XRP Moves Closer to $2, Reaching a New 2024 Price High Thanks to New Partnerships and Increased Trading Volume.

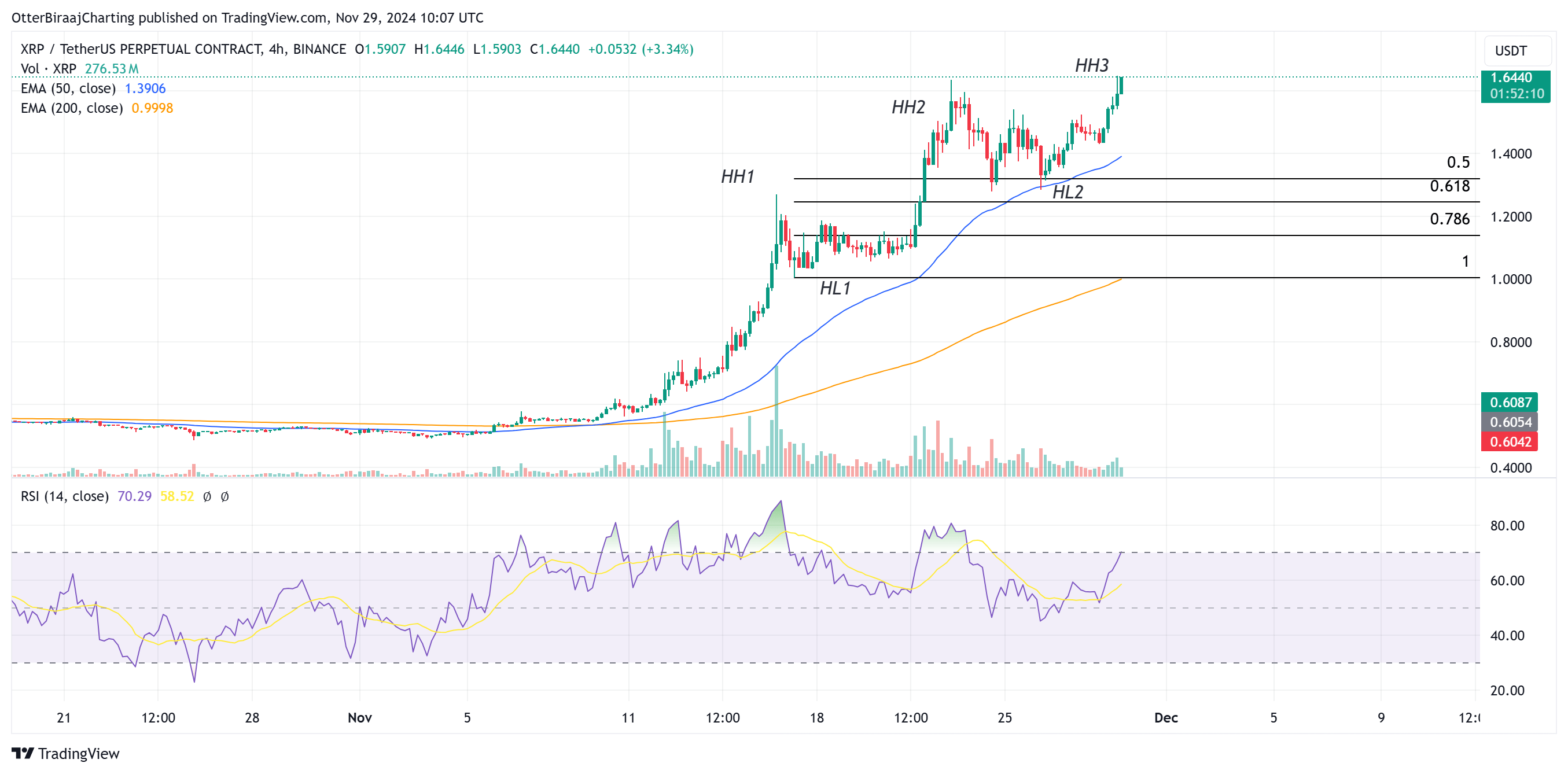

Ripple Rises to Year-to-Date High of $1.68 After Continuing to Form Higher Highs (HH). The crypto asset has gained 40% this week and may potentially surpass BNB to become the fifth-largest cryptocurrency by market capitalization.

XRP, 4 hour chart

Active XRP Accounts Increased by 100% in November

While XRP’s price surged by 232% over the past 30 days, on-chain metrics are also showing signs of a positive recovery. According to data from xrpscan, the number of active accounts or unique senders on the XRP network rose from 15,592 on November 1 to 47,044 on November 16.

The average number of active accounts in November doubled, increasing from approximately 12,000 to 25,000. Similarly, the number of new accounts activated on the XRP ledger showed a significant rise, indicating an influx of new users to the network.

The bullish sentiment around XRP was further bolstered by Ripple’s strategic partnership with Archax to launch a tokenized money market fund on the XRP ledger.

Additionally, crypto index fund manager Bitwise announced on November 7 that it would rebrand its European XRP ETP, providing European investors with access to XRP through a physically backed product.

XRP Aims for $2, but Overbought Conditions Signal “Distribution”

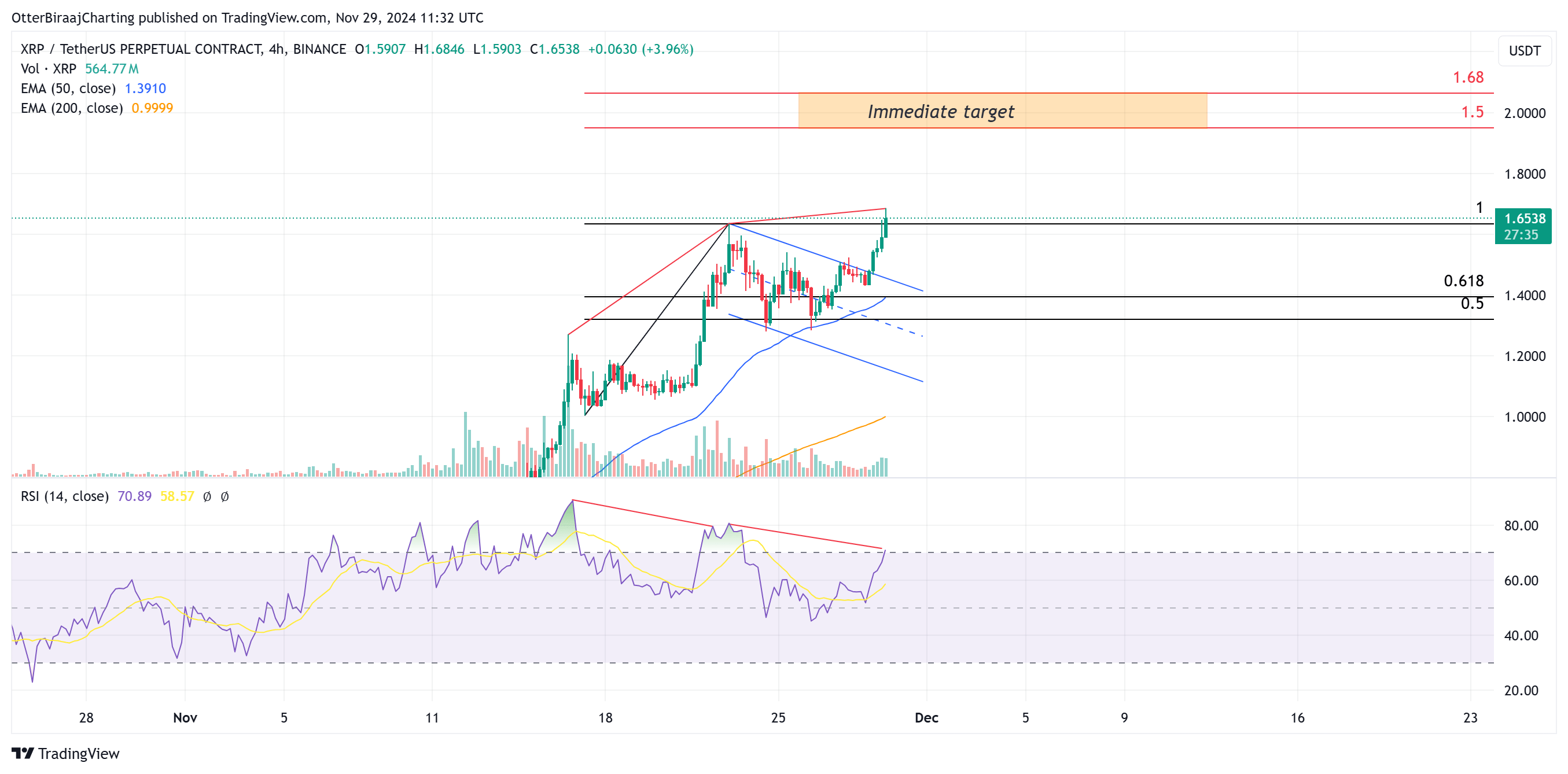

XRP’s recent rally came after a strong breakout from a bull flag formation. The formation of a new higher high on the chart indicates the continuation of the bullish trend and strengthens the possibility of further price gains.

XRP, 4 hour chart

According to the Fibonacci extension rule, XRP’s target lies between $1.95 and $2.05. Based on the Fibonacci extension levels calculated from XRP’s trend low of $1, the initial target range is between $1.95 and $2.05.

This range includes the previous market top of $1.97 from past bull runs, which could act as a strong resistance level.

Independent crypto analyst Mikybull also pointed out the potential for XRP to reach $2, stating:

“$XRP 2017 kind of rally vibes. Hit $2, experience a pullback, and then continue its vertical hated rallies to a new cycle top of probably $10.”

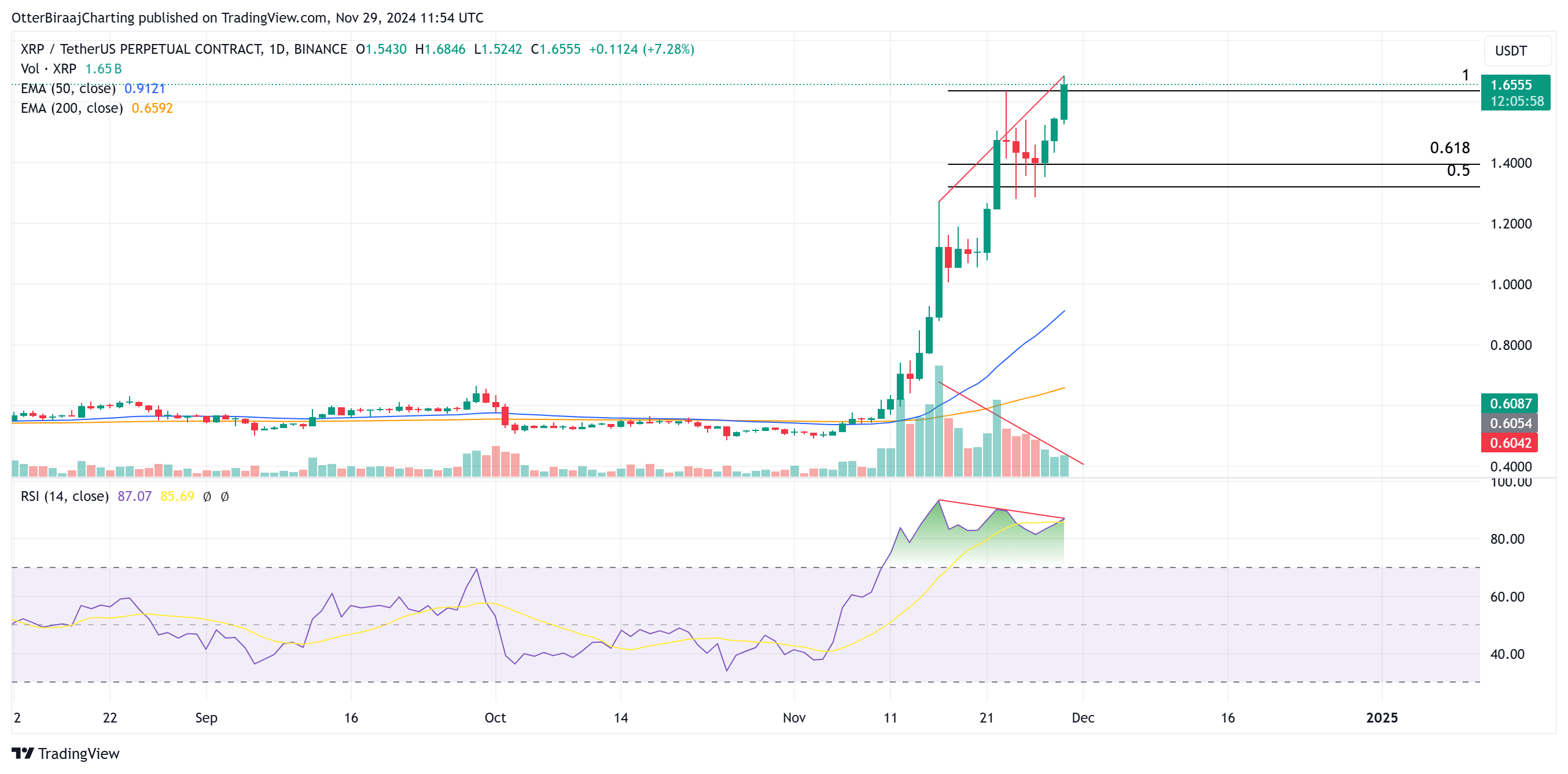

However, clear bearish divergences are shown on the mid-term and long-term charts.

XRP, 1 day chart

Price and trading volume have shown an inverse correlation since November 16. Another important analysis is that the price and trading volume have exhibited an inverse correlation since November 16.

This suggests that XRP is in a distribution phase, where market participants may be considering selling. Additionally, with trading volume reaching its lowest level since November 10 over the past three days, the likelihood of a bearish market reversal increases.

Investors should take these signals into account and be prepared for a potential pullback.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.