The cryptocurrency market continues to surprise investors with its volatile nature. On March 11, 2025, Bitcoin (BTC) and Ethereum (ETH) spot ETFs experienced outflows. A total of -4.72K outflows were seen from Bitcoin ETFs, while Ethereum ETFs recorded -11.58K outflows.

Outflows from Bitcoin ETFs!

Bitcoin ETF’lerinden Çıkışlar!

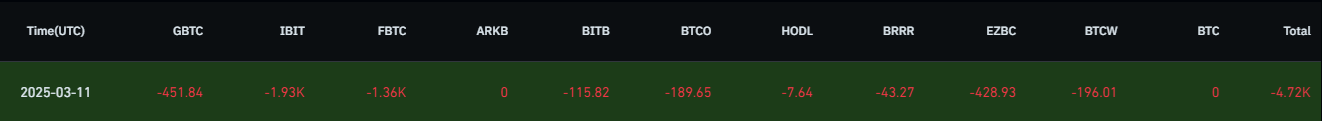

On March 11, total -4.72K net outflows were recorded from spot Bitcoin ETFs. The impact of custom tariffs is strongly felt in the market, with significant outflows from major funds creating a negative sentiment. This has raised concerns among investors about Bitcoin’s short-term direction.

Here are the details of the outflows from the major Bitcoin ETFs:

- IBIT: -1.93K

- FBTC: -1.36K

- GBTC: -451.84

- EZBC: -428.93

- BTCW: -196.01

- BTCO: -189.65

- BITB: -115.82

- BRRR: -43.27

- HODL: -7.64

Outflows Observed in Ethereum ETFs!

Significant outflows have also been observed in Ethereum ETFs. Recent data shows a total outflow of -11.58K from Ethereum ETFs. This could be seen as a response to changes in investor risk perception or market uncertainty.

The BlackRock Ethereum ETF (ETHA) experienced a -6.33K outflow, while the Fidelity Ethereum ETF (FETH) saw a -5.26K outflow. No outflows were observed in other Ethereum ETFs.

Current Status of Crypto ETFs: How Will the Market Be Affected?

While large inflows into crypto ETFs have been observed since the beginning of the year, recent outflows have raised questions about whether the market is entering a correction phase. Particularly, the outflows seen in Ethereum have occurred in parallel with Bitcoin, creating an overall sense of uncertainty in the markets.

Market experts suggest that ETF inflows and outflows can have significant effects on Bitcoin and Ethereum prices. These movements are believed to be driven by growing recession fears and global economic uncertainties such as trade tariffs.

The fear of a recession has led investors to avoid risks, while trade tariffs are triggering market volatility and trade wars. This could result in investors moving towards safer assets and withdrawing from the crypto markets. Therefore, experts recommend that investors closely monitor ETF movements in the upcoming period.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.