US-based spot Bitcoin ETFs are facing sustained capital pressure as market sentiment continues to deteriorate. Despite a shortened trading week due to the Martin Luther King Jr. holiday, total net outflows reached $1.72 billion over five consecutive trading days, signaling a clear erosion in short-term confidence around Bitcoin.

On Friday alone, spot Bitcoin ETFs recorded $103.5 million in net outflows, extending the negative streak that began the previous week. Meanwhile, Bitcoin has failed to reclaim the $100,000 psychological level since Nov. 13 and is currently trading around the $89,000 range.

ETF Flows Reflect Retail Risk Aversion

Spot Bitcoin ETF flows are widely viewed as a proxy for retail investor behavior. The recent wave of outflows suggests not only price pressure, but a broader pullback in risk appetite. Sideways price action has so far failed to offset the ongoing capital erosion on the ETF side.

Market Sentiment Stuck in Extreme Fear

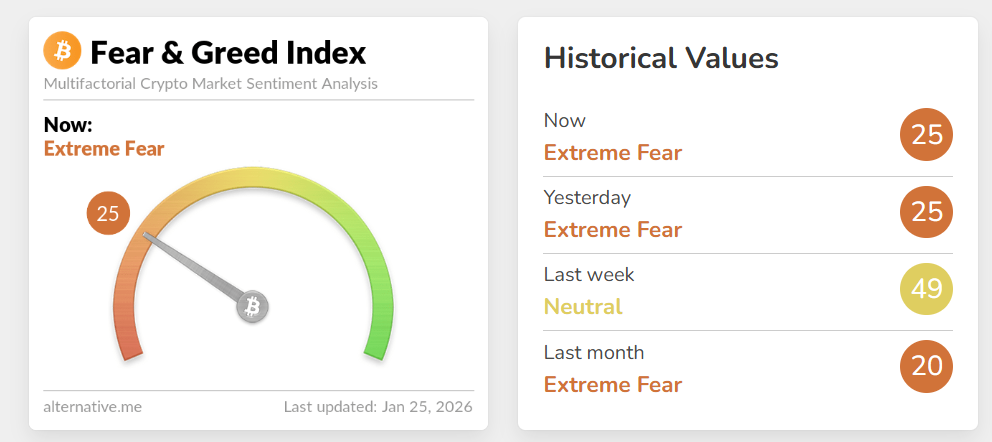

The broader crypto market shows a similar pattern. The Crypto Fear & Greed Index has fallen to 25, firmly within the “Extreme Fear” zone. According to Santiment, the market has entered a clear phase of uncertainty, marked by fading retail interest.

While some low-key indicators hint at a potential base-building process, the timing of any recovery remains unclear.

Metals Rally Leaves Bitcoin Behind

On the macro front, a notable divergence is emerging. The Bitcoin Layer founder Nik Bhatia argues that strong rallies in gold and silver are weighing on Bitcoin sentiment. According to Bhatia, being sidelined from the metals rally has pushed investor psychology toward post-FTX bear-market vibes.

Although he remains long-term bullish, Bhatia cautions that the current environment is painful and patience-testing, dominated by fear rather than conviction.

ETF outflows now represent more than short-term price pressure. As social interest fades and capital continues to exit, the risk of a delayed trend reversal remains elevated.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.