In today’s volatile cryptocurrency market, traders are constantly seeking innovative strategies to capitalize on price fluctuations. One such approach gaining popularity is Grid Trading. By strategically placing buy and sell orders above and below a predefined price range, traders can take advantage of changing market conditions. In this article, we’ll explore the mechanics of Binance Grid Trading and how it can help maximize profits.

Definiton of Grid Trading

Grid Trading is most effective in volatile and horizontal markets, where prices tend to fluctuate within a specific range. This technique leverages small price changes to generate profits. The concept involves creating a grid of buy and sell orders, gradually increasing or decreasing in price increments. The higher the number of grids employed, the greater the trading frequency. However, it’s crucial to consider associated costs, as the profit margin on each individual trade may be lower.

Optimizing Grid Trading Strategy: Rather than aiming for small profits on numerous trades, it is advisable to implement a strategy that focuses on less frequent but larger profit-per-trade opportunities. This approach allows traders to prioritize quality over quantity and minimize transaction costs associated with each trade.

How Binance Grid Trading Works: Binance Grid Trading facilitates Grid Trading for USDS-M and COIN-M Futures. The platform offers customizable parameters that allow traders to define upper and lower limits for the price range, as well as the number of grids to be implemented.

Once the grid is set, the system automatically executes buy and sell orders at predetermined prices.

You can use Coin Engineer special reference link when creating new account. The link contains %20 discount of fee payments.

Let’s explain with an example:

Suppose you anticipate that Bitcoin’s price will remain within the range of 50,000 USDT and 60,000 USDT over the next 24 hours. In this scenario, you can configure a Grid Trading system to operate exclusively within this specified range.

Key Parameters for Grid Trading:

- Upper and Lower Limits: Define the price range within which the trading system will operate.

- Number of Orders: Spe Upper and Lower Limits cify the desired number of buy and sell orders to be placed within the configured price range.

- Order Width: Determine the price increment between each buy and sell limit order.

When the price of Bitcoin drops to 55,000 USDT, Grid Trading bot will begin accumulating buy positions as it descends towards a price lower than the market value. As the price starts to recover, the bot will sell at a higher-than-market price, capitalizing on price returns.

In essence, this strategy aims to profit from price oscillations within the predetermined range.

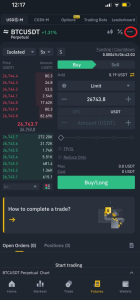

If you are using Binance App you follow the steps below:

Tap futures to start then tap […] (upper right corner)

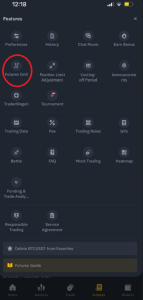

When the new page come up, click on ”Futures Grid”

After that you can start using Futures Grid Bot as you like:

For more information, don’t forget to watch our video:

You can present own thoughts as comment about the topic. Moreover, you can follow us on Telegram and YouTube channels for the kind of the news.