The crypto market is once again focused on Bitcoin and Ethereum as concerns grow about macroeconomic factors. Arthur Hayes, Chief Investment Officer of Maelstrom Fund, has warned that Bitcoin could fall back to the $100,000 level due to mounting economic pressures. Hayes has already taken profits from his crypto holdings in anticipation of this potential downturn.

Macroeconomic Pressures Could Drag Bitcoin Down to $100K!

Arthur Hayes attributes the recent crypto market pullback to renewed tariff concerns, triggered by a disappointing U.S. Non-Farm Payrolls report, which showed only 73,000 new jobs were added in July — a sign of economic fragility. Additionally, sluggish credit growth in major economies and stalled nominal GDP growth are contributing to fears that Bitcoin and Ethereum could fall further to the $100,000 and $3,000 levels, respectively.

Arthur Hayes Sells Over $13M in Crypto Assets

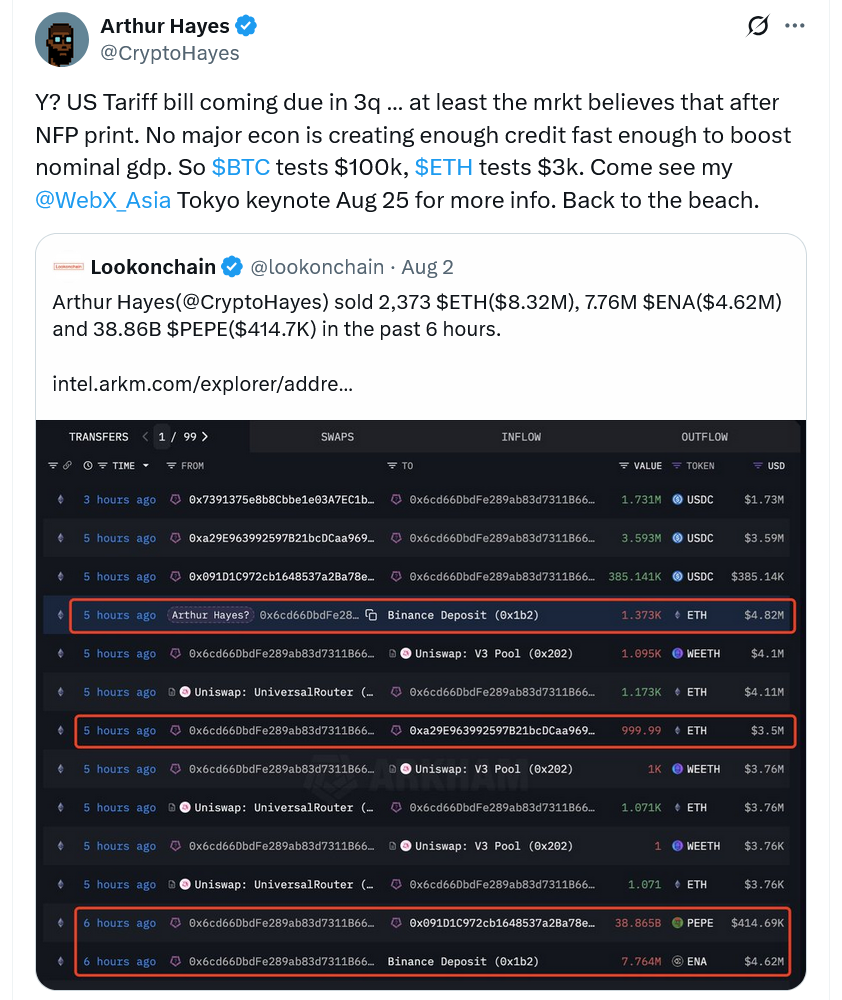

His comments came in response to an X post from blockchain analytics platform Lookonchain, which highlighted Hayes’ recent sell-off of $8.32 million worth of ETH, $4.62 million of Ethena (ENA), and $414,700 of Pepe (PEPE). After these sales, Hayes’ wallet now holds $28.3 million worth of tokens, with $22.95 million parked in USDC stablecoin.

You Might Be Interested In: Sonic SVM Research: Can New Stablecoins Shake Up the Old Order?

Bitcoin on the Verge of a Double-Digit Correction!

Hayes‘ remarks reflect broader fears that macroeconomic headwinds could stymie the momentum of the crypto market. Tight credit, renewed tariffs, and a weakening job market may place pressure on risk-on assets, testing investor conviction and potentially triggering a correction. Bitcoin has fallen over 7.7% from its all-time high of $123,000 on July 14, while Ether has dropped 12.5% since surpassing $3,900 on July 28.

Is Bitcoin Different This Time?

However, many industry analysts believe that Bitcoin has moved past the days of major double-digit pullbacks. Bloomberg ETF analyst Eric Balchunas noted that since BlackRock‘s spot Bitcoin ETF filing in June 2023, Bitcoin has experienced “Much less volatility and no vomit-inducing drawdowns.” Mitchell Askew, head analyst at Bitcoin mining firm Blockware Solutions, added, “The days of parabolic bull markets and devastating bear markets are over.”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.