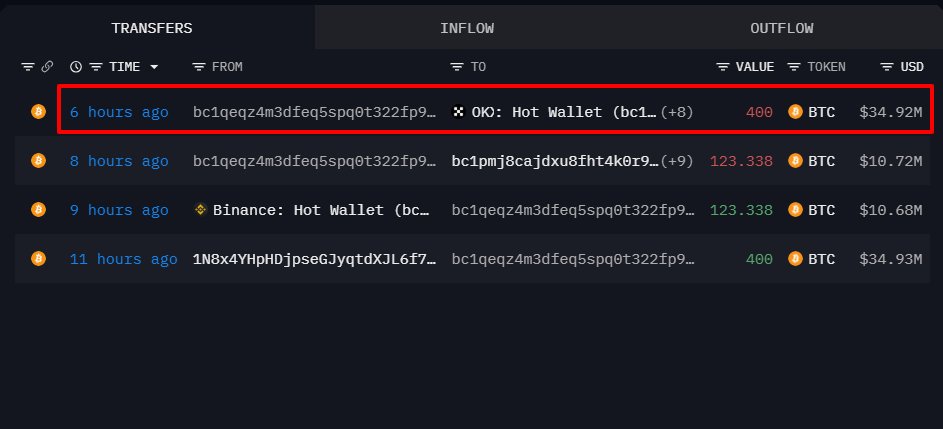

As the crypto market approaches the final days of the year, fresh on-chain data has drawn attention to renewed whale activity. A Bitcoin whale that had remained inactive for eight years transferred a total of 400 BTC to the OKX exchange. At current prices, the transaction is valued at approximately $34.9 million.

The timing of the transfer is closely monitored, as it coincides with a renewed increase in market volatility. On-chain data suggests the whale could realize an unrealized profit of roughly $30.4 million from this move.

The transaction was confirmed through data shared by on-chain analytics platform Onchain Lens.

From Eight Years of Silence to OKX

An examination of the wallet’s transaction history shows that the whale’s last activity occurred nearly eight years ago. At the time, the total acquisition cost of the 400 BTC was approximately $4 million.

The holdings entered the wallet through two separate inflows of 200 BTC each, previously transferred from HTX. After years of inactivity, the entire balance was moved in a single transaction to an address associated with OKX. The transfer reportedly took place around 11 hours before it was publicly identified, raising speculation about a potential sell-side move.

What remains clear is that this marks the first time the whale has sent its long-term Bitcoin holdings directly to an exchange.

Why it matters

The reactivation of long-dormant wallets is widely viewed as a critical signal for market psychology. Transfers directly to exchanges often increase the probability of short-term liquidity expansion and selling pressure. While such moves do not always result in immediate sales, they tend to influence trader sentiment and risk appetite.

In addition, the stark contrast between the original cost basis and current valuation once again highlights Bitcoin’s long-term return profile through tangible on-chain data.

Dormant Whales Return Simultaneously

This development is not an isolated case. In recent days, several other previously inactive large holders have also re-entered the market.

A Bitcoin wallet dormant for nearly three years transferred 200 BTC to Binance, while another large investor withdrew 171 BTC from the same exchange. These opposing flows suggest that selling and accumulation strategies are unfolding simultaneously.

Rather than signaling panic, the data points toward a phase dominated by strategic portfolio repositioning.

Short Positions Add to Market Pressure

On-chain metrics also indicate that some large investors are increasing short exposure alongside spot selling. Recent reports show one whale offloading 255 BTC while expanding short positions across Bitcoin, Ethereum, and Solana.

Since early December, large holders have sold approximately 36,500 BTC, representing a market value exceeding $3.3 billion. This activity, following recent sharp market swings, suggests that price discovery remains incomplete.

As uncertainty persists, further movements from large wallets are likely to remain a key factor shaping short-term market direction.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates