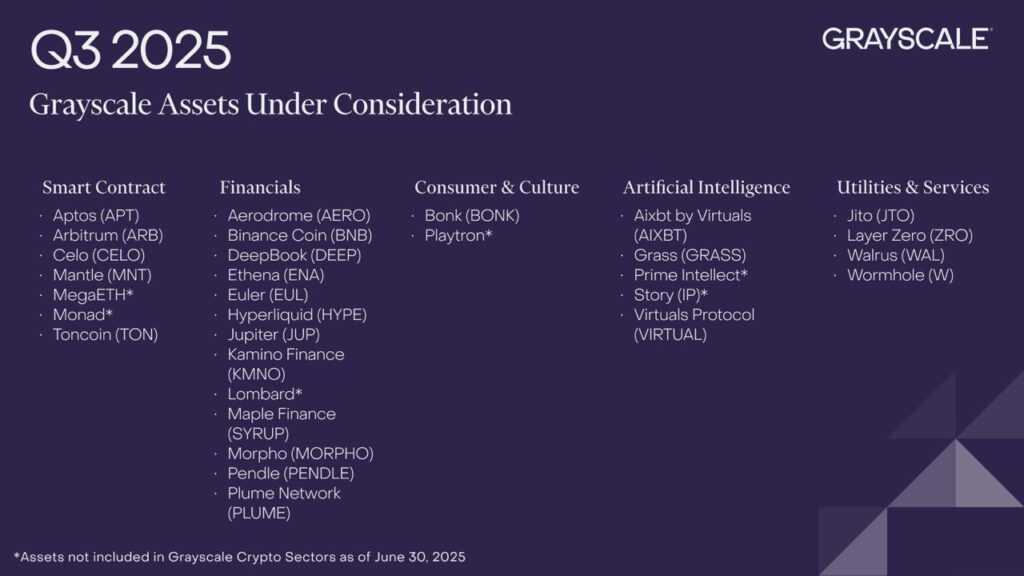

Grayscale published its updated crypto asset list for Q3 2025. This quarter, the company evaluated a total of 31 tokens. Compared to 40 assets last quarter, the list is now more streamlined. This shows Grayscale is making its evaluation process more strategic.

The company divided the projects into five main sectors in the new list. These sectors are: Smart Contracts, Finance, Artificial Intelligence, Consumer & Culture, and Services & Infrastructure.

New Tokens and Categories on Grayscale’s Radar

The Smart Contracts category remains one of Grayscale’s most focused areas. This group includes big names like Aptos (APT), Arbitrum (ARB), Celo (CELO), Mantle (MNT), and Toncoin (TON). Experimental projects such as MegaETH and Monad also stand out.

The Finance category emphasizes diversity. Binance Coin (BNB), Hyperliquid (HYPE), Pendle (PENDLE), and Aerodrome (AERO) are leading projects. Other notable tokens include DeepBook (DEEP), Ethena (ENA), Euler (EUL), Jupiter (JUP), Maple Finance (SYRUP), Kamino Finance (KMNO), Morpho (MORPHO), Plume Network (PLUME), and Lombard.

For the first time, Grayscale treated AI-focused projects as a separate class. This segment includes five tokens: Aixbt by Virtuals (AIXBT), Grass (GRASS), Virtuals Protocol (VIRTUAL), Prime Intellect, and Story (IP).

- The Consumer & Culture category is represented by two projects: Bonk (BONK) and Playtron.

- In Services & Infrastructure, Grayscale listed four projects: Jito (JTO), LayerZero (ZRO), Walrus (WAL), and Wormhole (W).

Some projects do not yet fully fit into existing sectors. MegaETH, Monad, Lombard, Playtron, Prime Intellect, and Story are classified as “unclassified.”

Which Projects Were Removed?

Grayscale not only added new projects this quarter but also removed some from its evaluation list. Notable removals include TRON, VeChain, Celestia, Akash, Arweave, Berachain, and Mantra. ELIZA, MOVE, Sentient, Eigen Layer, and Helium are also absent from the new list.

Additionally, the Services & Infrastructure segment shrank significantly. It had 13 projects in Q2 but is now limited to only 4 tokens. This simplification clearly shows Grayscale’s intent to focus its attention.

Grayscale did not provide specific explanations for removals. Its reports only list included assets without performance analysis or cause-effect evaluation. Therefore, investors should follow Grayscale’s other publications for deeper insights.

Grayscale Clarifies Institutional Focus

Grayscale’s list updates do not guarantee direct investments. However, the list indicates which projects the company finds worthy of research. This is an important signal for investors who want to understand institutional interest.

Moreover, many projects on the list can eventually be included in Grayscale’s single or multiple digital asset products. This update considered not only past data but also technological vision and market trends.

As a veteran player in digital asset management, Grayscale continues to lead the industry. The Q3 2025 update opens space for new projects and provides strong clues about how sectors will evolve in the future.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.