Some traders in the crypto market not only take risks but also draw significant attention. James Wynn, who had remained silent after major losses earlier this year, has returned to the scene. His latest actions involve high-leverage positions on Ethereum and PEPE, signaling a bold re-entry into the market.

25x Long Position on Ethereum Worth Over $12 Million!

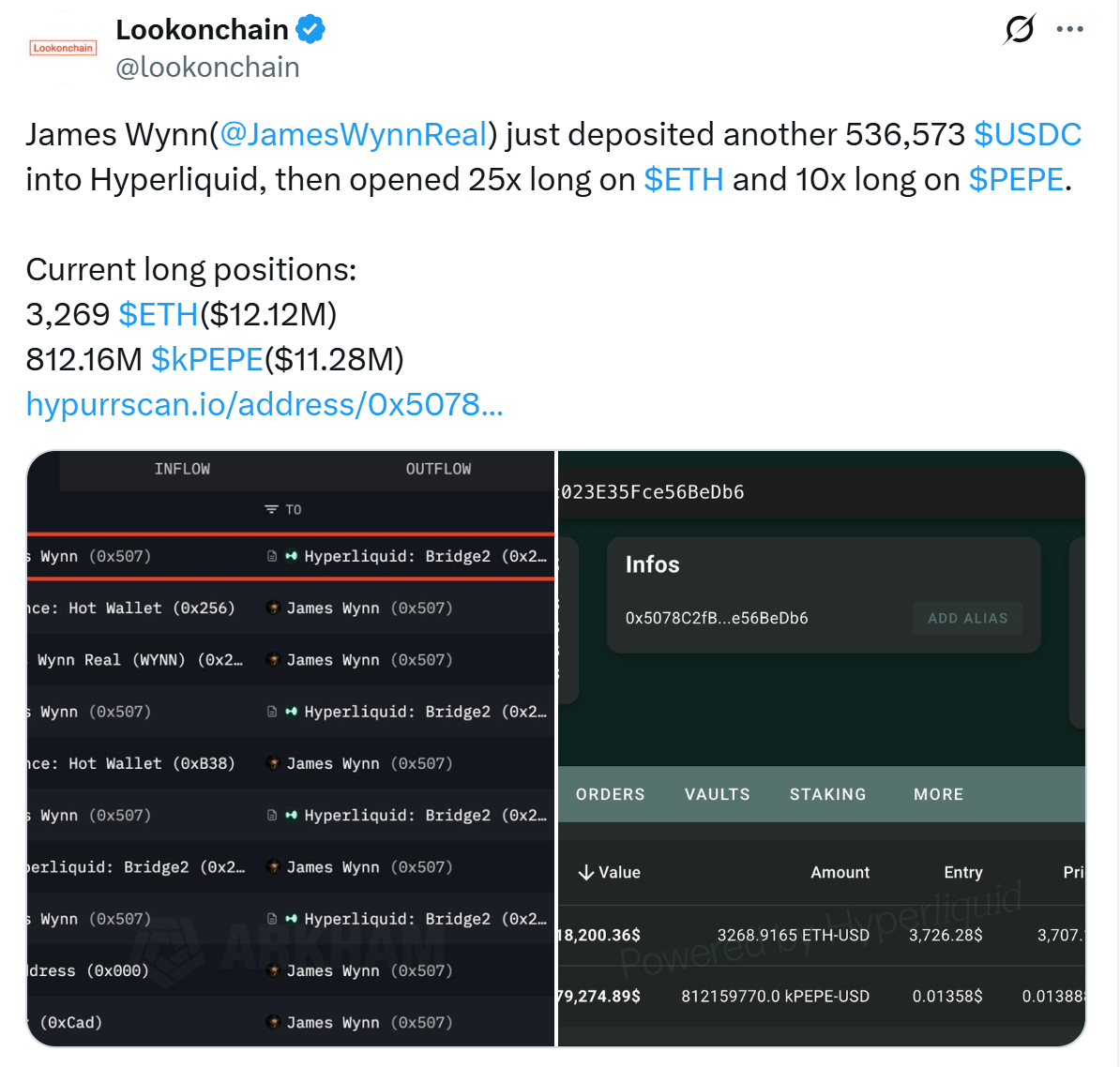

On-chain data indicates that Wynn opened a 25x leveraged position on 3,269 Ethereum, valued at approximately $12.12 million. His entry price is $3,726.28, and the liquidation point is set at $3,492.8. The trade currently reflects an unrealized loss of around $62,700.

812 Million PEPE Tokens Included in His Second Trade

Wynn’s second move involved a 10x leveraged position on PEPE. The position comprises 812.16 million tokens at an average entry price of $0.01358, totaling $11.28 million in value. This position currently shows an unrealized profit of $251,617.

You Might Be Interested In: Sonic SVM Research: Can New Stablecoins Shake Up the Old Order?

Before initiating these trades, Wynn deposited 536,573 USDC into Hyperliquid, a decentralized perpetuals exchange, indicating a calculated return to high-risk strategies.

A Return After Heavy Losses Earlier This Year

Wynn became known for previous high-profile losses, including a $100 million Bitcoin leveraged position that was liquidated on May 30, followed by a $25 million loss on June 5. After these incidents, he deactivated his social media accounts and updated his profile with the word “broke.”

In July, Ethereum gained over 20%, leading to one of the largest short squeezes in recent history. Market analysts suggest that if ETH surpasses $4,000, more leveraged short positions could be liquidated.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.