Today, the crypto market crashed, with the global market cap dropping 4% to $3.45 trillion. Bitcoin, Ethereum, XRP, and BNB prices fell sharply, as investors reacted to extreme volatility and rising liquidation risks.

Macro Shocks and Government Impact

ISM US Manufacturing PMI for October came in at 48.7, below forecasts, marking the eighth consecutive month of contraction in the sector. The prolonged U.S. government shutdown, combined with cautious comments from Federal Reserve officials regarding a potential rate cut, pushed the U.S. Dollar Index (DXY) above 100 and kept the 10-year Treasury yield near 4.1%. Since Bitcoin and crypto prices usually move inversely to DXY and Treasury yields, these macro factors contributed to heavy selling pressure in the crypto market.

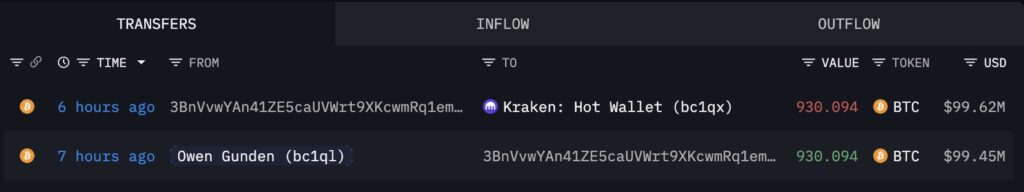

Whale Selling and Institutional Reactions

Whales and long-term holders have offloaded nearly $50 billion in BTC since October. Recent events, including the $130 million Balancer hack and the XUSD de-peg, further dampened whale sentiment. On-chain data shows active selling of ASTER, ETH, DOGE, XRP, and PEPE by major holders. Spot Bitcoin and Ethereum ETFs recorded net outflows for the fourth consecutive day, signaling bearish sentiment among institutional investors.

Hindenburg Omen Warnings and Liquidations

The Hindenburg Omen flashed twice at the end of October and once at the start of November, signaling a potential “serious decline within the next 40 days,” according to Bloomberg. This was the first appearance since March 3, 2025, which preceded a 20% U.S. market reversion triggered by President Trump’s new ‘emergency power’ tariffs. Historically, the indicator has flagged the 1987, 2000, 2007, and 2015 stock market crashes, making it popular among non-mainstream analysts. However, it is not a guarantee; while it highlights market risk and discrepancies, downturns do not always follow.

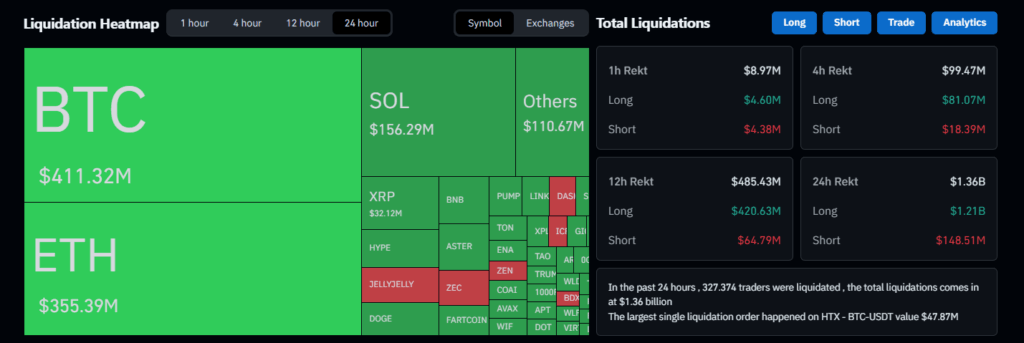

Coinglass data shows over $1.5 billion in liquidations within the last 24 hours, affecting 329K traders. A single BTCUSDT liquidation reached $47.87 million. These high-leverage liquidations are fueling further volatility and caution among investors.

Bullet List: 5 Key Reasons Behind Today’s Crypto Market Crash

-

Macro shocks from US manufacturing weakness and government shutdown

-

Whale and long-term holder selling pressure

-

Outflows from Bitcoin and Ethereum ETFs

-

Hindenburg Omen warnings signaling potential further declines

-

Over $1.5 billion in high-leverage liquidations

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.