Bitcoin’s price is up today due to a combination of dovish moves by central banks and rising optimism in the market. Several key factors are contributing to the surge:

1. Bank of Japan’s Steady Interest Rates

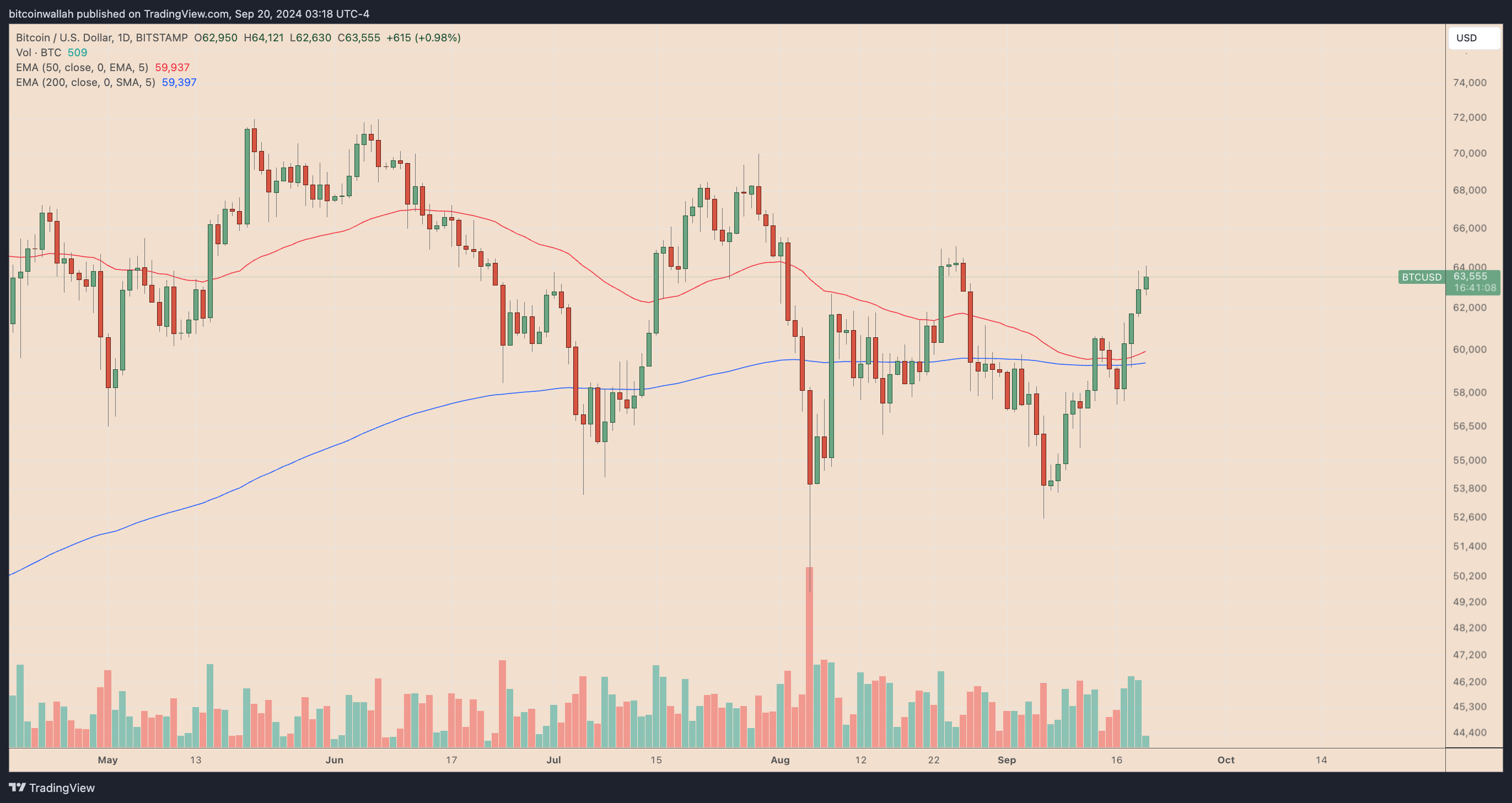

On September 20, Bitcoin’s price rose by approximately 2.5%, reaching over $64,000 after the Bank of Japan decided to maintain steady interest rates. This came after the central bank had increased rates in August, which had negatively impacted Bitcoin prices. The unchanged rates in Japan are favorable for investors, who can continue borrowing yen at lower costs and reinvesting in higher-yielding assets like Bitcoin, benefiting from cheaper liquidity.

2. Federal Reserve’s 50 bps Rate Cut

The U.S. Federal Reserve’s recent 50 basis points rate cut on September 18 also contributed to Bitcoin’s price surge. The rate cut makes traditional safer investments less attractive, encouraging investors to take on riskier, high-yielding assets like Bitcoin. This dovish stance from the Fed is boosting speculative investments, as borrowing costs remain low, pushing demand for Bitcoin higher.

3. Bitcoin Futures Open Interest and Funding Rates

Bitcoin’s rise is further supported by increasing open interest (OI) in its futures market, which indicates more capital flowing into Bitcoin. As of September 20, the total unsettled Bitcoin futures contracts were around $34.39 billion, the highest since August 26. This increase signals that traders are positioning themselves for further price increases. Additionally, funding rates have turned positive, suggesting a shift toward a more bullish market outlook. More traders are willing to pay the funding costs to hold long positions, expecting the price of Bitcoin to rise further.

Overall, the combination of these favorable economic conditions and positive market sentiment is pushing Bitcoin prices higher as traders feel confident in holding and increasing their positions.