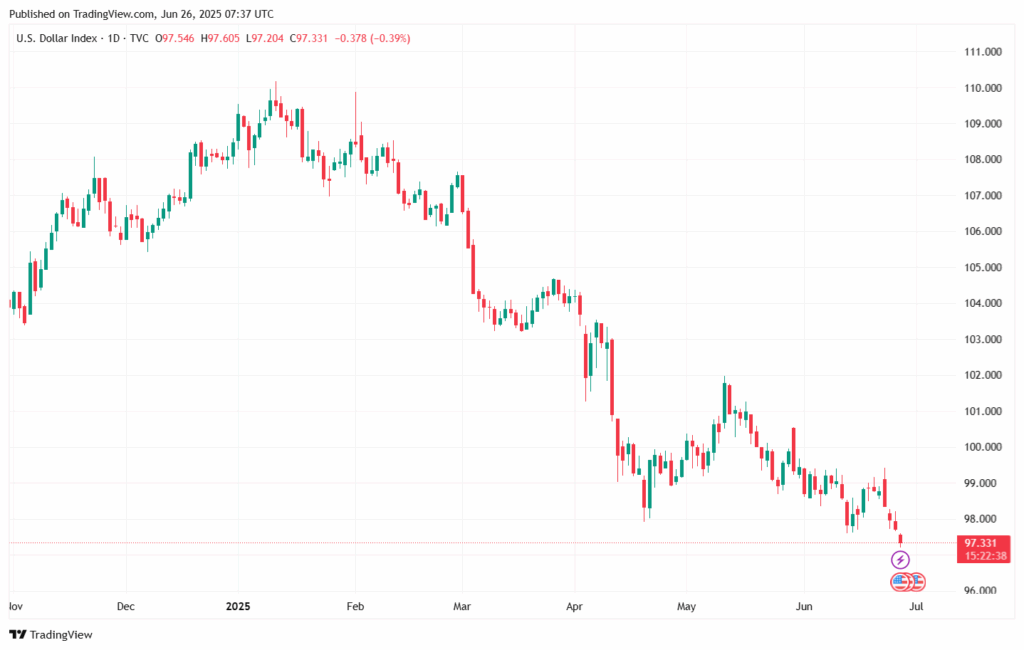

The US Dollar Index (DXY) dropped to 97.2, its lowest point since February 2022. Despite escalating geopolitical tensions between Iran and Israel, the dollar failed to maintain its traditional safe haven status. This has accelerated the search for new safe havens by investors.

On Sunday, Bitcoin briefly fell below $100,000. However, it quickly rebounded following US President Donald Trump’s announcement of a ceasefire. At the time of writing, Bitcoin is trading at $107,970.

Macroeconomist Lyn Alden noted on Wednesday, “The dollar index is currently hovering at new cyclical lows.” Alden added, “There has been almost no safe haven bid in the past few weeks.” These comments have increased speculation that the dollar’s weakness might be structural rather than temporary.

According to TradingView data, the dollar’s decline has driven investors toward riskier assets. Bitcoin (BTC), after brief dips, was trading at $107,930. During the same period, partial recovery in markets was observed following Trump’s fragile ceasefire announcement.

Jamie Coutts: Cryptocurrencies are the New Emerging Markets

Real Vision crypto analyst Jamie Coutts compared the current macro environment to the 2002-2008 period. Coutts said, “That period saw a major dollar devaluation, igniting a fire under emerging market equities and commodities.” He added, “EMs outperformed developed markets by 3x due to capital flows toward high-growth, youthful economies.” According to Coutts, a similar trend is now occurring in the crypto markets.

“Crypto is today’s EM. Capital moves where the energy is,” Coutts summarized, highlighting capital flow toward Bitcoin and altcoins. With the dollar weakening, Bitcoin gaining strength positions crypto as the next-generation safe haven.

Analysts suggest the weakening DXY presents a positive macro signal for crypto assets. While this hints at a possible altcoin season, it is clear that Bitcoin is currently the biggest winner.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.