Sharp fluctuations in the price of Bitcoin (BTC) have once again pushed investors to focus on critical levels. After showing strong moves both upward and downward recently, the $91,000 and $88,000 levels stand out as key thresholds that could determine the market’s short-term direction. According to the latest data shared by Coinglass, these levels signal a billion-dollar liquidation risk.

Hope for a Bitcoin Rally Was Short-Lived

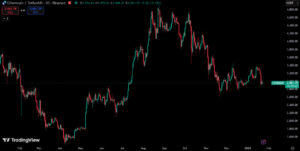

Last week, Bitcoin and the broader altcoin market saw a strong recovery. BTC climbed as high as $97,500, reviving expectations of a move toward $100,000. However, this optimism did not last long. Statements by U.S. President Donald Trump regarding tariffs on Greenland and the European Union dampened global risk appetite. Following these developments, Bitcoin experienced a sharp pullback and fell below $90,000 once again.

Pullback in Ethereum and Altcoins

The decline in Bitcoin also negatively impacted the altcoin market. Ethereum (ETH) dropped below $3,000, while notable losses were observed across other major altcoins. The overall market picture suggests that investors have shifted back into a more cautious stance. At this point, the short-term direction of the crypto market continues to depend heavily on macroeconomic and geopolitical developments.

Coinglass Data: Two Levels, Billions of Dollars

Crypto data and analytics platform Coinglass highlighted large-scale liquidation risks tied to Bitcoin’s price movements. According to the latest data, two critical levels stand out:

- If Bitcoin rises above $91,000, approximately $1 billion worth of BTC short positions on centralized exchanges (CEXs) could be liquidated.

- If Bitcoin falls below $88,000, around $638 million worth of long positions could be liquidated.

A sharp and sudden price move between these two levels could trigger high volatility due to the concentration of leveraged positions. For short-term traders in particular, this range represents a critical zone that should be closely monitored.

$200 Million Liquidated in the Last 24 Hours

According to current data, about $200 million in leveraged positions were liquidated over the past 24 hours. Of these liquidations:

- $98.85 million came from long positions

- $203 million came from short positions

This distribution shows that the market is struggling to establish a clear direction, with risky positions present on both sides. In the same period, 109,600 traders were liquidated, while the largest single liquidation reportedly occurred on the Hyperliquid platform in the BTC/USD pair. These figures highlight how sudden price movements during periods of heavy leverage can lead to significant losses for investors.

Why Is the Market So Sensitive?

Bitcoin trading within a narrow range has led to an accumulation of leveraged positions in the market. As long as price fails to pick a clear direction, risky positions continue to build on both the long and short sides. This creates a fragile structure where a break of key support or resistance levels could trigger chain liquidations. Especially for short-term traders, the current environment points to a phase where sudden and sharp price moves are possible. In such a highly leveraged market, even small price fluctuations can result in large-scale liquidations, with the risk of volatility increasing rapidly.

In conclusion, the $91,000 and $88,000 levels stand out as critical thresholds that could shape Bitcoin’s short-term fate. A strong breakout either upward or downward could trigger total liquidations approaching $1.6 billion. For this reason, carefully managing leverage ratios and staying cautious against high volatility is of great importance for investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.