Blockchain which Injective Protocol is a piece of hasn’t the very oldest history. Although this technology started integrating into our life in 2009, it was created in 1991. For the first time, this technology was invented toward saving data and transfer them securely.

But today we can use it almost in every field: Finance, Supply Chain, Healthcare, Security, etc. That’s why this technology is crucial for human and social development. Maybe blockchain won’t be the future, but Distributed Ledger Technology (DLT) will be.

The current topic is Injective Protocol and its different features. We gonna learn about that what is the Injective Protocol and how it works.

What Is Injective Protocol?

Injective Protocol is the blockchain network that developing for finance. In there are available decentralized spot and derivatives exchanges, betting markets, lending protocols, etc. on the chain. At the same time, Injective Protocol’s blockchain is the Layer 2 network for some DeFi applications.

Injective Protocol was created and designed for making powerful dApps (decentralized applications). Furthermore, the blockchain network presents a strong fundamental infrastructure for using dApps. Besides, Injective Protocol has an order book for blocking on-chain MEV events. The feature provides a more reliable environment for spot, derivatives, futures, and options exchanges.

Even the network gives an opportunity as cross-chain infrastructure for IBC blockchains like Ethereum, and non-EVM blockchains like Solana.

What Are the Advantages Of Injective Protocol?

- Layer 1 Smart Contract Blockchain: Injective, requires 0 gas fee and it can reach a high speed at one time. Additionally, the protocol provides a cross-chain feature.

- Interchain Trading and Income: The blockchain provides a wide variety for trading and earning high incomes on Layer 1 blockchain networks such as Cosmos and Ethereum.

You might also like: What Is Ethereum (ETH)? How Does It Work?

- Community-focused chain governance: The protocol has its own DAO (Decentralized Autonomous Organization) structure. The network is managed by the community.

- Interoperability: The network is the most interoperable blockchain that has connections like Ethereum, Cosmos, Solana, etc.

- Completely Ownable: You can change your own product settings so fastly and send them.

- Environment Friendly: Injective Protocol provides %99 carbon oscillation less than normal PoS blockchains thanks to the Tendermint PoS consensus mechanism.

Technical Infrastructure

Injective are divided into 4 main components that are shown below:

- Chain Nodes

- Bridge Smart Contracts and Orchestrator

- API Nodes

- dApps and tools

Bridge

The network supplies decentralized cross-chain bridging infrastructure for IBC and nonEVM blockchains. But the protocol’s bridge to Ethereum isn’t decentral, but the bridge is under the management of Injective’s validators.

Furthermore, the bridge provides ERC-20 tokens and some random data transfers. The bridge is provided by a private “Peggy Bridge” system and it can them because of having EVM compatibility, Cross-Chain Execution, and Smart Contract Interoperability.

Moreover, the Protocol can provide transfer data to other IBC blockchains as IBC blockchain. In this manner, developers and users can use the network for accessing easily their own assets on the other blockchains.

Injective Data Layer

Injective API nodes are responsible for becoming a decentralized data layer for external processors. Every Injective API node can index every piece of data on the network. Additionally, the nodes supply high potential, and lower delayed APIs for exchanges, trading programs for Market Makers, user interfaces for apps, block explorers, etc. Furthermore, the nodes can deliver to DAO contributors gassless delegation mechanism.

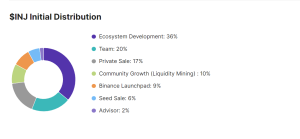

INJ Coin Tokenomics And Market Statistics

INJ Coin’s live price is $8.8078. The coin has a market cap of $704,671,172. Total and Maximum supplies equal 100.000.000 INJ Coin. The circulating supplies amount is 80,005,555. Is equivalent to %80 of the total supply.

How Can I Buy INJ Coin?

You can buy the coin from Centralized (CEX) and Decentralized Exchanges (DEX). The INJ Coin is listed on Binance, Huobi, Gate.io, MEXC, Kucoin, OKX, ByBit, Phemex, AscendEX, CoinEx, and Bitget. If you want to get a discount (%10-%20), you can interact and use the link. Every exchange has a relevant reference link.

You can present your thoughts as comments about the topic. Moreover, you can follow us on Telegram, Twitter, and YouTube channels for the kind of news.