As global financial markets grapple with uncertainty, two powerful assets have emerged as the week’s clear winners: Bitcoin and Nvidia. With the U.S. dollar sliding and economic data pointing to a possible recession, investors are doubling down on tech and crypto.

A striking detail? The strong correlation between Bitcoin and Nvidia has come into sharper focus — fueling the rally and reshaping investment strategies.

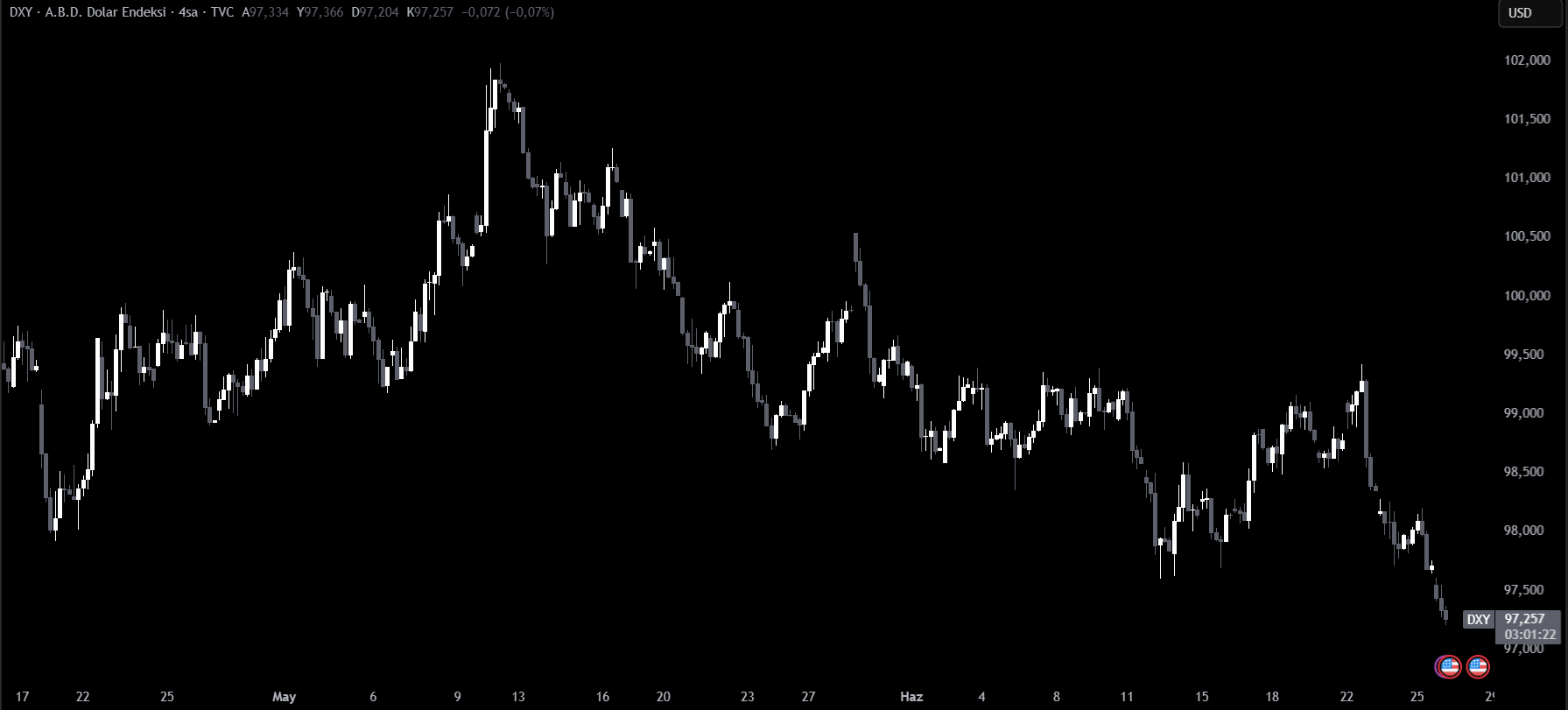

Dollar Index Drops, Bitcoin Rebounds

The U.S. Dollar Index (DXY) fell to 97.27, its lowest level since February 2022, driven by rising expectations of a Federal Reserve rate cut in July and weaker housing and consumer sentiment data.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

As financial conditions ease, risk-on sentiment dominates. Bitcoin has responded with a near 10% recovery from its weekend lows. “DXY is now at its lowest since March 2022. This is very bullish for global money supply and Bitcoin,” noted Bitwise Europe research head Andre Dragosch.

Nvidia Hits Record High As Nasdaq Signals Bull Rally

Meanwhile, Nvidia — the AI giant and tech bellwether — soared by 4.33% to reach an all-time high of $154.30. The 90-day correlation between BTC and Nvidia now stands at 0.80, reflecting a robust positive link.

The surge followed a golden cross pattern in Nasdaq futures, a strong bullish technical signal suggesting further upward momentum.

Bond Yields and Consumer Data Indicate Recession Risk

Yields on 2-year U.S. Treasury notes dropped to 3.76%, while 10-year yields slipped to 4.27%. This steepening of the yield curve often precedes economic contractions.

Consumer confidence also dropped sharply, with the expectations index falling to 69 — well below the recession-warning threshold of 80. Combined with sliding oil prices and dovish signals from Fed officials, traders are increasingly pricing in a July rate cut.

Bitcoin stands to benefit from this shift in monetary policy outlook.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.