NAVI Protocol is the first native liquidity protocol built on the Sui blockchain. NAVX is the ecosystem’s native token, playing an active role in both governance and economic operations. Users can collateralize their digital assets to borrow or provide liquidity to earn passive income.

Next-Gen Financial Infrastructure

Decentralized Finance (DeFi) has emerged as a transformative force in recent years. However, the user experience in DeFi can often be complex and limiting. This is where NAVI Protocol steps in. Promoted as a “Web3 bank for Web2 users,” the platform is designed to make DeFi more accessible to everyone.

How Does the Protocol Work?

NAVI Protocol operates through shared liquidity pools. Each supported asset has its own pool, where users can deposit funds and earn interest. Borrowers can draw from these pools by offering collateral.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

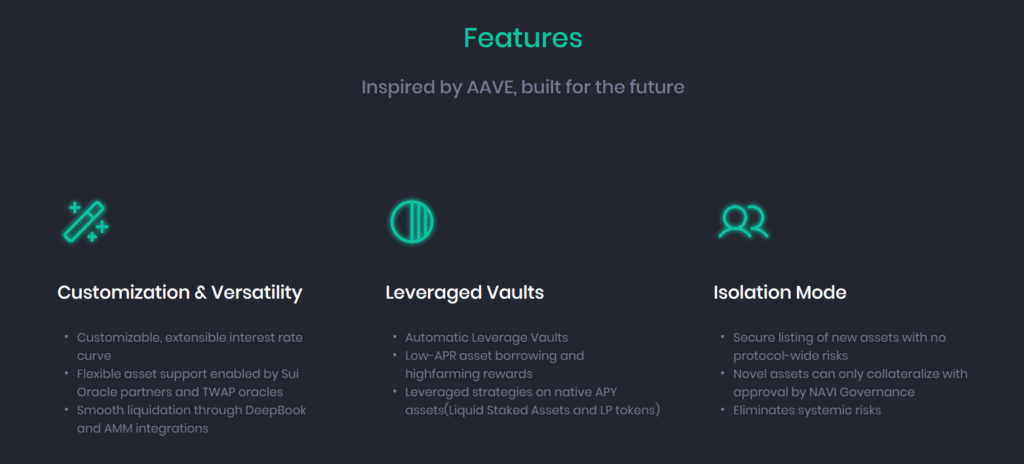

Each borrower’s position is tracked via a “health factor.” When this metric drops below 1, the position is subject to liquidation. To ensure robust risk management, the platform uses isolation modes, debt ceilings, and oracle-backed pricing systems.

Key Features

NAVI Protocol offers a suite of features focused on enhancing capital efficiency and improving the user experience:

- Liquidity Provision: Earn passive income by supplying assets

- Borrowing: Receive crypto loans by providing collateral

- Flash Loans: Borrow without collateral, provided it’s repaid within one transaction

- NAVI Pro: Advanced tools designed for professional investors

- Volo: Staking and yield optimization system that maximizes asset efficiency

NAVX Tokenomics

NAVX is the governance token of the protocol. With it, users can:

- Participate in governance decisions

- Stake for rewards

- Provide liquidity in NAVX/SUI and NAVX/vSUI pairs to earn LP token incentives

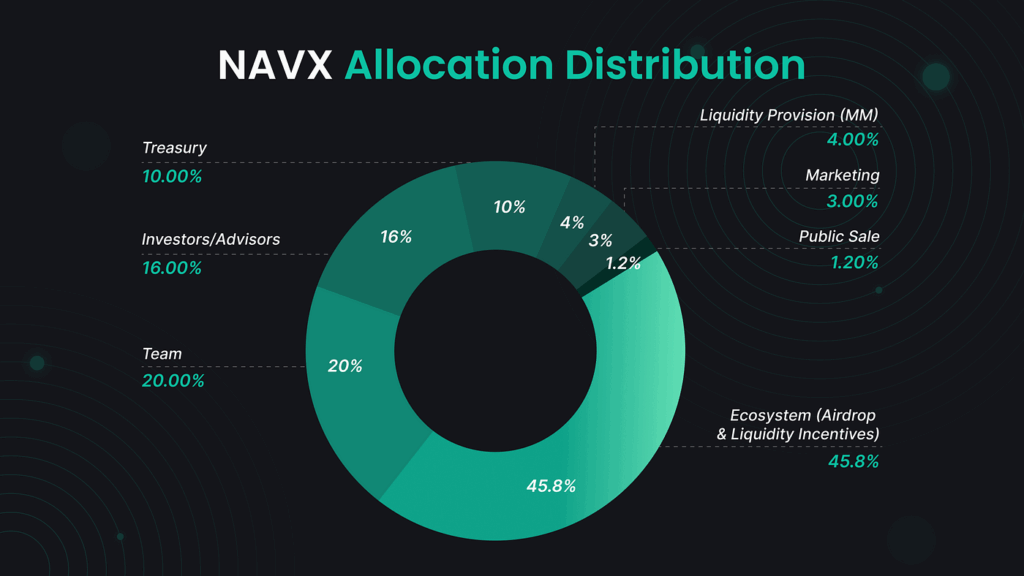

Token Distribution:

- Total Supply: 1 Billion NAVX

- Ecosystem & Airdrops: 45.8%

- Team: 20%

- Investors & Advisors: 16%

- Treasury: 10%

- Liquidity Provision: 4%

- Marketing: 3%

- Public Sale: 1.2%

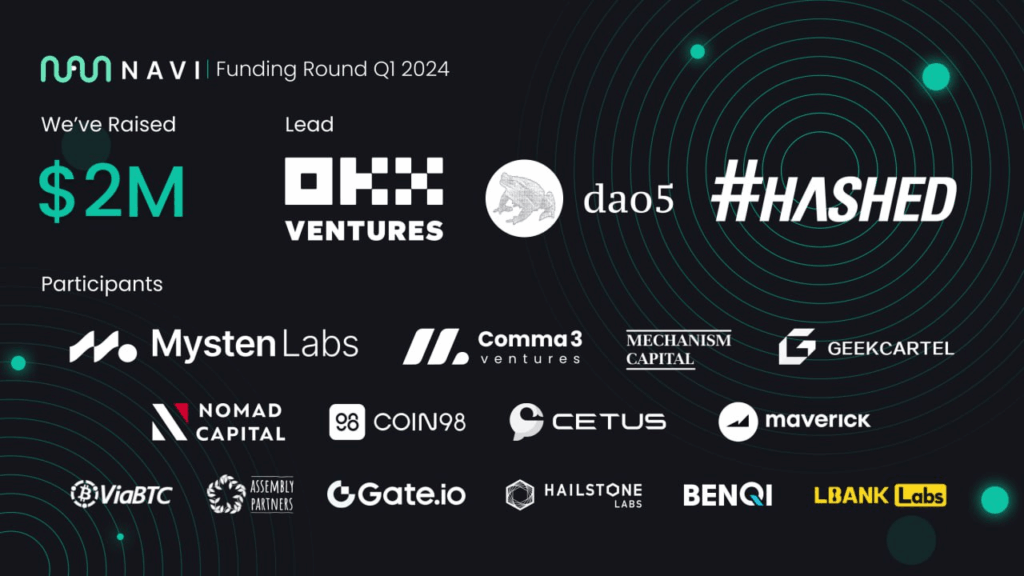

NAVI Protocol Investors

NAVI Protocol has gained trust not just through its technology, but also its strategic funding. The project raised a total of $2.03 million, aimed at scaling DeFi applications on the Sui blockchain.

The fundraising occurred in two major phases. In early 2024, the private funding round attracted key crypto funds like OKX Ventures, Hashed Fund, dao5, Mechanism Capital, Gate.io, and Arche Fund. This round brought in $2 million to support initial development.

Position in the Sui Ecosystem

NAVI Protocol holds the highest Total Value Locked (TVL) on the Sui blockchain, leading the DeFi sector with $381 million locked. In the BTCFi space, it has attracted over $60 million in staked BTC, reflecting strong user trust.

Its founders have backgrounds at major tech firms like Apple and LinkedIn. With robust infrastructure, a user-centric interface, and extensive security audits, NAVI Protocol aims to redefine the standards of decentralized finance.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.