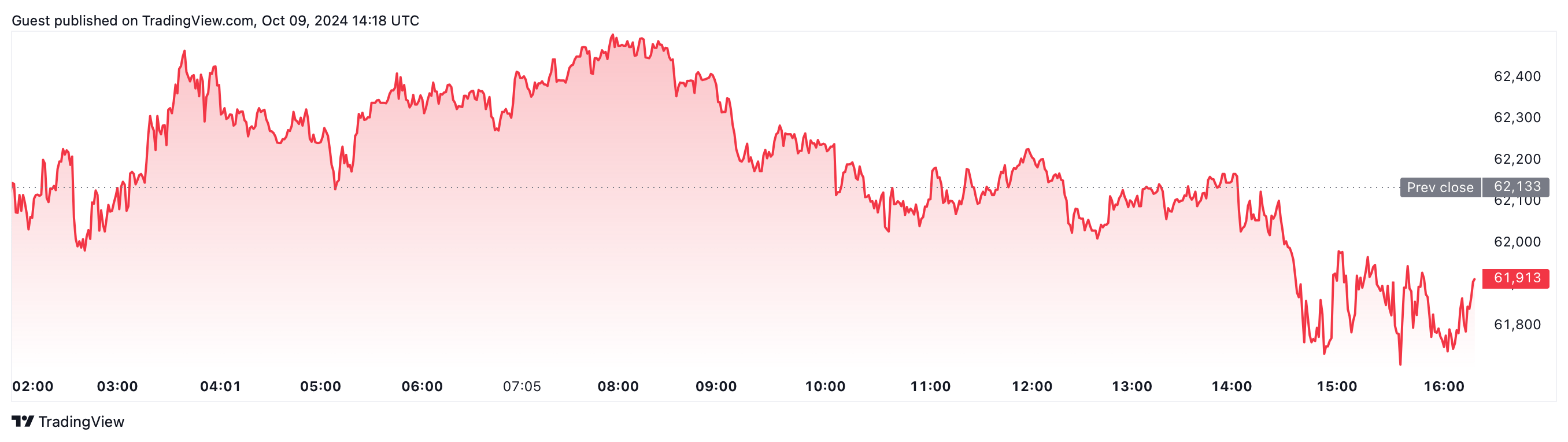

Bitcoin’s price has been consolidating around the $62,000 mark, leading some analysts to predict a significant move in the near future. However, the direction of this move remains unclear.

A well-known crypto trader highlighted that Bitcoin’s price compression often precedes a large movement, though it’s uncertain whether it will surge or drop. Factors that could influence the market include potential further interest rate cuts by the US Federal Reserve and the possibility of the US government selling off additional Bitcoin seized from Silk Road.

In an October 9 post, pseudonymous trader Daan Crypto Trades commented on the stagnation of Bitcoin’s price, stating, “Bitcoin is getting very compressed again after trading at this same price level for the past couple of days.” He added that a “large” move is likely coming, though it could go in either direction.

Daan advised traders to wait for clearer signals before making any decisions, suggesting it may be prudent to hold off on buying or selling until the market offers stronger cues.

Meanwhile, market speculations suggest that the Federal Reserve may continue to lower interest rates following its recent 50 basis point cut on September 18. Further rate cuts are generally seen as positive for riskier assets like cryptocurrencies, as traditional investments become less attractive.

Might interest you: What is BabyDoge?

HSBC predicts several more rate cuts in the coming months, with a potential 25 basis point reduction in November and subsequent cuts in early 2024. These cuts are expected to benefit Bitcoin and other digital assets, although concerns remain about the impact on those holding USD.

Some experts, like Strike CEO Jack Mallers, warn that these rate cuts could have negative effects on the US dollar. Similarly, Marketwise founder Porter Stansberry cautioned that many Americans may not realize the potential consequences of rate cuts, which could lead to higher inflation and interest rates, potentially devastating for those unprepared.Might interest you: What is BabyDoge?

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.