What is zkLend?

zkLend is a money market protocol built on StarkNet that leverages the scalability and security advantages of blockchain technology to enable fast and secure financial transactions. By combining zk-rollup scalability with the security of Ethereum in a fast and cost-effective manner, zkLend aims to shape the future of decentralized finance.

zkLend was the first L2 money market protocol launched on StarkNet in 2022. The protocol offers a permissioned and compliance-focused solution for institutional clients and a permissionless service for DeFi users.

Some Features

Interest Rates: The protocol sets interest rates dynamically based on supply and demand.

Collateral: The protocol allows users to use multiple assets as collateral to borrow.

Liquidity: The protocol allows users to borrow and repay at any time.

Governance: The protocol allows ZEND token holders to vote on protocol parameters and supported assets.

How zkLend Works:

zkLend comprises two platforms, Artemis and Apollo, catering to both retail and institutional investors.

- Artemis: A zk-rollup protocol running on StarkNet, designed for DeFi users. Users can deposit, borrow, and lend supported assets, and utilize advanced features like flash loans.

- Apollo: Provides a dedicated layer for institutional clients.

Advantages:

zkLend offers a multitude of advantages, including:

- Decentralized: zkLend is a decentralized platform, allowing users to conduct financial transactions without relying on a central authority.

- Privacy: User privacy is protected through the use of zero-knowledge proof protocols, enhancing platform security.

- Fast and Easy: zkLend automates and accelerates transactions through smart contracts, enabling users to easily use the platform to borrow or lend.

- Institutional: Built with institutions in mind, zkLend adopts an approach focused on onboarding institutional users.

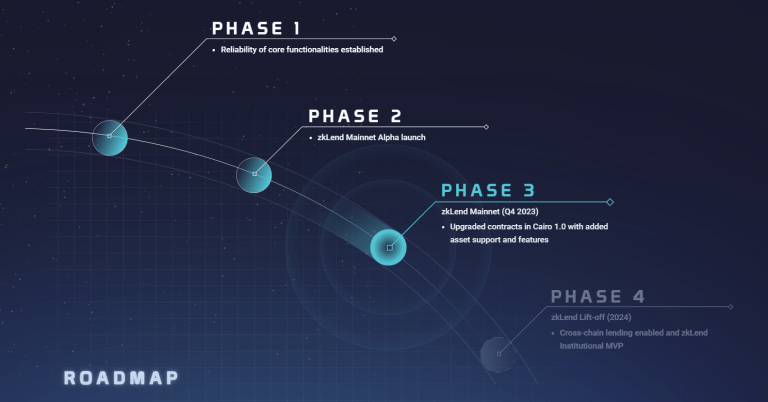

Roadmap:

zkLend’s roadmap aims to enhance the protocol’s reliability, security, usability, and innovation. The roadmap phases are as follows:

Phase 1: The protocol’s core functionalities have been secured. In this phase, the protocol operates on StarkNet’s alpha version and supports only specific assets like DAI, USDC, ETH, WBTC, and LINK.

Phase 2: The protocol’s security and auditability have been enhanced. In this phase, the protocol migrates to StarkNet’s beta version, supports more assets, audits its smart contracts, and establishes insurance pools.

Phase 3: The protocol’s usability and accessibility have been improved. In this phase, the protocol migrates to StarkNet’s mainnet, integrates with more wallets and interfaces, enhances user experience, and provides educational materials.

Phase 4: The protocol’s innovation and competitiveness have been solidified. In this phase, the protocol develops new features and products, offering services like credit cards, fixed-rate loans, derivatives, NFTs, and integration with other L2 protocols.

Backers and Partners:

zkLend is backed by the following institutions:

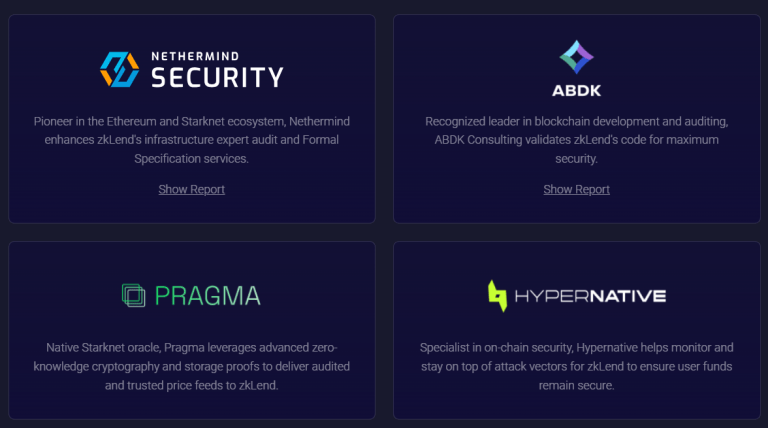

zkLend is secured by the following institutions:

Team with a Vision for Financial Freedom and Inclusion:

The zkLend team comprises a group of talented and passionate individuals dedicated to developing an L2 money market protocol with a vision for financial freedom and inclusion. Team members include some of StarkNet’s founders and developers, experienced engineers, designers, and marketers in the DeFi and blockchain space, academic researchers, and advisors.

The team actively contributes to the development of the StarkNet ecosystem and shares StarkNet full node snapshots. The team maintains constant communication with the DeFi community and takes feedback into consideration.

Tokenomics

zkLend tokenomics are the elements that define the protocol’s operation, governance, and value. The native token of the zkLend protocol is the ZEND token. ZEND is both a utility and governance token for the protocol.

ZEND Token Features

Total Supply: The total supply of ZEND tokens is fixed at 1 billion and is non-inflationary. No individual or entity has the authority to create ZEND tokens.

Distribution: The distribution of ZEND tokens will be fair and transparent among the protocol’s developers, investors, advisors, partners, users, and community. The distribution percentages are as follows:

- Developers: 20%

- Investors: 15%

- Advisors: 5%

- Partners: 10%

- Users: 25%

- Community: 25%

Utility: The ZEND token is a necessary payment instrument for using the protocol. ZEND tokens are required for borrowing, lending, collateralizing, providing liquidity, participating in insurance pools, and availing other services on the protocol.

Governance: ZEND token holders can use their tokens to vote on protocol parameters, supported assets, new features, and products.