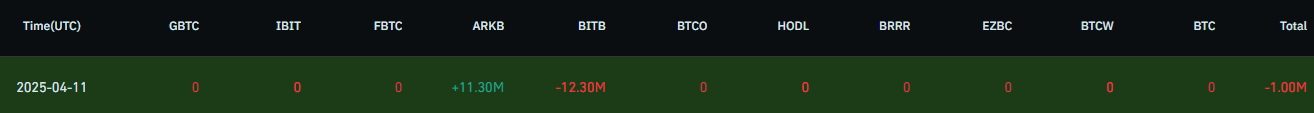

The cryptocurrency market continues to surprise its investors with its volatile nature. On April 11, 2025, notable movements were observed in the Bitcoin (BTC) and Ethereum (ETH) spot ETFs. Bitcoin ETFs saw a net outflow of 1 million dollars, while Ethereum ETFs experienced a net outflow of 29 million dollars.

Bitcoin ETF Outflows Continue

On April 11, Bitcoin investors withdrew a total of 1 million dollars from spot ETFs. The largest outflows came from the BITB fund. While there was an inflow to the ARKB fund, other funds remained neutral.

-

BITB: -12.30M

-

ARKB: +11.30M million dollars

-

GBTC, IBIT, FBTC, BTCO, HODL, BRRR, EZBC, BTCW, BTC: 0

Although there was an inflow of +11.30 million dollars into the ARKB fund, it was not enough to offset the overall outflows.

What’s the Situation with Ethereum ETFs?

While Bitcoin ETFs saw outflows, Ethereum ETFs recorded a total net outflow of 29.20 million dollars. Outflows in Ethereum spot ETFs were higher compared to Bitcoin ETFs, and no inflows were observed.

-

ETHW: -3.10 million dollars

-

ETHE: -26.10 million dollars

-

ETH, EZET, CETH, QETH, FETH, ETHV, ETHA: 0

Increasing Outflows in Crypto ETFs: Economic Uncertainty is Pressuring the Market

The cryptocurrency market has been under pressure lately due to heavy outflows from ETFs. The outflows observed on April 11, 2025, from both Bitcoin and Ethereum spot ETFs show that investors are becoming more risk-averse.

The -12.30 million dollar outflow from BITB, along with only a +11.30 million dollar inflow to ARKB, created a negative overall position. On the Ethereum side, the massive -26.10 million dollar outflow from ETHE has intensified concerns in the market.

Macroeconomic Developments as a Pressure Factor

Experts note that these outflows cannot be explained solely by technical analysis. In recent days, particularly the significant increase in import tariffs imposed by U.S. President Donald Trump, has put serious pressure on the markets. The new tariffs on China, reaching up to 145%, have raised supply chain costs, and investors are starting to adopt defensive positions against potential inflationary pressures.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.