Bitcoin has dropped below $60,000 in recent weeks, raising alarms among investors. Meanwhile, technology and AI-focused stocks have been climbing, highlighting a notable divergence in the crypto market.

Since the October peak, the ongoing decline has wiped approximately $1.2 trillion from the total market value, with losses exceeding 30% in the past seven days. However, this pullback cannot be attributed to a single headline.

Whales and Institutional Selling Pressure

The first breakdown comes from large wallets. Major investors and large wallets hold 68% of BTC supply. In just the past eight days, whale wallets have sold 81,068 BTC. Small wallets are buying, but the overall impact remains limited. Historically, this combination signals early stages of a bear market cycle.

Moreover, it’s not only investors—miners have also joined the selling side. Mining companies like Marathon Digital have transferred millions of BTC to exchanges. MARA and RIOT shares fell 14–18%, increasing selling pressure and straining market liquidity. These movements create a “death spiral” effect on investor psychology, also affecting gold, silver, and treasury assets.

Options and Expiry Dates

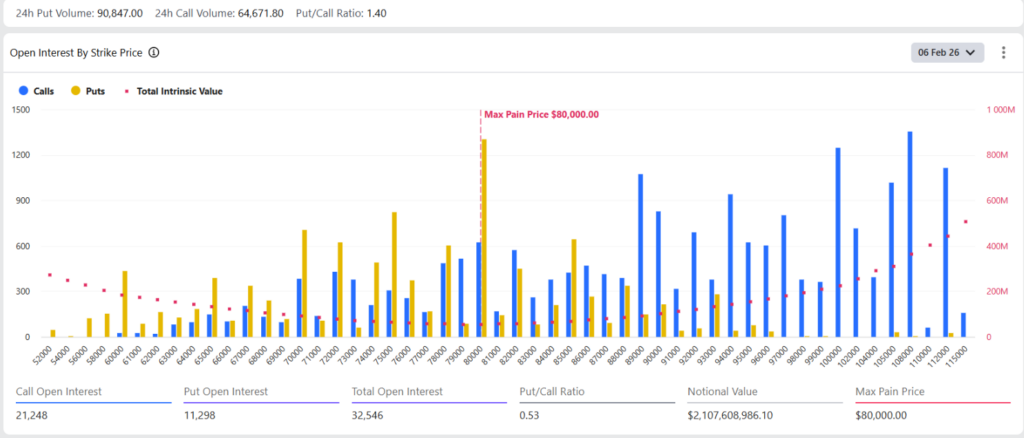

On February 6, more than 32,000 BTC options expired on Deribit. With a nominal value of $2.1 billion, this created significant volatility in the options market. Put option volume exceeded calls, increasing downside pressure; BTC’s implied volatility fell from 90 to 69 within hours.

But here’s the other side. The maximum drop price remained high at $80,000, signaling a potential short-term rebound. Investors are tracking macro indicators, ETF flows, and overall market sentiment, expecting BTC to consolidate between $65,000 and $70,000.

ETF Outflows and Market Perception

Another structural shift occurred on the ETF front. Spot Bitcoin ETFs saw about $1.2 billion in net outflows over the last three trading days. An additional $434 million was withdrawn in just two days. BlackRock’s IBIT fund led with a $175 million outflow, while Fidelity, Grayscale, Bitwise, and Ark 21Shares moved in a similar direction.

Interestingly, IBIT trading volume hit a record 284 million shares on the same day, representing over $10 billion in nominal value. Bloomberg analyst Eric Balchunas described this volume as “extremely brutal” as the price dropped 13%.

The charts show the decline. But seeing red on screen is another story.

At the same time, declines in tech stocks and rising AI investments affected investor psychology. Amazon, Qualcomm, and other giants increased spending, while software and semiconductor sectors faced heightened risks.

Additionally, Trump’s harsh reaction to the potential Fed chair appointment of Kevin Warsh and Treasury Secretary Scott Bessent’s statement, “We do not have the authority to rescue Bitcoin,” reinforced caution among institutional investors.

In Summary: Bitcoin’s sharp decline is not the result of a single event. Whale sales, options expiry, chain liquidations, ETF outflows, and weakness in tech stocks all played a role simultaneously.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.