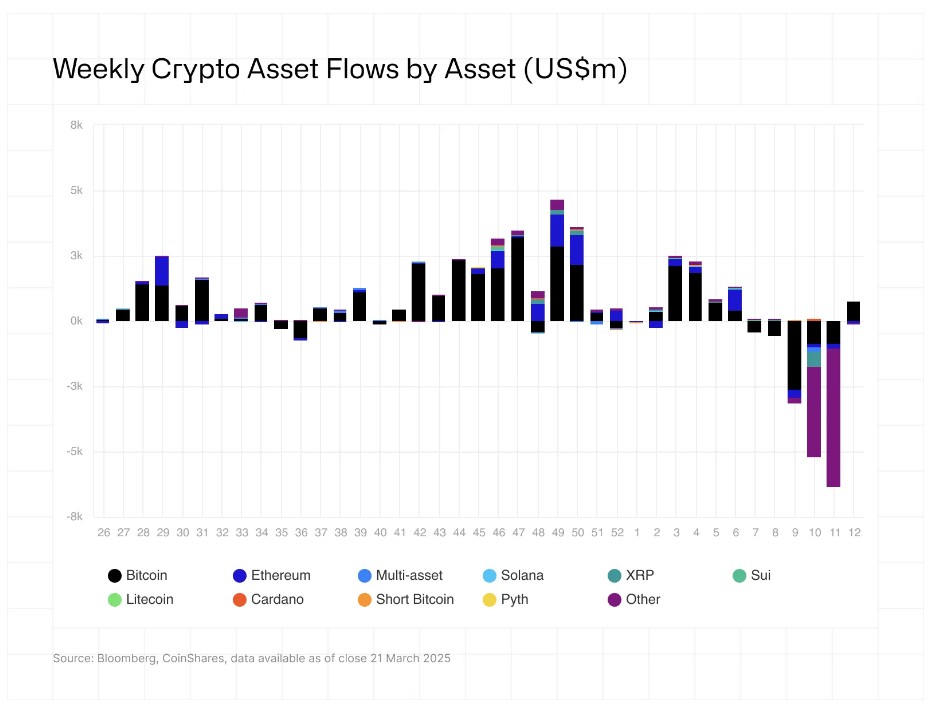

Digital asset investment products recorded net inflows for the first time in five weeks, following a period of net outflows, but Ethereum-based ETPs saw outflows of $86 million.

XRP and Solana led altcoin-based exchange-traded product (ETP) inflows for the week ending March 21, with $6.71 million and $6.44 million, respectively. Other altcoin inflows remained modest, with Polygon (MATIC) at $400,000 and Chainlink (LINK) at $200,000.

Ethereum Outflows Weaken Altcoin Market

However, the overall sentiment toward altcoins remained mixed, as Ether (ETH) alone experienced significant outflows totaling $86 million. Other notable outflows included Sui (SUI) with $1.3 million, Polkadot (DOT) with $1.3 million, and Tron (TRX) with $950,000.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Despite this, Bitcoin (BTC) led the recovery in digital assets, recording inflows of $724 million, snapping a five-week negative streak. Altcoins struggled, particularly due to Ethereum’s substantial outflows, but the total inflows amounted to $644 million.

United States Dominates Digital Asset ETP Inflows

According to CoinShares, the majority of inflows came from the United States, largely driven by BlackRock’s iShares Bitcoin Trust (IBIT). In Europe, Switzerland led with $15.9 million, followed by Germany at $13.9 million and Hong Kong at $1.2 million.

Solana and XRP were standout performers despite the overall altcoin outflows. Solana saw a surge following the introduction of the first Solana futures exchange-traded funds (ETFs) in the U.S., potentially paving the way for spot Solana ETFs in the future.

XRP, on the other hand, gained significant momentum following the dismissal of the long-running lawsuit filed by the SEC against Ripple Labs.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.