Whale distribution and a convincing bearish reversal indicator suggest that XRP will experience further price declines in early 2025.

XRP’s price surged by over 300% in the past two months, trading at $2.10 on December 27. However, warning signs indicate that XRP/USD could erase at least 25% of these gains in the short term.

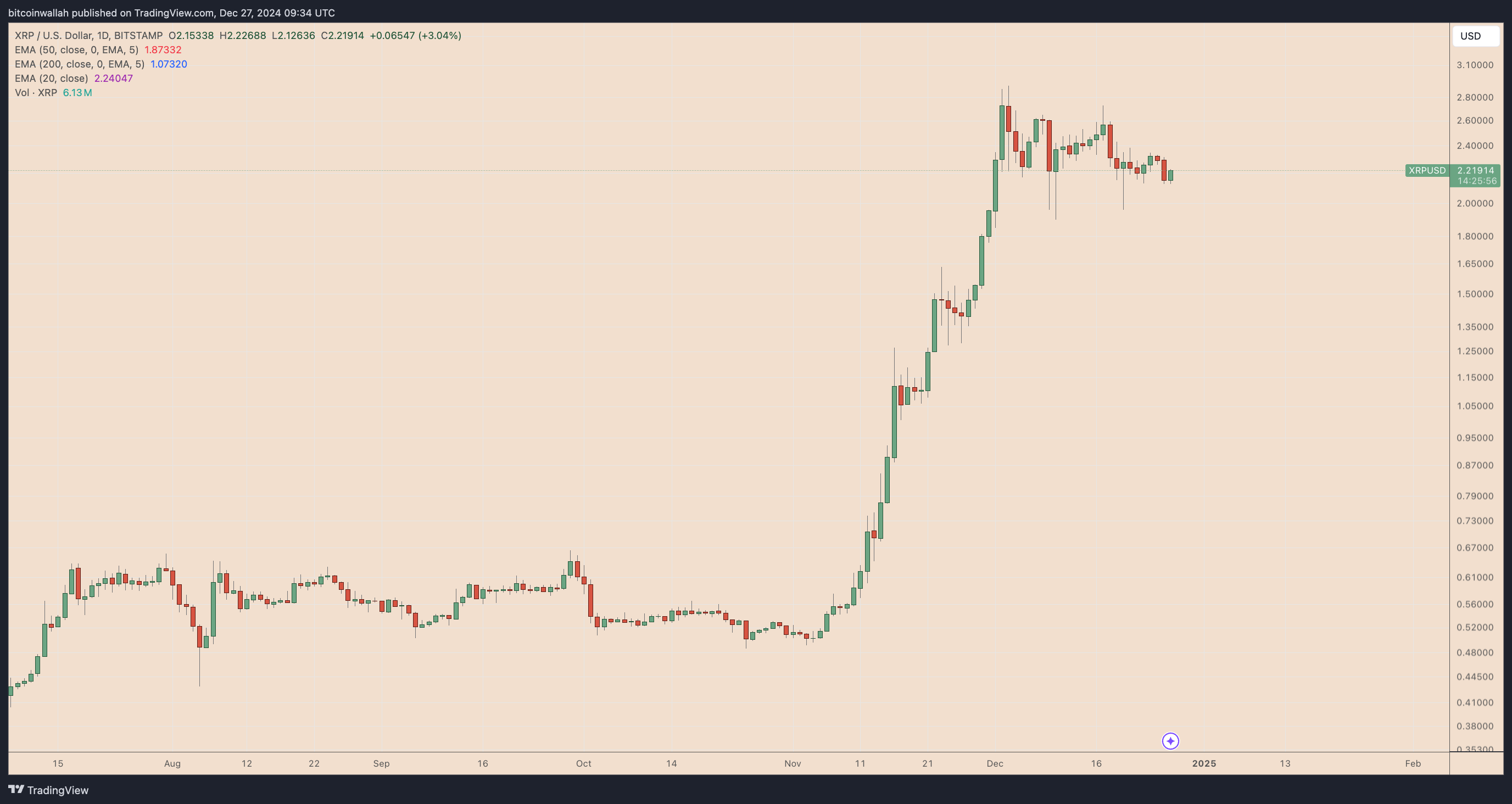

XRP/USD Daily Chart

XRP is Approaching a Descending Triangle Breakdown

XRP’s recent losses are emerging as its price trades within a descending triangle pattern, which is typically a bearish structure signaling further declines. This pattern is defined by a series of lower highs forming the descending trendline of the triangle, while the $2.10 level acts as horizontal support.

A decisive breakdown below the $2.10 support level could open the door to a deeper correction. The potential downside target for this breakdown is calculated by subtracting the height of the triangle from the breakdown point, according to technical analysis rules. In other words, XRP’s price could decline to around $1.64 in January 2025, approximately a 25% drop from the current price levels.

XRP Whales Are Taking Advantage of the Price Surge to Sell

On-chain data, along with metrics tracking whale addresses, supports the bearish outlook and reveals distribution sentiment. Notably, the supply held by XRP’s wealthiest investors (those with balances over 1 million tokens) has decreased by 180 million since the beginning of December.

XRP Supply in Addresses with a Balance of Over 1 Million

Meanwhile, the supply held by entities with a balance of 100,000 XRP has decreased by 170 million. The supply declines in both address groups align with XRP’s price drop of over 26% from its local top of $2.90.

XRP Supply in Addresses with a Balance of Over 100.000

Large-scale whale selling can create downward pressure on prices due to the increased token supply in circulation. Combined with the price decline, this suggests that selling activity has overwhelmed demand.

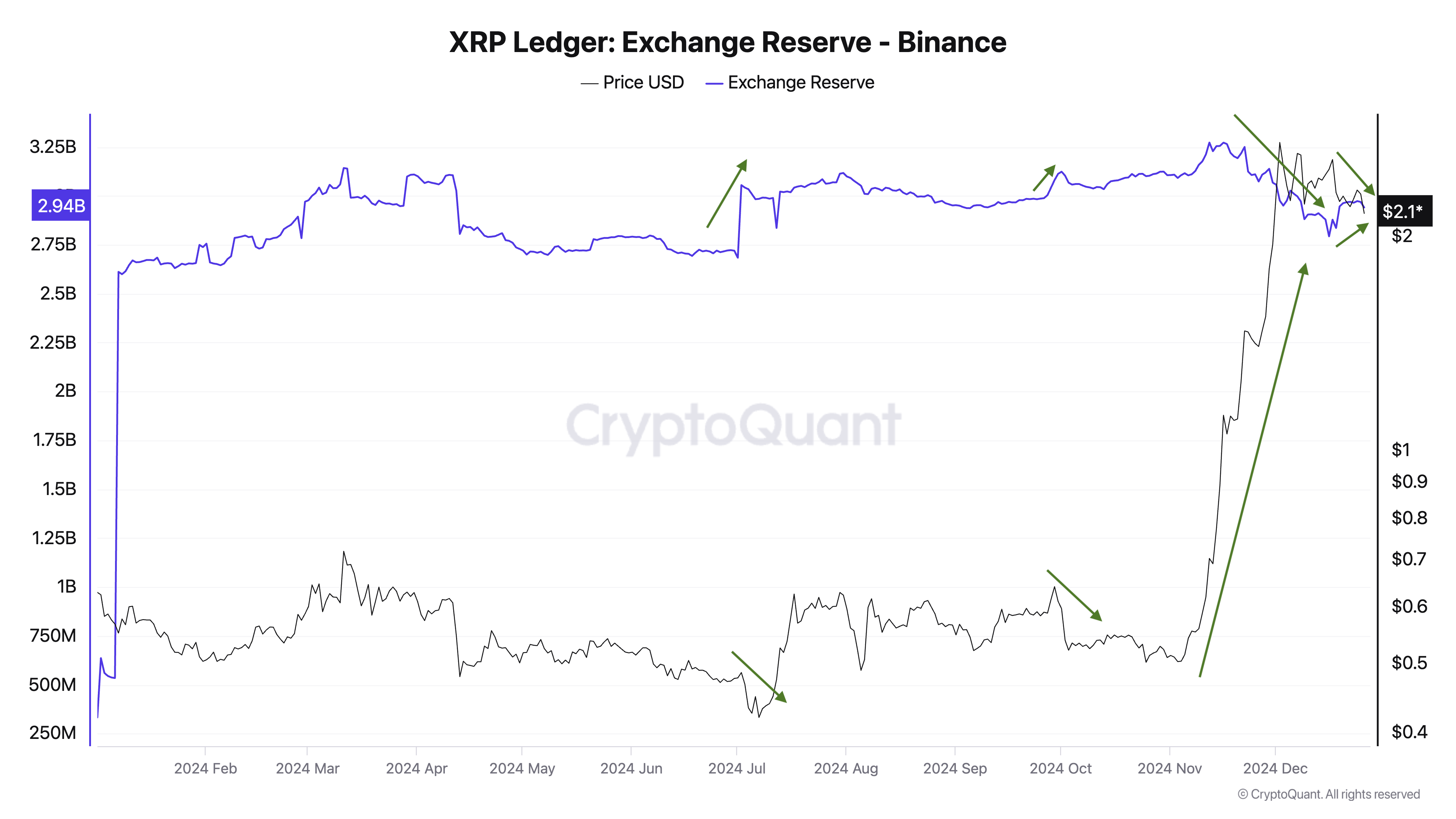

XRP Supply on Binance is Increasing

Additionally, XRP reserves on Binance, the largest cryptocurrency exchange by volume, have been steadily increasing since mid-December; this is typically considered a bearish signal, as it often precedes price corrections.

XRP Ledger Binance Exchange Reserves

The increase in exchange reserves supports profit-taking at local highs, contributing to XRP’s ongoing bearish momentum. Unless this trend reverses, as supply on exchanges grows and large investors continue to sell, XRP price could face a 25% downside risk.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.