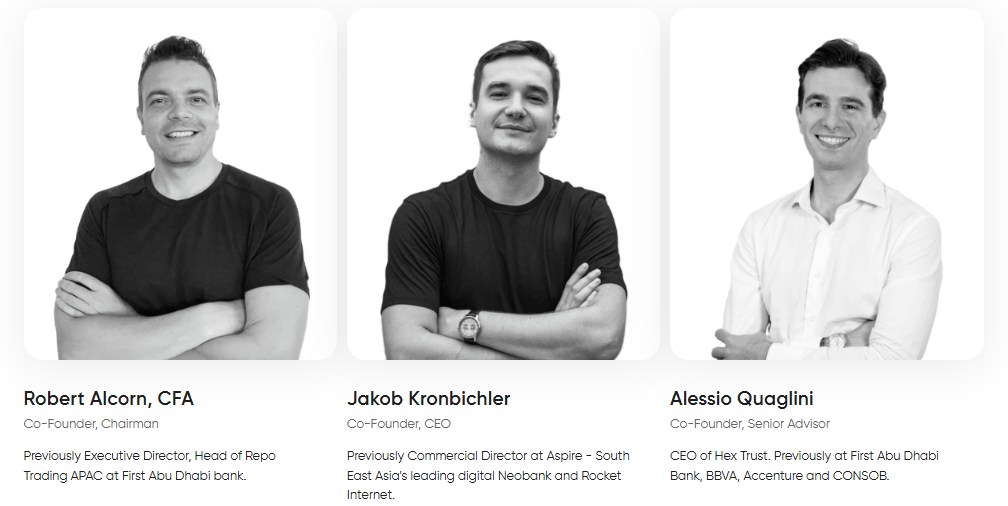

Clearpool (CPOOL) Team

Clearpool is built by a team of professionals from traditional finance, fintech, and blockchain industries.

- Robert Alcorn, CFA: Co-Founder, President. Previously served as the Head of APAC Repo Trading at First Abu Dhabi Bank.

- Jakob Kronbichler: Co-Founder, CEO. Former Commercial Director at Aspire and worked at Rocket Internet. Aspire is one of Southeast Asia’s leading digital neobanks.

- Alessio Quaglini: Co-Founder, Senior Advisor, CEO of Hex Trust. Previously worked at First Abu Dhabi Bank, BBVA, Accenture, and CONSOB.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.