The cryptocurrency markets have rapidly grown and developed in recent years, securing a significant place in the financial world. This rapid growth has created a need for comprehensive and reliable data to help investors and traders better understand the market and make more informed decisions. This is where CoinGlass comes into play.

CoinGlass is a platform that provides comprehensive data and analysis on cryptocurrency derivatives and futures markets. In this blog post, we will thoroughly examine all the features offered by CoinGlass and discuss how these features can benefit investors.

1. What is CoinGlass?

CoinGlass is a data platform that offers detailed information and analysis on cryptocurrency derivatives and futures. The platform provides various tools and statistics to help users better understand the market and make strategic decisions. These tools include liquidation data, open positions, futures exchange information, and market sentiment. CoinGlass stands out as a valuable resource for both experienced traders and new investors.CoinGlass is an excellent tool for investors looking to develop strategies based on data analysis. The data provided by the platform allows users to analyze the market more deeply and predict future price movements. Additionally, CoinGlass’s user-friendly interface ensures that the data is easily accessible and understandable.

2. Liquidation Data

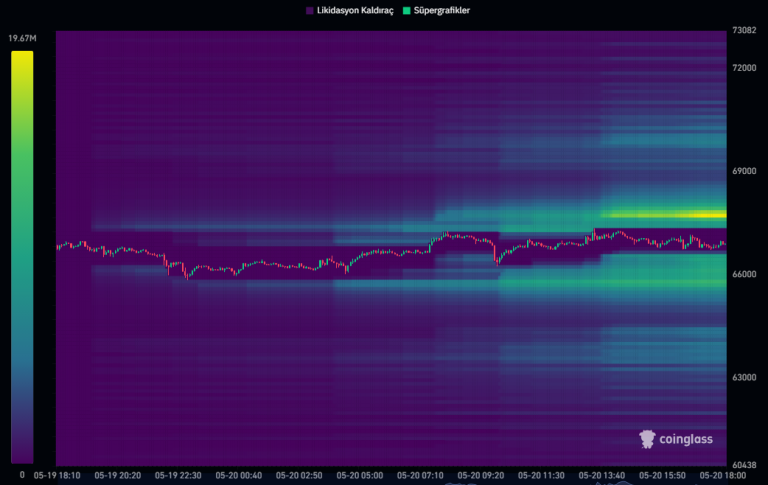

In cryptocurrency markets, liquidations refer to the forced closure of investors’ positions, which can often lead to significant price fluctuations. CoinGlass provides users with detailed data on which positions have been liquidated. This data helps investors better understand market dynamics and potential risks.

Liquidation data shows the number of liquidations over a given time period and the exchanges on which these liquidations took place. This information allows traders to track major movements in the market and adjust their strategies accordingly.CoinGlass‘ liquidation data provides traders with important clues to understand the current state of the market. For example, during a period of high liquidation, there may be significant selling pressure in the market. This may require traders to act more cautiously. Likewise, low liquidation data may indicate that there is less volatility in the market and a calmer period.

3. Open Positions

Open positions refer to the total number of outstanding positions in a specific futures contract. CoinGlass provides users with open position data to understand the overall market situation. This data shows how many open positions there are in a specific cryptocurrency and on which exchanges these positions are held. Open position data helps investors evaluate potential risks and opportunities in the market. For instance, a high number of open positions in a particular cryptocurrency could indicate significant price movements for that asset.

Open position data also helps investors understand the general trends in the market. A high number of open positions might indicate a significant movement in a particular direction. This situation allows investors to reassess their strategies and adjust their positions accordingly. CoinGlass presents this data through user-friendly charts and tables, making it easier for investors to analyze the information.

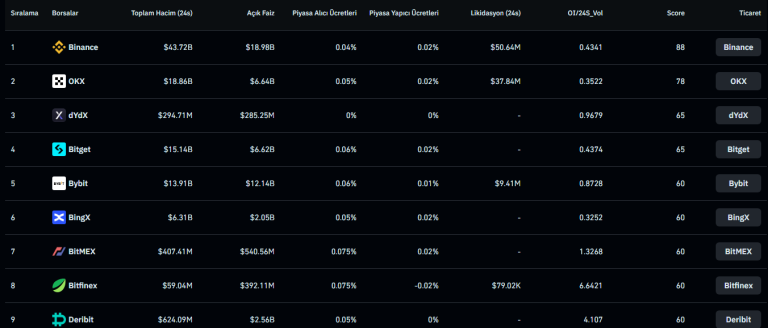

4. Futures Exchange InformationCoinGlass

provides users with futures trading volumes and other statistics across various cryptocurrency exchanges. This information helps investors compare market movements on different exchanges and identify the most liquid ones. Futures exchange information includes the total trading volume, the number of open positions, and the amount of liquidations on a specific exchange. This data helps investors understand which exchanges are more active and where more trading occurs.

Futures exchange information allows investors to evaluate market depth and liquidity. For example, an exchange with high trading volume offers more liquidity, resulting in more stable prices. This information can be a crucial factor for investors when deciding which exchanges to trade on. CoinGlass provides this data accurately and up-to-date, helping investors make the best decisions.

5. Market Sentiment

Market sentiment is an indicator that measures how investors react to general market conditions and the overall emotional trends in the market. CoinGlass offers various tools and indicators to measure market sentiment for its users. These tools help investors understand the overall market mood and make more strategic decisions instead of emotional ones. Market sentiment indicators show how many long and short positions are opened in a specific cryptocurrency and how these positions have changed.

Market sentiment data helps investors predict market trends and potential turning points. For example, if most investors have opened long positions on an asset, it may indicate a bullish trend in the market. Similarly, an increase in short positions might suggest a bearish trend. CoinGlass uses this data to help investors make more informed and strategic decisions.

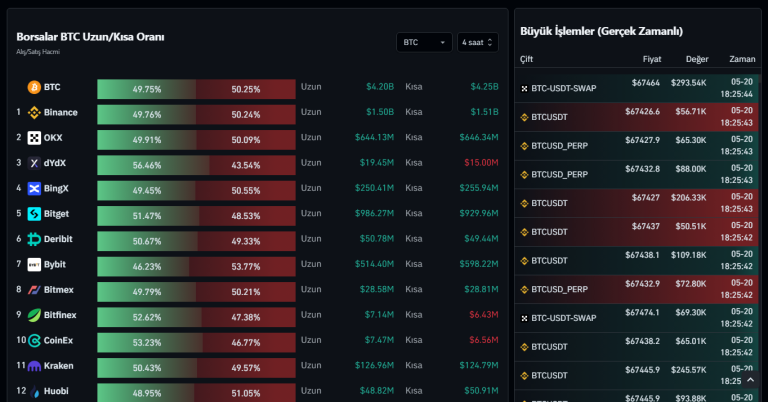

6. Long/Short Ratio

CoinGlass provides data showing the ratio of long (buy) and short (sell) positions opened in a specific cryptocurrency. The long/short ratio helps investors understand market expectations regarding its direction. For instance, a high long/short ratio may indicate that most investors believe prices will rise. This data plays a crucial role in helping investors determine their positions and form risk management strategies.

Long/short ratio data helps investors understand market sentiment and trends. A high long/short ratio might indicate a general bullish expectation in the market, while a low ratio might suggest a bearish expectation. This information allows investors to comprehend the overall market mood and adjust their strategies accordingly. CoinGlass presents this data through user-friendly charts and tables, making it easy for investors to analyze the information.

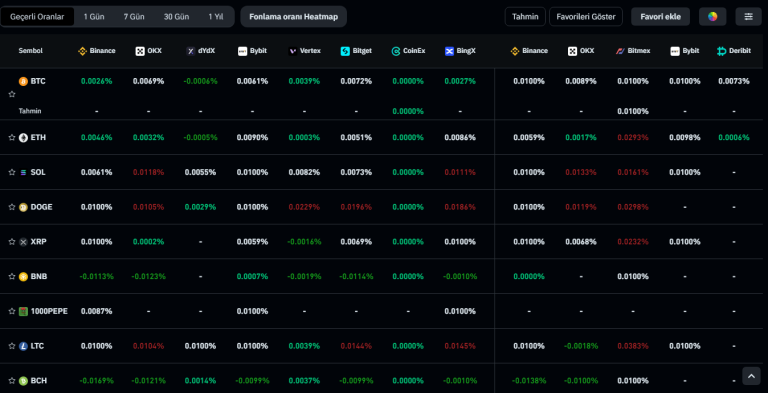

7. Funding Rates

Funding rates are a mechanism used in futures markets to maintain the balance between long and short positions. CoinGlass shows users the funding rates across various exchanges. These rates help investors understand market trends and potential reversal points. High positive funding rates might indicate excessive buying pressure in the market, while negative funding rates might indicate excessive selling pressure.

Funding rates help investors understand market trends and potential reversal points. High positive funding rates might indicate excessive buying pressure, while negative funding rates might indicate excessive selling pressure. This data helps investors predict market movements and adjust their strategies accordingly. CoinGlass provides funding rates accurately and up-to-date, helping investors make the best decisions.

8. Data Visualization

CoinGlass supports the data it provides with visualization tools. Charts and tables help investors understand and analyze the data more easily. Visualization tools graphically display liquidation data, open positions, funding rates, and other important metrics. This allows users to evaluate the data more quickly and make more informed decisions.

Data visualization helps investors understand complex data more easily and make quick decisions. CoinGlass offers user-friendly charts and tables, enabling investors to analyze the data effortlessly. These visualization tools allow investors to evaluate the data more quickly and efficiently.

9. Training and information resourcesCoinGlass

Offers a variety of educational and informational resources to help its users better understand the platform and the cryptocurrency markets. Resources such as blogs, guides, video content, and webinars allow traders to increase their level of knowledge and make better trading decisions. Educational materials contain valuable information for both beginners and experienced traders.Educational and information resources help traders better understand the market and make more informed decisions. With the various educational materials CoinGlass offers to its users, it enables investors to increase their level of knowledge and make more successful investments. These resources help investors better understand the cryptocurrency markets and make more informed decisions.

10. Mobile ApplicationCoinGlass

offers a mobile application for users to access market data on the go. The mobile app allows users to follow instant market data and analyses on their mobile phones. This allows traders to monitor and react quickly to market movements from anywhere at any time.The mobile application allows traders to access market data even on the go, allowing them to make fast and informed decisions. CoinGlass offers a user-friendly mobile application, allowing traders to easily track and analyse data. In this way, investors can monitor market movements from anywhere at any time and adjust their strategies accordingly.

CoinGlass is an indispensable resource for investors who want to make more informed and strategic decisions in the cryptocurrency markets. With liquidation data, open positions, futures exchange information, market sentiment and other important metrics, users can better understand the market and better manage their investments. The comprehensive data and analyses offered by CoinGlass help traders manage risks and seize opportunities. Utilising a powerful tool like CoinGlass to succeed in the cryptocurrency markets will be a huge advantage for traders.