Scallop (SCA) is a leading decentralized money market on the Sui blockchain. Focusing on enterprise-level quality, advanced composability, and robust security, the platform is dedicated to providing users with a dynamic money market that offers high-interest lending, low-fee borrowing, and more.

What is Scallop?

Scallop (SCA) is a lending and borrowing platform based on the Sui blockchain that stands out in the decentralized finance (DeFi) ecosystem. With rapidly growing interest in the DeFi space, Scallop provides users with a decentralized money market, allowing the use of various financial instruments. What sets Scallop apart in this ecosystem is its enterprise-level infrastructure that exceeds market expectations while delivering high security and interoperability. Additionally, Scallop made headlines as one of the first DeFi projects to qualify for a grant from the Sui blockchain in 2022, showcasing its innovative approach and security measures.

The Scallop platform operates on smart contracts, which are one of the most crucial elements for security in decentralized finance. These smart contracts have been audited by security experts like OtterSec and MoveBit to ensure the integrity of the protocol. To enhance reliability, these audits are conducted regularly, guaranteeing the security of user transactions. As a result, the robust infrastructure provided by Scallop creates a safe financial environment for both lenders and borrowers.

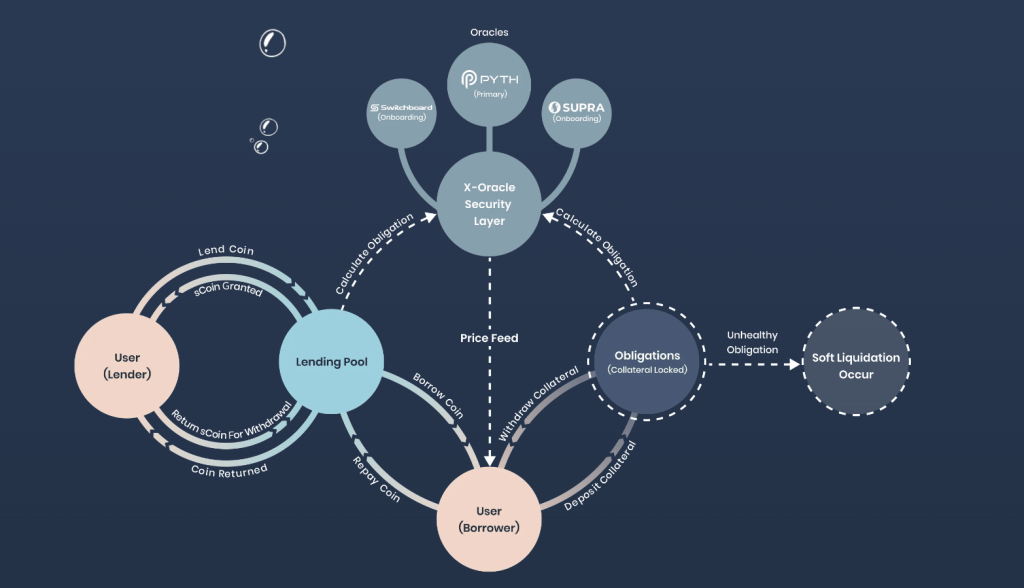

How Does Scallop Work?

Scallop’s operating principle is based on a variety of features that offer users a wide range of services in the decentralized finance world. It optimizes users’ financial experiences with lending, borrowing, flash loans, and liquidation mechanisms. Here are Scallop’s main functions:

- Lending: Scallop allows users to lend their digital assets to other users in a decentralized manner. This lending occurs through liquidity pools, and lenders begin to earn interest on their deposited assets. Borrowers must provide specific collateral to obtain loans. In this process, lenders’ investments are kept secure while borrowers can access the assets they need. Lending is a core function that supports the transparency and security of decentralized platforms, and Scallop excels in this area.

- Borrowing: Scallop offers borrowers the flexibility to manage multiple positions. This feature facilitates operations with different assets, helping borrowers manage their risks. One of the significant advantages Scallop offers is the ability for users to create up to five sub-accounts, allowing them to manage their borrowing positions separately. Scallop employs various parameters, such as collateral pools, collateral weight, and borrowing weight, to optimize borrowing capacity. This mechanism enables users to effectively manage their borrowing capacity while minimizing potential risks.

- Zero Transaction Fee Loans: One of Scallop’s most notable features is zero-fee flash loans. Flash loans are considered an innovative tool in the DeFi world. Users can borrow a specific amount of assets without providing collateral upfront and repay it within the same transaction block. This feature offers great flexibility for DeFi users and serves as an effective method for resolving liquidity issues. Scallop provides these transactions with zero fees, offering users a cost advantage and supporting strategies such as arbitrage, debt repayment, and liquidity provision.

- Interest Rates: Scallop dynamically determines interest rates for borrowing transactions based on market conditions. The platform utilizes three different linear interest rate models based on supply and demand balance. These models aim to create a fair and stable financial environment for both borrowers and lenders. Borrowing costs fluctuate according to the amount of liquidity in the market, enhancing the platform’s flexibility and user experience. By adjusting interest rates, Scallop ensures that both lenders and borrowers benefit optimally.

- Liquidations: Liquidation is a critical mechanism that activates when the value of collateral drops below a certain level on DeFi platforms. Scallop employs a soft liquidation mechanism to protect both lenders and borrowers. The liquidation process involves closing borrower positions and putting collateral up for sale. Scallop’s liquidation system offers liquidity providers the opportunity to receive discounted collateral in exchange for repaying outstanding debts. This process ensures the protocol’s stability while reducing the risks for lenders. Participants in the liquidation process are rewarded for filling gaps in the protocol.

Tokenomics

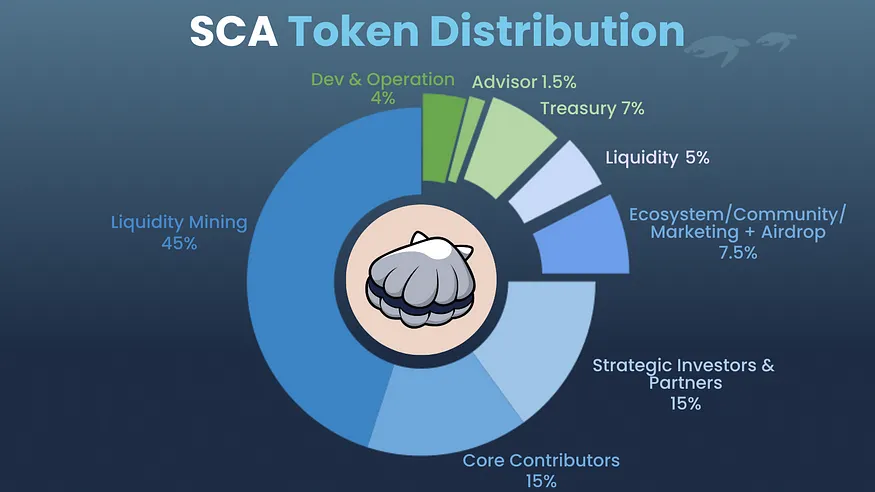

Scallop’s ecosystem is based on a dual-token structure: SCA and veSCA. SCA is the primary token used for transactions within the platform, enabling users to borrow and lend. veSCA is designed for users who wish to take a more active role in the platform’s governance. Users who lock SCA tokens for a specific period receive veSCA as a reward, allowing them to participate in the governance of the platform. Additionally, veSCA holders gain discounts on transaction fees, providing further advantages. The dual-token model aims to foster deeper interaction between users and strengthen decentralized governance mechanisms.

Scallop (SCA) is carving out an important place in the future of decentralized finance by leveraging the power and security of the Sui blockchain. The platform offers users secure, flexible, and efficient lending and borrowing opportunities while maintaining the highest levels of security through its tokenomics and liquidation processes.

- Liquidity Mining (45%) — Distributed through various liquidity incentive programs.

- Scallop Core Contributors (15%) — Allocated to founding team participants.

- Development and Operations (4%) — Set aside for development and operational purposes.

- Advisors (1.5%) — Distributed to key project advisors.

- Strategic Investors and Partners (15%) — Allocated for private fundraising and strategic partnerships.

- Ecosystem/Community/Marketing/Airdrop (7.5%) — Allocated to finance marketing and platform growth initiatives.

- Liquidity (5%)

- Treasury (7%)

How Was Scallop Established?

The solution was spearheaded by founding partners Raj Bagadi (CEO) and Mindy Bejawn (COO). The platform has a native utility token known as Scallop Token (SCLP), primarily used to unlock specific advantages and rewards.

Investors

Among the investors, there are many leading platforms, including Kucoin Ventures, CMS Holding, DWF Labs, and numerous prominent names that have invested here.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.

The information in this article does not provide any investment advice.