APRO (AT) is a groundbreaking data oracle protocol that bridges blockchain networks with real-world data. Designed with a decentralized architecture, APRO delivers data for cutting-edge ecosystems such as Real-World Assets (RWA), Artificial Intelligence (AI), prediction markets, and Decentralized Finance (DeFi). Operating through pull and push models, APRO enables smart contracts to access real-time, reliable data. Integrated with over 40 blockchain networks, it provides more than 1,400 data feeds. APRO ensures data accuracy and security through proprietary AI technology, decentralized data aggregation, a dispute resolution layer, and partnerships with leading security audit firms. This article delves into APRO’s essence, functionality, advantages, risks, and ecosystem.

What is APRO (AT)?

APRO is a decentralized oracle protocol that securely delivers real-world data to blockchain networks. It supports applications in RWA, AI, prediction markets, and DeFi. Leveraging machine learning models, APRO enhances data validation and sourcing. Compatible with over 40 blockchain networks—including Bitcoin native, BTC Layer 2, EVM-compatible chains, MoveVM, SVM, zkEVM, and TVM—APRO offers 1,400+ data feeds covering cryptocurrencies, stocks, real estate, commodities, and social media data. It is both startup-friendly and cost-efficient for established enterprises.

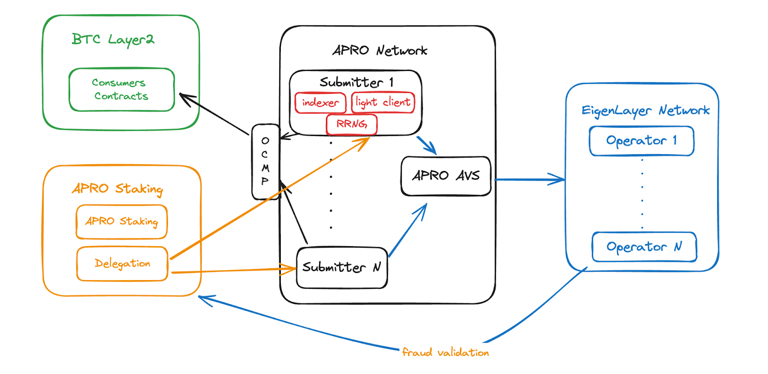

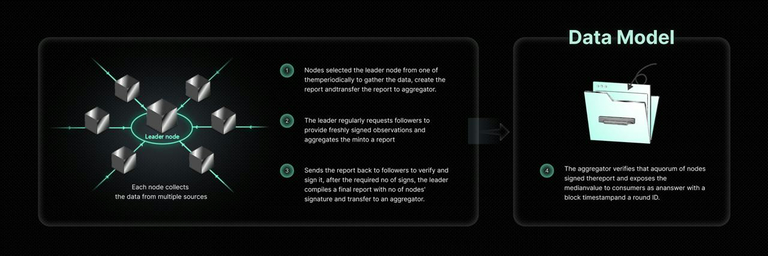

APRO operates two primary data models: Data Pull and Data Push. The Data Pull model retrieves data from APRO’s decentralized network only when needed, offering cost-effective, low-latency access. The Data Push model provides automatic data updates based on price thresholds or heartbeat intervals, ideal for DeFi and prediction markets. APRO’s dual-layer oracle network—OCMP (Off-Chain Message Protocol) as the primary layer and Eigenlayer as the secondary layer—enhances data reliability and resolves disputes.

Purpose of APRO

APRO’s mission is to provide blockchain ecosystems with secure, accurate, and real-time data. Blockchains are deterministic systems, producing consistent outputs for identical inputs. However, external data (prices, weather, election outcomes) is variable, requiring secure integration into blockchains.

APRO serves as this data bridge, enabling smart contracts to interact with the external world. It excels in DeFi protocols, decentralized exchanges, prediction markets, and RWA tokenization. By leveraging AI-driven analytics, multi-source data aggregation, and decentralized validation, APRO prevents data manipulation, fostering a trustworthy ecosystem.

How Does APRO Work?

APRO operates through Data Pull and Data Push models, alongside a Proof of Reserve (PoR) feature for transparent verification of tokenized asset reserves. Its dual-layer oracle network enhances data reliability: the OCMP layer collects data from independent nodes, while the Eigenlayer serves as an adjudicator in disputes.

Nodes are incentivized through staking, with margins slashed for inaccurate data or erroneous escalations. Users can challenge node behavior, integrating the community into the security framework. APRO employs PBFT (Practical Byzantine Fault Tolerance) consensus to ensure data integrity, requiring a minimum of seven validation nodes and a two-thirds majority.

Data Pull

The Data Pull model retrieves data only when required, enabling smart contracts to fetch price data (price, timestamp, signatures) from APRO’s decentralized network via the Live-Api service. Data is verified on-chain and used in four scenarios:

-

Update and Use Latest Price: Fetch the latest price from Live-Api, verify and update it on-chain, and use it in business logic.

-

Specific Timestamp Price: Retrieve and verify a price for a specific time.

-

Price Verification: Similar to traditional push models, verify the price on-chain.

-

Read Verified Price: Access the latest verified price on-chain, though timeliness depends on user verifications.

Warning: Report data is valid for 24 hours; outdated data may be mistaken for the latest price.

Data Push

The Data Push model delivers automatic data updates at price thresholds or heartbeat intervals. Independent nodes aggregate and push data to the blockchain, ideal for scalable applications like DeFi and Bitcoin Layer 2. APRO ensures reliability through a hybrid node architecture, multi-centralized communication networks, TVWAP price discovery, and a multi-signature framework.

Proof of Reserve (PoR)

PoR verifies tokenized asset reserves transparently in real time. APRO RWA Oracle aggregates data from multiple sources (exchange APIs, DeFi protocols, banks, regulatory filings) and uses AI-driven analytics to:

-

Parse documents (PDF reports, audit records).

-

Standardize multilingual data.

-

Detect anomalies and assess risks.

PoR Workflow:

-

User request → AI (LLM) → MCP Protocol → Oracle Adapter → Blockchain Data → Report Generation.

-

Report: Asset-liability summary, collateral ratio, asset categories, compliance status, risk assessment.

Real-Time Monitoring: Tracks reserve ratios, asset ownership, compliance, and market risks, triggering alerts for critical events (e.g., reserve ratio below 100%).

Technical Infrastructure

APRO’s dual-layer network includes:

-

OCMP Layer: Nodes collect data, monitor each other, and report anomalies to Eigenlayer.

-

Eigenlayer: Resolves disputes, leveraging high reliability scores or ETH security.

Nodes stake two margins:

-

Slashed for reporting data differing from the majority.

-

Slashed for faulty escalations.

Users can challenge node behavior, integrating the community into security. APRO’s PBFT consensus ensures data integrity with at least seven validation nodes and a two-thirds majority requirement.

APRO Use Cases

APRO supports:

-

DeFi and Derivatives: Real-time price data for transactions and settlements.

-

RWA Tokenization: Pricing for stocks, bonds, commodities, and real estate.

-

Prediction Markets: Event data for contract settlements.

-

Gaming and Social Media: Specialized data feeds.

Usage Steps:

-

Connect to data feeds via APRO API.

-

Use Data Pull or Push in smart contracts.

-

Verify reserves with PoR.

-

Read data using Solidity or Web3.js.

Advantages of APRO

-

Broad Coverage: Supports 40+ blockchains and 1,400+ data feeds.

-

AI Integration: Intelligent analytics, anomaly detection, multilingual reporting.

-

Decentralized Security: PBFT consensus and multi-source validation.

-

Cost Efficiency: Data Pull reduces gas fees.

-

Flexibility: Supports high-frequency and event-driven data access.

Technical Features of APRO

APRO RWA Oracle supports multiple asset classes (bonds, stocks, commodities, real estate). The TVWAP algorithm calculates prices with high accuracy:

-

High-frequency assets (stocks): Updated every 30 seconds.

-

Medium-frequency assets (bonds): Updated every 5 minutes.

-

Low-frequency assets (real estate): Updated every 24 hours.

Anti-Manipulation:

-

Multi-source data (NYSE, Uniswap, Reuters, Federal Reserve).

-

Median-value algorithms, Z-score anomaly detection, dynamic thresholds.

AI Capabilities:

-

Document parsing (audit reports, regulatory filings).

-

Multilingual standardization.

-

Predictive anomaly detection.

-

Natural language report generation.

Third-Party Validation: An independent node network prevents issuer manipulation.

APRO Tokenomics

While detailed tokenomics are not specified, APRO’s service fees are paid using native blockchain gas tokens or their ERC20-wrapped versions. In the Data Pull model, on-chain costs are typically passed to users, with APRO offering potential discounts based on gas fee dynamics.

APRO Team and Investors

APRO’s development team specializes in blockchain and AI technologies, though specific members are not disclosed. The protocol is backed by prominent investors:

-

Polychain Capital

-

Franklin Templeton

-

YZi Labs

-

abcde

-

CMS

-

Oak Grove Ventures

-

UTXO

-

Comma3 Ventures

-

Presto

These investors fund APRO’s research, development, and ecosystem expansion.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.