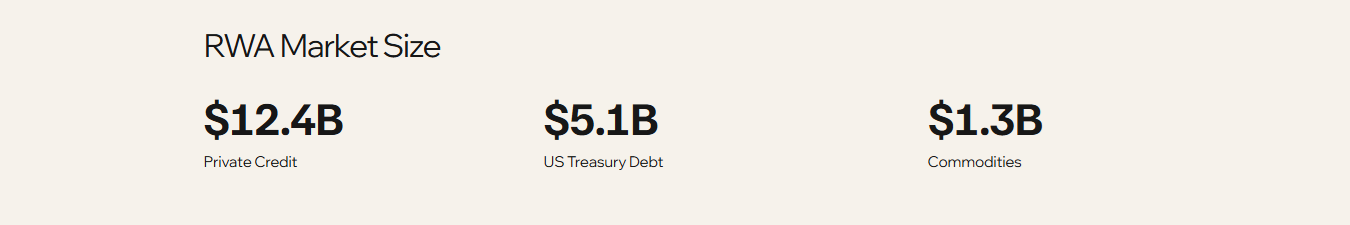

As the tokenization of real-world assets (RWA) onto the blockchain becomes one of the fastest-growing areas in the crypto ecosystem, the tokenization of established and reliable assets like gold is at the center of this transformation. Arowana (ARW) stands out as a gold-based RWA platform that aims to offer a transparent and verifiable digital asset model by combining physical gold with blockchain infrastructure.

Arowana’s core goal is to eliminate the access, storage, and liquidity issues of traditional finance, bringing real-world assets—starting with gold—on-chain and building a more efficient financial infrastructure on a global scale.

What is Arowana Protocol (ARW)?

Arowana Protocol is a Real World Asset (RWA) platform that enables the secure, transparent, and efficient use of digital assets backed by physical gold on the blockchain. While focusing on gold tokenization in the initial phase, the protocol plans to include different asset classes such as real estate, commodities, and bonds in the ecosystem in the long term.

At the center of the platform is AGT (Arowana Gold Token), designed as a fully verifiable digital asset backed by physical gold. Arowana aims not only to produce tokens but also to provide an infrastructure where these assets can be actively used within the DeFi ecosystem.

What is AGT (Arowana Gold Token)?

AGT is the core asset of the Arowana Protocol and operates on the principle of 1 AGT = 1 gram of LBMA-certified physical gold. Each AGT token is minted only after the corresponding physical gold is stored in secure vaults.

Key features of AGT include:

- 1:1 Physical Gold Backing: Each token is fully collateralized by an equivalent amount of physical gold.

- Always Redeemable: Users can convert their AGT into physical gold at any time.

- Real-Time Verification: Gold reserves are continuously monitored through on-chain systems.

- Transparent Ownership: All minting, transfer, and redemption processes are traceable on the blockchain.

This structure combines the flexibility of the digital world with gold’s centuries-old safe-haven property.

Chainlink Proof-of-Reserve and Transparency

One of the most critical components of the Arowana Protocol is the Chainlink Proof-of-Reserve (PoR) system. This system verifies on-chain whether the physical gold reserves backing AGT tokens actually exist.

Thanks to Chainlink oracles:

- Gold reserves are automatically updated every minute.

- The system instantly refreshes data in case of deviations of 0.5% or more.

- The balance between AGT supply and physical gold amount is continuously audited.

This mechanism increases user trust in the platform while eliminating transparency issues commonly encountered in traditional gold tokenization projects.

SPC Structure for Legal Assurance

Arowana stores physical gold reserves under Special Purpose Corporation (SPC) structures that are completely independent from the platform. This structure separates user assets from platform risks.

Thanks to the SPC model:

- Gold reserves are separate from the platform’s balance sheet.

- Potential financial issues of the platform do not affect user gold.

- Legal ownership is clear and protected.

This approach makes Arowana a strong RWA platform not only technically but also legally.

What is ARW Token?

ARW is the utility and governance token of the Arowana ecosystem. While AGT represents the value of physical gold, ARW supports the protocol’s economic and governance structure.

The ARW token is actively used in staking, liquidity incentives, governance voting, and platform incentive mechanisms.

ARW Tokenomics

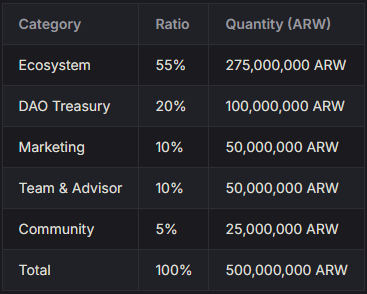

The total supply of ARW is capped at 500,000,000 tokens. The distribution is as follows:

- Ecosystem: 55% – 275,000,000 ARW

- DAO Treasury: 20% – 100,000,000 ARW

- Marketing: 10% – 50,000,000 ARW

- Team & Advisors: 10% – 50,000,000 ARW

- Community: 5% – 25,000,000 ARW

Token distribution will be carried out gradually and used in parallel with the platform’s growth process.

ARW Value Balancing Mechanisms

ARW is designed not just as a reward token but to create a sustainable economic structure.

Burn Policy

Regular burning of certain fees earned by the platform aims to reduce the circulating ARW supply.

Liquidity Mining

Early liquidity providers are rewarded with ARW to support market stability.

Staking System

ARW and AGT staking mechanisms reduce short-term supply while encouraging long-term participation.

Core Products of the Arowana Platform

Arowana Swap

A decentralized exchange (DEX) infrastructure offering swaps between AGT, USDT, and ARW through liquidity pools. It uses an AMM model instead of an order book.

AGT Mint & Redeem

Users can mint AGT in exchange for physical gold or stable assets and redeem it at any time.

Borrowing

Offers stablecoin borrowing by collateralizing AGT. This allows users to access liquidity without liquidating their gold positions.

Tokenized Real World Assets Fund

Enables the creation of investment funds where gold, commodities, real estate, and other RWAs are tokenized.

Governance and DAO Structure

ARW holders can directly shape the future of the Arowana Protocol. The governance process is conducted entirely on-chain and transparently.

- Voting Rights: 1 ARW = 1 vote

- Proposal Submission: Users staking a certain amount of ARW can create proposals

- Voting: Smart contract-based, automatic, and traceable

This structure aims for the protocol to become fully decentralized over time.

Audit, Verification, and Security

To maintain AGT’s 1:1 gold backing, Arowana adopts a multi-layered security approach including:

- Regular physical gold audits

- Independent audit firms

- On-chain Proof-of-Reserve system

- Public reports

Roadmap

2025 Q3–Q4

- Launch of the lending protocol

- Staking and liquidity reward programs

- RWA Dashboard Alpha version

2026

- More RWA tokenization

- Launch of Tokenized RWA Fund

- Multichain bridges

- Chain Abstraction and mobile integrations

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.