Avalanche (AVAX) has recently become a focus of investor attention thanks to its strong growth initiatives in the Asian market. In particular, the launch of a won-backed stablecoin in South Korea has accelerated the network’s regional adoption, while global corporate partnerships are also drawing attention.

On-chain data reveals record-breaking transaction volumes and increasing user activity within the Avalanche ecosystem. The trading volume on decentralized exchanges (DEXs) on the network indicates not only individual investor interest but also that institutional capital is flowing into Avalanche.

Avalanche’s Rise in Asia

Avalanche is gaining significant momentum, especially in the Asian region. In South Korea, BDACS launched KRW1, the first won-backed stablecoin on Avalanche, in partnership with Woori Bank. Following a successful proof of concept, KRW1 is now in the pilot phase and offers a wide range of uses, from remittances to public payments.

Additionally, INEX exchange, under its agreement with Ava Labs, has begun testing stablecoin payments across both online and offline channels. These initiatives bring the Avalanche ecosystem closer to South Korea’s active market, which has over 15 million crypto accounts.

Avalanche is also actively expanding in Japan. Partnerships with Densan (65,000+ stores) and SMBC Bank for stablecoin-based payment solutions are ongoing. Additionally, Bowmore & Suntory’s tokenized whiskey projects and Toyota Blockchain Lab’s automotive finance initiatives demonstrate that Avalanche is a pioneer not only in crypto but also in tokenizing real-world assets (RWA).

Strong On-Chain Data

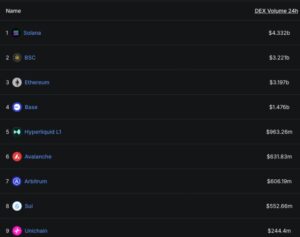

The growth of the Avalanche ecosystem is not limited to marketing announcements. DEX trading volume reached $12 billion in August, and in the past 24 hours, $630 million in volume surpassed Arbitrum and Sui. This represents an eightfold increase over the last two months.

The total value of RWAs (Real-World Assets) in the ecosystem has exceeded $450 million. Grove Finance is targeting $250 million in institutional loans, while SkyBridge is tokenizing a $300 million investment fund. The Wyoming-backed FRNT stablecoin and Exit Festival’s 500,000-ticket NFT integration highlight Avalanche’s real-world use cases.

Institutional Interest and ETF Prospects

Avalanche is making strong moves at the institutional level as well. With “first-of-their-kind” projects such as KKR’s healthcare fund tokenization in 2022 and the Wyoming stablecoin in 2025, Avalanche stands out through major corporate partnerships.

Currently, four separate AVAX ETF applications are awaiting SEC approval. If these products are approved, institutional capital is expected to flow into Avalanche similarly to Bitcoin ETFs. Analysts predict that this could drive AVAX prices to new highs.

Price Action

From a technical perspective, AVAX has broken out of a bullish flag formation and gained strong upward momentum. Finding solid support at $27, the token is currently trading around $32. The recent 8% increase indicates strengthening positive sentiment in the market.

Experts suggest that, considering on-chain data, institutional partnerships, and ETF expectations, the next target for AVAX could be $42. Having reached its highest level since February, AVAX has attracted institutional attention, especially following news of the $500 million Treasury bond.

Analysis

Avalanche has gained strong momentum in 2025 toward global expansion, driven by stablecoin initiatives in Korea and Japan, institutional partnerships, and record-breaking network performance. The KRW1 launch, collaboration with INEX, and Japan-based stablecoin projects are increasing Avalanche’s influence in Asia.

The upward expectation for AVAX is supported by on-chain metrics and institutional ETF applications. All these developments indicate that Avalanche is not just a blockchain network but a central player in the digitalization of global finance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.