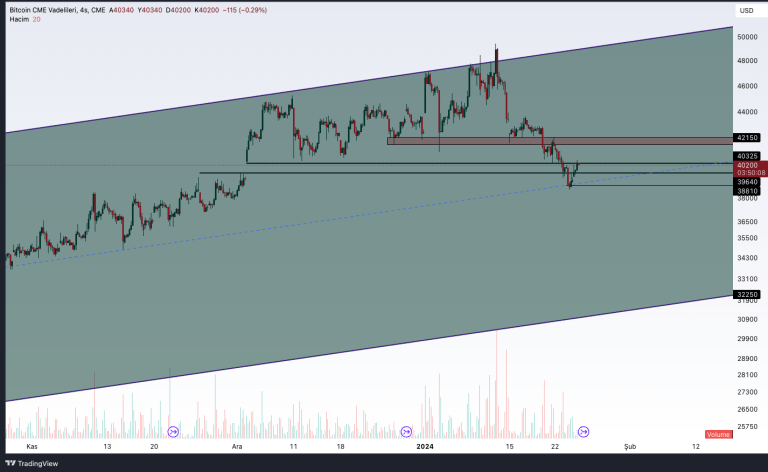

Bitcoin‘s Declines Close the CME Gap Between $40,325 and $39,640: Reacted from the middle band of the rising channel we mentioned a few days ago!

You might like: Aptos (APT) Price on the Rise Again | Aptos Review

In the cryptocurrency market, Bitcoin prices are experiencing a sharp retracement, coinciding with the sales of Bitcoin from exchanges by companies buying ETFs. Analyses show that this decline is due to formations studied from a technical perspective. Therefore, it is predicted that the current situation has the potential for correction. A detailed examination and interpretation of technical analysis helps us base our views on Bitcoin prices on a more solid foundation.

Let’s evaluate it on the Bitcoin chart now;

While tracking Bitcoin’s price movements, our thinking that a decline occurred due to the resistance of the upper band of the channel and the factors mentioned previously continues. The combination of these two factors contributed to the rapid occurrence of the decline. After falling to the middle band of the channel as of yesterday, we are observing a recovery today.

In order for this recovery to turn into an uptrend, we can think that Bitcoin needs to make daily closings above the levels of $42,150 on average. If this region is strengthened as support, Bitcoin may form an upward trend along with a horizontal course in the coming period. However, if the resistance level of $42,150 cannot be overcome, an accumulation period may occur between $42,000 and $38,800.

At this point, if the level of $38,800 clearly breaks the middle band of the channel, the target region may be the levels of (32,000 – 34,000), which is the lower band of the channel. Therefore, it is important to closely monitor Bitcoin price movements at the levels of $37,800 and $38,800.

Overall, the short-term trend for Bitcoin is still uncertain. However, the closing of the CME gap is a positive sign for the bulls. If Bitcoin can break the resistance level of $42,150, it could set the stage for a larger rally.