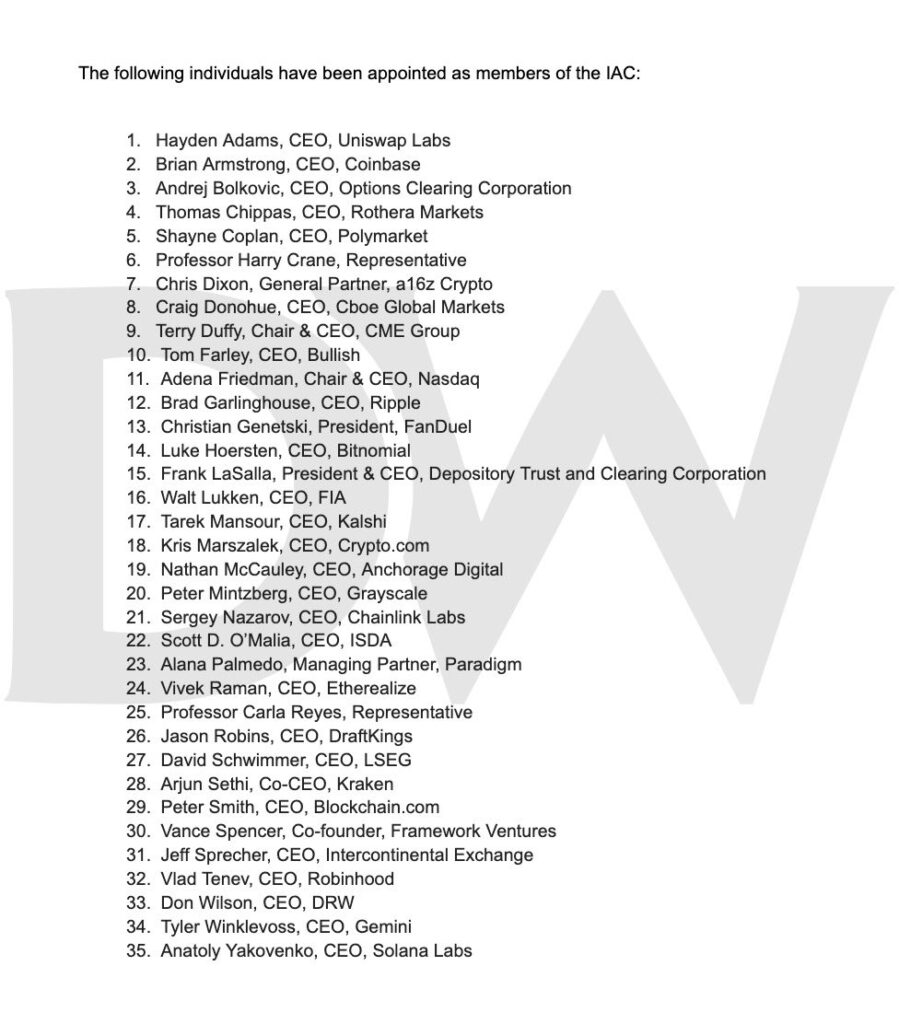

The U.S. Commodity Futures Trading Commission (CFTC) has announced the inaugural members of its newly formed Innovation Advisory Committee. Some of the crypto industry’s most influential CEOs including Brad Garlinghouse of Ripple, Brian Armstrong of Coinbase, and executives from Robinhood Markets will now take part in the panel.

CFTC Chair Mike Selig described the committee’s mission as “future-proofing U.S. markets and building clear roadmaps forward.” The newly formed 35-member group will evaluate how financial innovation impacts derivatives markets. Most members were selected from a CEO council created by the agency last year, bringing together leaders from major crypto platforms.

A New Chapter in Crypto Regulation

The committee is not limited to crypto executives. Traditional market giants such as Nasdaq, CME Group, and Cboe Global Markets will also serve in advisory roles. This blend is designed to ensure that both blockchain-native firms and legacy finance institutions shape CFTC policy.

Crypto rules in the U.S. are steadily becoming clearer. Last month, the CFTC met with the U.S. Securities and Exchange Commission to further define jurisdictional boundaries. Under “Project Crypto,” regulators aim to create a more flexible framework for digital assets, prediction markets, and other financial innovations.

Previous CFTC digital asset guidance was formally withdrawn last year. The commission acknowledged that the crypto ecosystem has evolved rapidly and that older frameworks no longer reflect today’s market realities. This move is widely viewed as part of a broader effort to strengthen the U.S. position in the global crypto economy.

Old Rules Are Gone

The CFTC’s decision to scrap all prior digital asset guidance last year now looks like an early signal of today’s shift. The agency openly accepted that rules written in 2020 cannot govern the financial architecture of 2026.

The new focus areas include self-custody wallets, tokenization, and institutional DeFi. Giving industry leaders a direct seat at the advisory table signals that regulation will no longer be built in isolation, but shaped by on-the-ground operational needs. It may sound subtle — but structurally, it matters.

These appointments are far from symbolic. In the coming weeks, the committee is expected to begin outlining technical frameworks for stablecoin infrastructure, institutional DeFi models, and on-chain derivatives products. Long-awaited regulatory clarity in the U.S. is now emerging through a mechanism directly informed by the sector itself.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.