The traditional world of finance is quietly being reshaped. Institutional giants can no longer ignore the growing momentum of blockchain-based assets. The latest move from a major European fund manager highlights this shift in a striking way.

APS Invests $3.4M in MetaWealth’s Tokenized Bonds

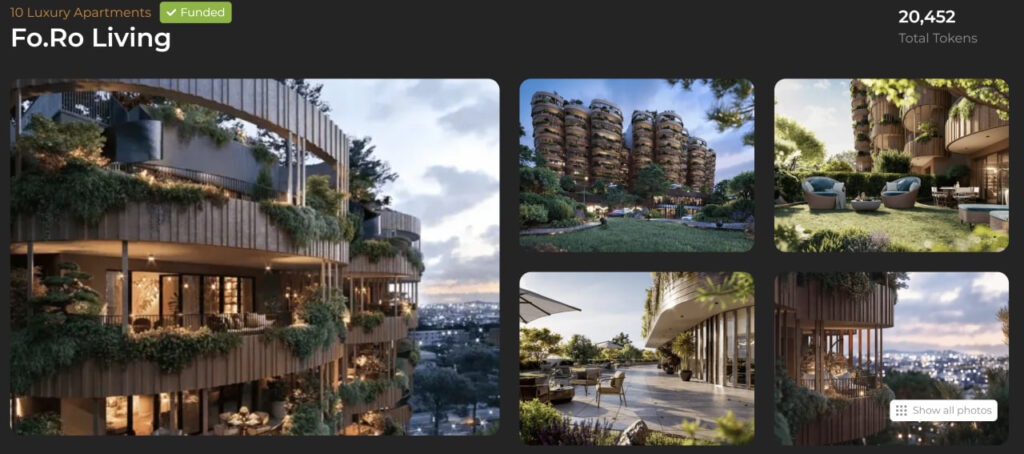

Pan-European asset manager APS, which controls over €12 billion ($13.7 billion), has become the first institutional investor to directly purchase tokenized real estate assets via MetaWealth. The company acquired €3 million ($3.4 million) in tokenized bonds tied to two residential projects in Italy — Fo.Ro Living Rome and Porta Pamphili Rome.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Each tranche was worth €1.5 million and offered on the same terms as those available to retail investors. All transactions were recorded on blockchain, ensuring full transparency and security.

“Tokenisation is a transformative shift in investment, increasing liquidity and simplifying transactions while maintaining compliance,” said Mihai Pop, manager at APS.

MetaWealth Expands Its Real Estate Token Empire

Founded in 2023, MetaWealth enables fractional ownership of Pan-European properties. The platform has already processed over $50 million in tokenized real estate transactions across Romania, Spain, Greece, and Italy.

CEO Amr Adawi commented, “This investment builds trust in the sector, adds liquidity to the ecosystem, and expands access to real-world assets for institutions and individuals alike.” MetaWealth now ranks among the world’s top 10 RWA tokenization platforms, with users from 23 countries.

Tokenization Goes Mainstream

Interest in RWA tokenization has soared recently. On April 30, BlackRock filed to introduce a blockchain-based share class for its $150 billion Treasury Trust Fund. That same day, Libre announced plans to tokenize $500 million in Telegram debt.

On May 1, MultiBank Group secured a $3 billion tokenization deal with UAE-based MAG and Mavryk, further confirming that tokenization is not just a trend — it’s the future of finance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.