OpenEden is an innovative platform that merges decentralized finance (DeFi) with traditional finance (TradFi), providing blockchain-based access to traditional financial assets such as U.S. Treasury Bills (T-Bills). It aims to enable institutional and retail investors to securely, transparently, and efficiently benefit from the U.S. risk-free interest rate. In this review, we will explore how OpenEden works, its founders, investors, and tokenomics structure in detail.

What is OpenEden?

OpenEden is a platform that tokenizes one of the most reliable instruments in traditional finance—U.S. Treasury Bills—and makes them accessible to DeFi investors. This system provides a blockchain-backed financial model that allows investors to securely allocate funds within a decentralized structure.

In traditional banking, investing in T-Bills is typically done through major financial institutions. However, OpenEden aims to make this process more accessible and transparent. The platform offers digital assets pegged to U.S. Treasury Bills in exchange for stablecoins (USDC), combining the security of traditional financial instruments with the advantages of DeFi.

For more details about the project, click here to visit the website.

How Does OpenEden Work?

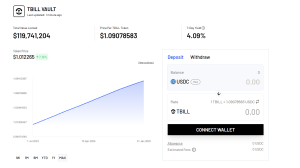

OpenEden’s core functionality is based on the TBILL Vault, a system designed to tokenize U.S. Treasury Bills. The process works as follows:

- Stablecoin Investment – Users deposit stablecoins (USDC) into the OpenEden platform and receive TBILL tokens in return.

- Conversion to U.S. Treasury Bills – The deposited USDC is used to purchase U.S. Treasury Bills.

- Yield Distribution – The interest income generated from the T-Bills is distributed to TBILL token holders.

- Liquidity and Exit Mechanism – Users can convert TBILL tokens back into USDC whenever they wish, ensuring liquidity.

The platform operates on multiple blockchain networks, including Ethereum (ETH), Arbitrum (ARB), and XRPL, allowing users to interact with different ecosystems.

In summary, OpenEden enables investors to access U.S. Treasury Bills—a low-risk and secure investment instrument—via a blockchain-based system while benefiting from 24/7 liquidity.

To review the project’s white paper, click here.

Who Founded OpenEden?

OpenEden was founded in 2022 by former Gemini exchange executives Eugene Ng and Jeremy Ng. Headquartered in Singapore, the company is led by an experienced team that aims to integrate traditional finance with blockchain technology.

- Jeremy Ng previously worked at major financial institutions such as Goldman Sachs and Morgan Stanley, giving him extensive knowledge of traditional financial markets.

- Eugene Ng managed Gemini’s Asia-Pacific operations and has been actively involved in projects that bridge crypto and traditional finance.

The founders’ strong financial backgrounds and experience in regulatory compliance have helped OpenEden establish a trustworthy structure.

Who Can Invest in OpenEden?

While OpenEden is open to investors, it operates under a permissioned protocol called TBILL Vault, which imposes specific eligibility criteria.

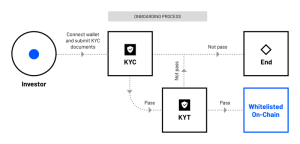

Investment Process:

- Potential investors start the onboarding process via an application link.

- Compliance checks (KYC) are conducted based on the provided documents.

- Know Your Transaction (KYT) checks are performed on the investor’s wallet address.

- If the KYC and KYT checks are successful, the compliance team whitelists the investor’s wallet address on-chain.

- Whitelisted investors receive an email notification, allowing them to make their first subscription.

To access OpenEden’s official X (Twitter) account, click here.

OpenEden Tokenomics

OpenEden operates with a tokenized U.S. Treasury Bill system, utilizing TBILL Tokens.

TBILL Token Features:

- 1:1 Backing – TBILL tokens are fully backed by U.S. Treasury Bills.

- Stablecoin-Based – Users mint TBILL tokens by depositing USDC.

- Yield Generation – TBILL token holders earn a share of interest income from T-Bills.

- Liquidity – Users can convert TBILL tokens back into USDC at any time.

OpenEden’s tokenization model aims to merge DeFi and traditional finance, providing investors with a secure and low-risk yield source.

OpenEden’s Contribution to the Crypto Ecosystem

OpenEden introduces real-world assets (RWAs) into the DeFi ecosystem, marking a significant innovation. By bringing traditional financial instruments onto the blockchain, the platform could accelerate the adoption of decentralized finance and attract institutional investors.

Key Advantages of OpenEden:

- Low-Risk Yield – Provides access to U.S. Treasury Bills, making it a secure investment option.

- Regulatory Compliance – Managed by an experienced financial team that prioritizes regulatory adherence.

- Institutional Appeal – Serves as a bridge to integrate traditional investors into DeFi.

- 24/7 Liquidity – Offers more flexible investment opportunities compared to traditional markets.

Potential Risks and Challenges:

- Regulatory Issues – The legal framework for tokenizing traditional financial assets on the blockchain may vary based on regulatory decisions.

- DeFi Integration Risks – While institutional interest in DeFi is growing, concerns about security vulnerabilities and smart contract risks remain.

OpenEden is an innovative platform that brings traditional low-risk financial assets onto the blockchain, creating a new investment model for both institutional and retail investors. If successful, this model could accelerate the entry of traditional investors into the DeFi ecosystem and significantly contribute to the growth of decentralized finance.