Strategy’s Bitcoin Holdings and Total Accumulation

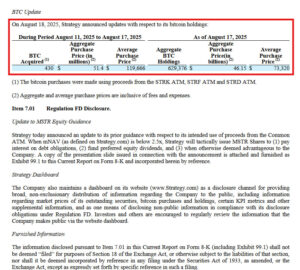

Strategy has carved out a unique position in the institutional finance world through its Bitcoin investments. With the latest purchase, the company now holds a total of 629,376 BTC.

The acquisition cost of these BTC to date is approximately $46.15 billion. As of August 17, 2025, the average market price of Bitcoin is $73,320. While the current market price remains below the acquisition cost, Strategy considers these fluctuations a natural part of its long-term accumulation strategy.

Investment Performance and Strategic Insights

Since the beginning of 2025, Strategy’s Bitcoin holdings have generated a return of 25.1%. The recent 430 BTC purchase demonstrates the company’s confidence in its long-term approach, despite the market’s downward trend.

Michael Saylor, Strategy’s founder and chairman, has repeatedly referred to Bitcoin as “digital gold” and “the reserve asset of the future.” The company’s strategy is based on making regular acquisitions regardless of short-term price volatility, thereby building a strong portfolio over the long term.

Strategy’s moves not only strengthen its balance sheet but also send a strong signal to other institutional investors. This approach could influence large funds and corporations seeking “long-term security and stability” to reconsider their stance on Bitcoin.

Future Outlook

The recent 430 BTC acquisition reaffirms Strategy’s visionary approach to Bitcoin. Despite volatile market conditions, the company’s commitment highlights that Bitcoin is viewed not merely as an investment but as a strategic reserve asset.

Experts suggest that Strategy’s policy could pave the way for greater institutional participation in the cryptocurrency market in the future.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.