Bitcoin is once again approaching levels that, in previous cycles, have coincided with major inflection points. However, analysts caution that current conditions still fall short of the clear capitulation signals typically associated with durable market bottoms. On-chain data suggests the market is hovering between a mid-cycle correction and a deeper structural reset, leaving investors divided on whether the worst has already passed.

On-Chain Metrics Signal a “Neutral Zone”

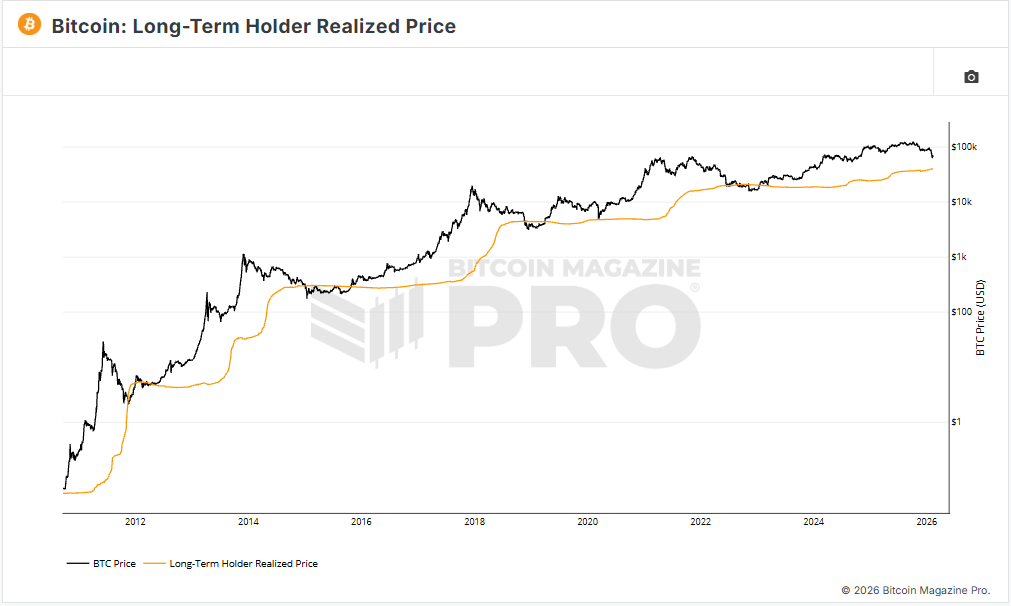

Several core indicators — including Long-Term Holder (LTH) profitability, the Market Value to Realized Value (MVRV) ratio, Net Unrealized Profit/Loss (NUPL), and the percentage of supply in profit — remain stuck in what could be described as an intermediate zone.

Historically, definitive bear market bottoms have occurred when long-term holders were sitting on losses of roughly 30% to 40%. Recent data shows that long-term holder profits have fallen sharply from 142% in October to around breakeven levels. While this marks a significant compression in profitability, it does not yet reflect the type of forced capitulation seen at prior cycle lows.

Similarly, the MVRV Z-score has not yet entered the traditional oversold range of -0.4 to -0.7 that has marked historical bottoms. NUPL currently stands near 0.1, whereas previous cycle lows tended to form when investors were experiencing approximately 20% unrealized losses on average.

Macro Pressures Still in Play

Beyond blockchain data, macroeconomic headwinds continue to weigh on risk assets. Liquidity conditions remain tight, and Bitcoin has been highly sensitive to economic releases. After stronger-than-expected employment data, markets are now closely watching January inflation figures. An upside surprise could reinforce expectations of prolonged restrictive monetary policy, adding further pressure to digital assets.

Some traditional financial institutions have projected a potential short-term pullback toward the $50,000–$58,000 range, underscoring lingering downside risks.

Panic Selling or Early Bottom Formation?

Not all signals are bearish. The Crypto Fear & Greed Index recently plunged to 11 out of 100, indicating extreme fear — levels often associated with seller exhaustion.

Last week, Bitcoin briefly tested the psychological $60,000 support before staging a rapid 19% rebound within 24 hours. During that period, 66,940 BTC flowed into accumulation addresses in a single day, suggesting institutional players actively defended the $60,000–$62,000 zone.

Meanwhile, with the MVRV Z-score at 1.2 and Bitcoin trading near its realized cost basis of approximately $55,000, the probability of a sustained breakdown below that level may be limited.

Overall, while definitive bottom signals have yet to emerge, growing signs of stabilization indicate that the market may be in the process of building a foundation. Clear confirmation, however, will likely require stronger alignment between on-chain metrics and macroeconomic conditions.

This content is not investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.