One of the biggest problems in the blockchain world is that transferring assets between different networks is complex and expensive. Allbridge (ABR) is a cross-chain bridge protocol that aims to solve this problem by enabling fast and secure asset transfers between both EVM and non-EVM networks. The project’s core mission is to free the blockchain ecosystem from chain boundaries and create a global, borderless digital asset circulation.

With its infrastructure that allows users to transfer tokens between different networks quickly, securely, and flexibly, Allbridge plays a critical role especially for DeFi, NFTs, and Layer-2 solutions.

What is Allbridge (ABR)?

Allbridge Classic is a bridge infrastructure that connects EVM and non-EVM compatible blockchain networks, providing fast and secure asset transfers. Thanks to this system, users can freely move native and wrapped tokens across chains.

The project’s long-term vision is to enable not only token transfers but also NFT and Layer-2-based asset transfers in the future.

What is a Blockchain Bridge?

A blockchain bridge is an infrastructure that allows tokens or data on one network to be securely transferred to another blockchain network. Since different networks differ in consensus mechanisms, governance models, and technical infrastructure, direct transfers are not possible. Bridges eliminate this incompatibility.

Bridges are generally divided into two main categories:

- Centralized (Federated) Bridges: Based on trust relationships.

- Decentralized (Trustless) Bridges: Operate through smart contracts and validators.

Allbridge Classic offers a more modern and versatile structure, providing reliable interaction between different networks.

Advantages of Allbridge Classic

-

Wide Chain Compatibility Supports both EVM-based and non-EVM networks, allowing seamless transitions between different infrastructures.

-

Fast Transfer Mechanism Transfers take only as long as the relevant blockchain’s confirmation time. Each transfer consists of two stages:

- Sending from the source chain

- Receiving on the destination chain

This minimizes transfer duration.

-

Flexible Transfer Architecture Users can:

- Send native → receive native

- Send native → receive wrapped

- Send wrapped → receive native

- Send wrapped → receive wrapped

This flexibility is a key advantage that sets Allbridge apart from many competitors.

-

Dynamic Fee System Users who stake ABR can reduce transfer fees. The bridge fee is collected at the start of the transaction and automatically calculated based on the amount of staked xABR.

-

Security Allbridge infrastructure has been audited by security firms such as Hacken, Kudelski Security, Cossack Labs, and CoinFabric.

How Does Allbridge Classic Work?

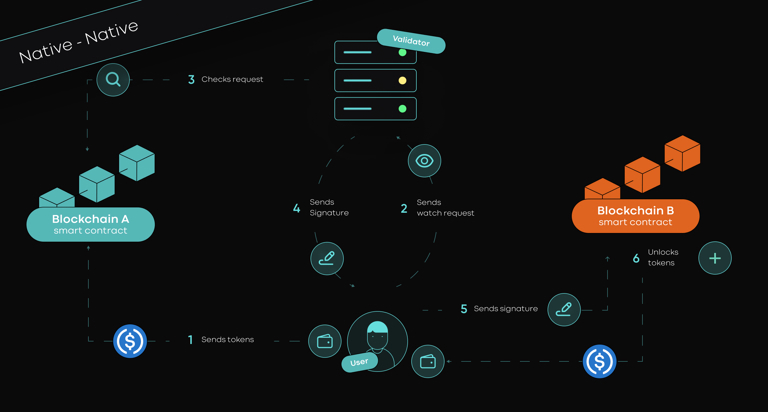

A transfer consists of two main steps:

- “Send” transaction on the source chain

- “Receive” transaction on the destination chain

Four main components are involved in the transfer process:

- User wallet

- Source chain smart contract

- Destination chain smart contract

- Validator

Four Different Transfer Scenarios

- Native → Native Transfer Token is locked on the source chain; the same token is released from the liquidity pool on the destination chain.

- Native → Wrapped Transfer Token is locked on the source chain; an equivalent amount of wrapped token is minted on the destination chain.

- Wrapped → Native Transfer Wrapped token is burned; the locked native token on the source chain is released.

- Wrapped → Wrapped Transfer Burning occurs on one chain while a new wrapped token is minted on the other chain.

This system keeps total token supply always balanced.

What is ABR Staking?

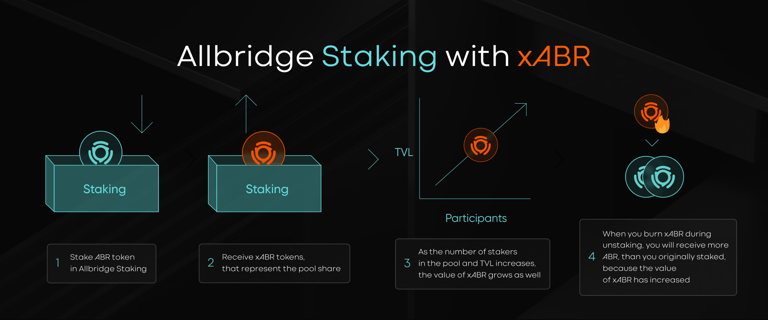

Allbridge Staking allows users to stake ABR tokens to:

- Earn a share of bridge fees

- Reduce their own transfer costs

Stakers receive xABR in return, which represents their share in the pool.

Staking Pool Structure Each blockchain has its own staking pool. Rewards are calculated based on the pool of the chain where the user staked. Rewards come from two sources:

- Shares of bridge fees

- Early-stage incentive rewards

Relationship Between Staking and Bridge Fees

The amount of xABR in the user’s wallet directly affects the bridge fee paid during transfers. As pool TVL increases, more ABR must be staked to maintain the same discount rate. The fee is automatically calculated just before the transfer begins.

How to Stake ABR?

- Decide on which chain the fee discount is desired.

- Purchase ABR tokens.

- Stake via Allbridge Staking interface.

- Receive xABR in return.

What is Staking DAO?

Staking DAO enables decentralized determination of reward distribution within the Allbridge ecosystem. Users who stake ABR gain voting rights (Vote) in proportion to their locked xABR.

Main responsibilities of the DAO:

- Determine reward distribution across chains

- Grant governance functions to xABR token

DAO Voting System

- Votes are cast weekly.

- Voting power increases with the lock duration of xABR.

- Lock periods range from 1 month to 3 years.

Longer locks grant higher voting power.

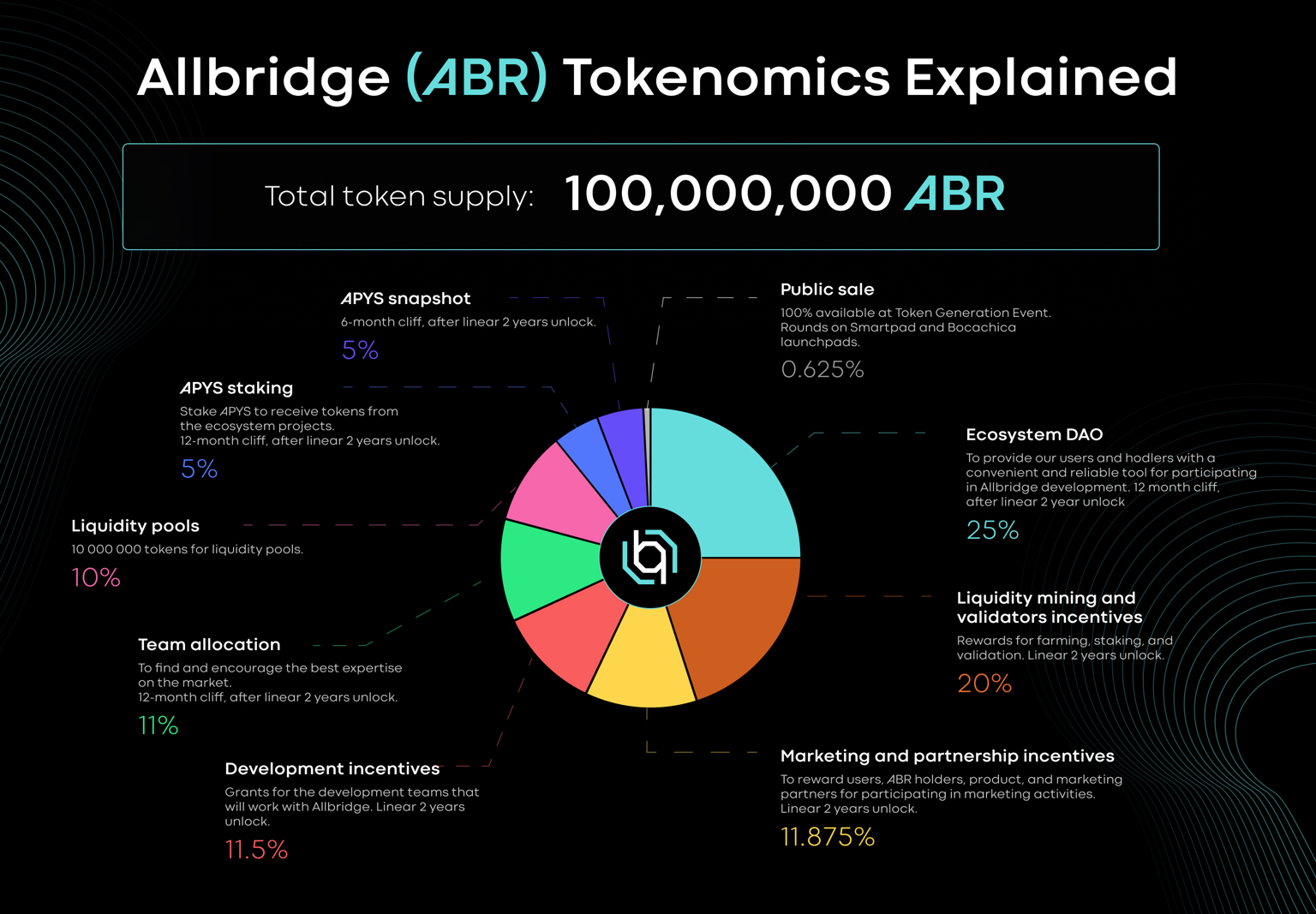

Allbridge (ABR) Tokenomics

ABR Token Distribution

Total supply: 100,000,000 ABR

- Ecosystem DAO: 25%

- Liquidity mining & validator incentives: 20%

- Marketing & partnerships: 11.875%

- Development incentives: 11.5%

- Team: 11%

- Liquidity pools: 10%

- APYS staking: 5%

- APYS Snapshot: 5%

- Public sale: 0.625%

Use Cases:

- Payment of bridge fees

- Staking

- Token listing subscription fee

- DAO governance

Token Subscription Fee

For a project’s token to be listed on Allbridge, a monthly subscription fee in ABR is required. This fee is non-refundable. If payment is not made, the token is automatically removed from the bridge.

Fee Distribution

- 80% → Staking pools

- 20% → Allbridge team

Allbridge Investors

Among Allbridge’s early investors is Race Capital, one of the key venture capital funds that supported the project during the seed round.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.