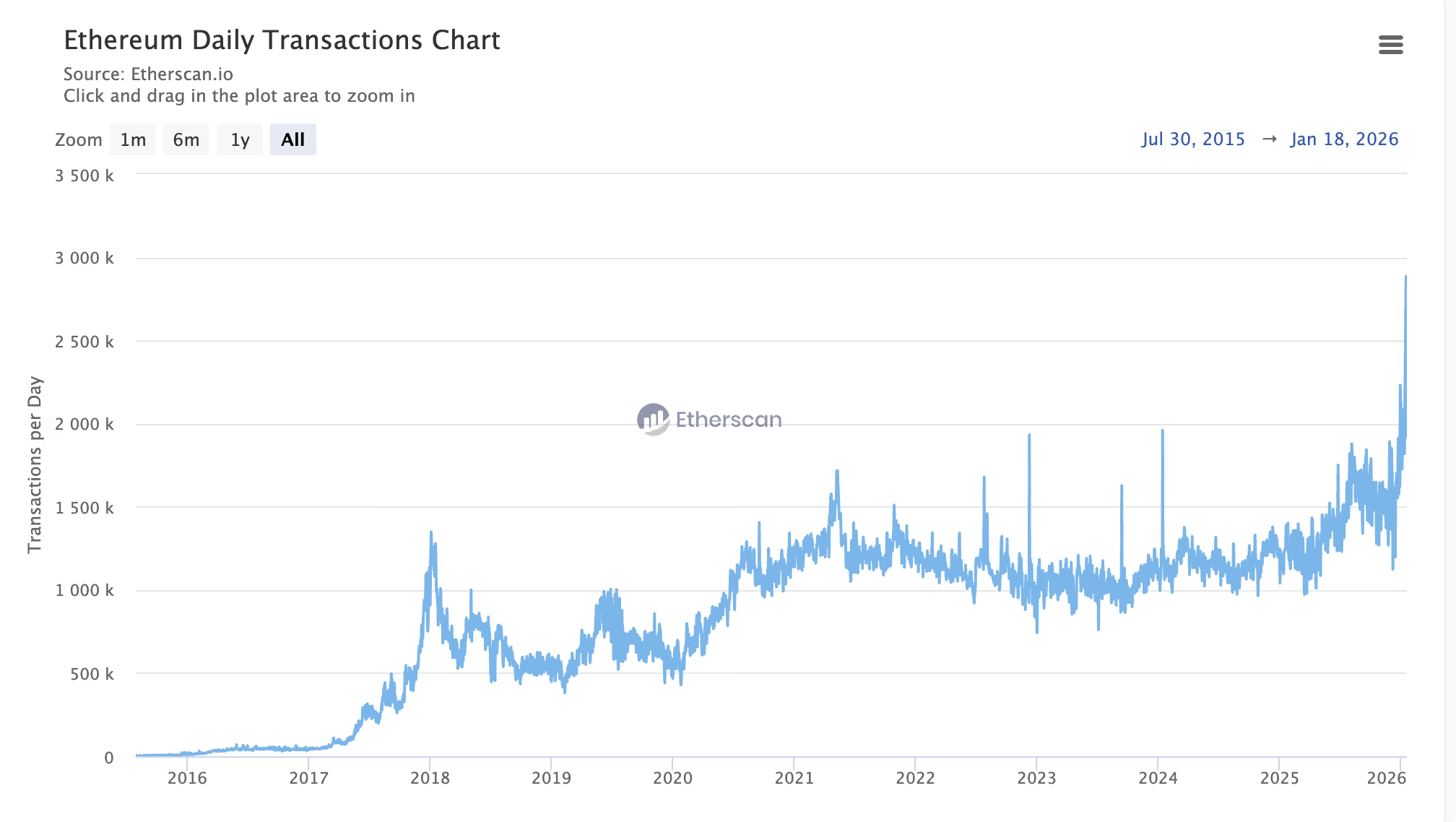

As 2026 begins, Ethereum is entering one of the most active periods in its history. Recent on-chain data shows that the network is handling a level of transaction throughput never seen before, highlighting both rising demand and improved network efficiency.

New All-Time High in Daily Transactions

Ethereum processed 2,885,524 transactions in a single day on Friday, setting a new record for daily activity. This milestone reflects a clear acceleration in network usage that has been building since mid-December. After a prolonged slowdown throughout much of 2025, transaction volumes began to recover toward the end of the year and have continued climbing into early 2026.

Importantly, this increase does not appear to be a one-off spike. Instead, it suggests a broader shift back toward higher baseline activity levels across the Ethereum ecosystem, driven by applications, users, and infrastructure returning to sustained growth.

Network Load Rising Without Fee Pressure

One of the most notable aspects of this surge is what has not happened. Despite record transaction counts, average gas fees remain close to recent lows. In previous market cycles, similar increases in usage often resulted in sharp fee spikes and network congestion.

This time, Ethereum appears better equipped to handle demand. Ongoing protocol upgrades, combined with the growing role of layer-2 networks, have significantly reduced pressure on the main chain. While overall activity is rising, a meaningful portion of that load is being distributed more efficiently across the broader Ethereum scaling stack.

Staking Queues Signal Stability, Not Stress

Alongside higher transaction activity, Ethereum’s staking mechanics are showing signs of balance rather than strain. The validator exit queue has dropped to zero, meaning stakers can withdraw ETH without delay. At the same time, entry queues remain extended, indicating continued interest in staking without a rush to exit.

This combination points to a stable staking environment. There is no evidence of panic withdrawals or speculative lockups. Instead, participation appears steady, suggesting confidence in the network’s long-term fundamentals.

What This Means for Ethereum Narrative

Taken together, record transaction throughput, low fees, and stable staking conditions suggest Ethereum is maturing as a network. It is increasingly capable of supporting heavy usage without the bottlenecks that once defined periods of high demand.

For users, this translates into a smoother experience. For the broader market, it subtly challenges the long-standing assumption that higher usage must inevitably lead to fee spikes and reduced supply pressure. Ethereum’s current performance suggests a more nuanced reality is taking shape.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.