Solv Protocol is a Bitcoin-focused staking protocol aiming to unlock the potential of over $1 trillion worth of Bitcoin assets by creating a Bitcoin-centric financial ecosystem. Through innovative solutions, Solv Protocol enables both retail and institutional investors to explore yield opportunities without compromising liquidity.

Solv Protocol’s core mission is to fully unlock Bitcoin’s potential. The project aims to transform idle Bitcoin assets into yield-generating active assets and establish Bitcoin as an on-chain reserve in the DeFi ecosystem.

Solv Protocol expands Bitcoin’s utility and integrates it into DeFi ecosystems by offering a unique value proposition. The platform’s innovative staking solutions empower Bitcoin holders to generate yields while enhancing liquidity.

By prioritizing transparency and security, Solv Protocol builds a decentralized and secure infrastructure that allows users to manage their assets with confidence.

Key Features

Staking Abstraction Layer (SAL): The protocol simplifies the staking process, enabling Bitcoin holders to seamlessly stake their assets across different ecosystems. SAL abstracts numerous processes and parameters, offering a unified interface that simplifies yield generation across multiple blockchains.

Non-Custodial System: Solv Protocol manages user assets in a decentralized environment. Using smart contracts, Bitcoin scripts, and third-party verifiers, user assets remain under full control throughout the entire process.

Bitcoin Reserve Offerings (BRO): To enhance its Bitcoin reserves, Solv Protocol introduces Bitcoin Reserve Offerings (BRO). In 2025, three reserve offerings will mint 42 million SOLV tokens, allocated for convertible note sales. These notes will mature in one year, and the funds raised will increase the protocol-owned Bitcoin reserve.

One of the most innovative products of Solv Protocol is the Vesting Voucher, a mechanism that enables tokens to be released gradually over time. Vesting Vouchers are tokenized as NFTs, making liquidity management more efficient. The project integrates with Ethereum, BNB Chain, Polygon, Arbitrum, and Avalanche, enabling users to seamlessly operate across multiple blockchains.

Existing Products

Solv Protocol offers a variety of products designed to enhance Bitcoin’s role in the DeFi ecosystem and improve liquidity.

SolvBTC: SolvBTC is a 1:1 BTC-pegged token that facilitates seamless transfers across blockchains and unlocks Bitcoin’s participation in DeFi. SolvBTC supports native Bitcoin and derivatives like WBTC, BTCB, and others on platforms such as Ethereum, BNB Chain, Arbitrum, and Avalanche.

SolvBTC.LSTs (Liquid Staking Tokens): Liquid Staking Tokens (LSTs) allow users to earn yields while maintaining liquidity. This product increases Bitcoin’s accessibility within the DeFi space.

Key variants of SolvBTC.LSTs include:

- SolvBTC.BBN – Babylon-based liquid staking

- SolvBTC.JUP – Jupiter-based delta-neutral strategy

- SolvBTC.CORE – CoreDAO-based liquid staking

- SolvBTC.ENA – Ethena-based delta-neutral strategy

SolvBTC DeFi Vaults: The DeFi Vaults simplify user interactions with LSTs and decentralized exchanges (DEXs), reducing the costs and complexities of on-chain transactions.

Solv Protocol redefines Bitcoin from being a mere store of value to an active financial asset. Through its innovative products and infrastructure, Solv Protocol is set to place Bitcoin at the heart of the DeFi world.

SOLV Token and Tokenomics

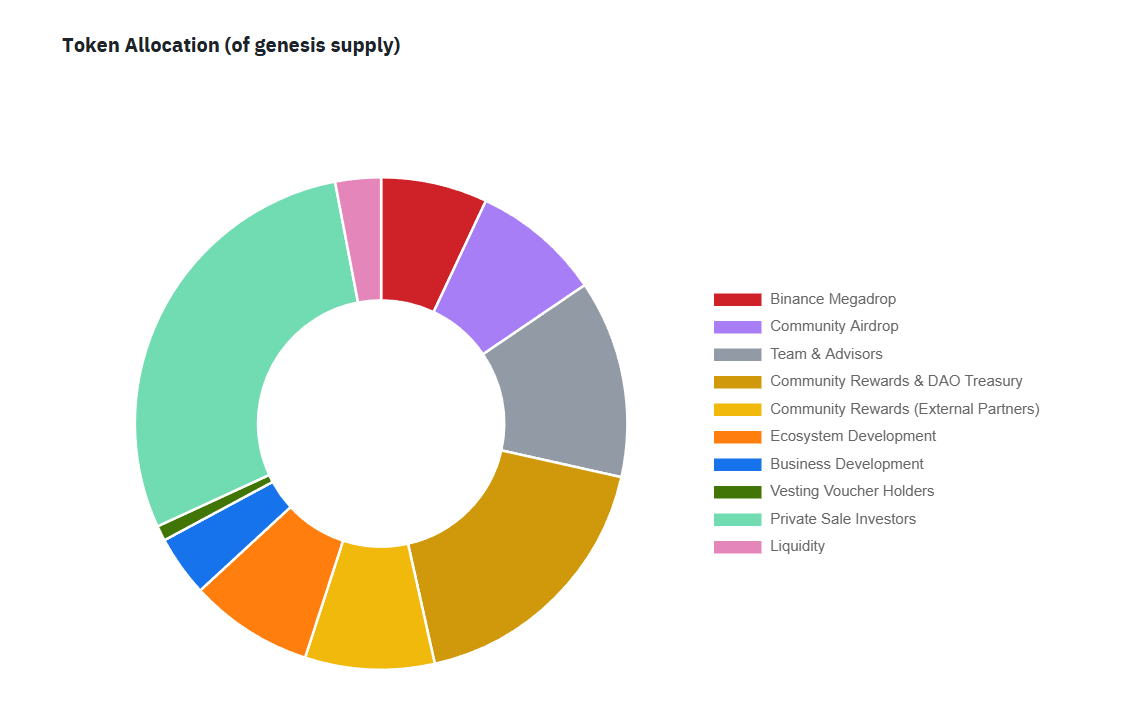

The native cryptocurrency of the platform, the SOLV Token, powers the economic infrastructure of Solv Protocol. It is used for paying transaction fees, participating in community governance, and earning liquidity rewards. With a total supply of 8.4 billion SOLV, the token follows a deflationary model. A portion of transaction fees is burned to reduce the circulating supply, aiming to preserve the token’s value.

NFT Financing and Multi-Chain Support

Solv Protocol delivers groundbreaking solutions in the realm of NFT financing. By tokenizing traditional financial instruments, it allows these tools to be traded seamlessly on the blockchain. This system provides exceptional flexibility in liquidity management for both investors and projects. Additionally, with multi-chain support, users can manage assets across different blockchains effortlessly, offering both technical flexibility and a user-friendly experience.

Partnerships and Backers

Solv Protocol stands out with its strong partnerships. Binance Labs invested in the project during its early stages, significantly contributing to its growth. Polygon Studios supported the platform’s multi-chain integration, while The Spartan Group played a pivotal role in developing the project’s tokenomics. These partnerships have strengthened both the technical and financial foundation of Solv Protocol.

Solv Protocol is committed to digitizing financial instruments and providing innovative solutions within the DeFi ecosystem. The platform aims to reach a broader audience by focusing on institutional investors. Looking ahead, the project plans to develop new products to increase the adoption of tokenized financial instruments and bridge the gap between traditional finance and DeFi. By simplifying liquidity management, Solv Protocol is poised to make a significant impact on the DeFi ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.