In the world of cryptocurrency and blockchain, projects that eliminate the inefficiencies of traditional financial markets and transform digital asset management are gaining significant attention. Chintai (CHEX) stands out as a pioneering platform in this space. By facilitating the tokenization of real-world assets (RWA), this project offers institutional-grade digital asset solutions. So, what exactly is Chintai (CHEX), how does it work, and why is it so significant? Let’s dive into this innovative platform in detail!

What is Chintai (CHEX)?

Chintai is a high-performance, permissioned blockchain network designed to provide institutional-grade digital asset solutions. Making its mark in 2018 by launching the first fully on-chain, decentralized order book exchange, Chintai has since evolved into a comprehensive solution for asset issuance, secondary market trading, and asset management. The platform focuses on tokenizing real-world assets (RWA), aiming to eliminate the complex processes and high costs of traditional financial markets. The $CHEX token serves as the cornerstone of the platform, supporting functions such as transaction fees, governance, and liquidity management.

Chintai introduced the $CHEX token in 2019 through a KYC/AML-compliant distribution process and secured $7.5 million in investment in 2021, fueling its continued growth. By addressing the inefficiencies of traditional finance (e.g., high intermediary fees and manual processes), Chintai enables financial institutions to achieve 30-70% cost savings. It also democratizes capital-raising opportunities for small and medium-sized enterprises (SMEs), creating an accessible financial ecosystem for all.

Key Features of Chintai (CHEX)

Chintai stands out with its innovative features that automate complex financial processes and reduce costs. Here are the platform’s core features:

1. Tokenization of Real-World Assets

Chintai enables the tokenization of assets such as equities, real estate, bonds, carbon credits, and more, increasing liquidity and expanding investment opportunities. This particularly simplifies capital access for SMEs.

2. Two Platforms: Chintai and Chintai Nexus

-

Chintai (Singapore): Licensed by the Monetary Authority of Singapore (MAS) as a Capital Markets Services provider and Recognized Market Operator, it supports primary issuance and secondary market trading of digital securities (e.g., equities, real estate, bonds). It primarily serves mid-to-large-scale asset managers and accredited/institutional investors.

-

Chintai Nexus (British Virgin Islands): Designed for non-security tokens (e.g., utility tokens, carbon credits), it caters to SMEs and retail users. Both platforms share the same blockchain infrastructure but operate as separate legal and operational entities.

3. Regulatory Compliance

Chintai operates in compliance with strict regulatory standards in both Singapore and the British Virgin Islands. Automated KYC/AML checks, transaction monitoring, and market manipulation prevention systems ensure a secure and transparent environment.

4. High-Performance Antelope Blockchain

Built on the Antelope blockchain protocol, Chintai offers transaction finality in 0.5 seconds and a capacity of 8,000 transactions per second (TPS), guaranteeing fast and efficient operations.

5. Automated Market Maker (AMM) and Order Book

Chintai Nexus features an AMM to enable continuous trading even in low-liquidity markets. Additionally, the platform’s order book exchange ensures instant matching of buyers and sellers.

6. White-Label Solutions

Chintai provides white-label solutions, allowing businesses to use the platform under their own branding. Comprehensive API support ensures seamless integration.

7. $CHEX Token

$CHEX supports the platform’s transactions, governance, and liquidity incentives. It is used for gas fees, staking rewards, and token buybacks. A 5% buyback-and-burn policy reduces the token supply, aiming for long-term value stability.

How Chintai (CHEX) Works

Chintai facilitates asset tokenization and trading as follows:

-

Asset Issuance: Businesses tokenize assets like equities, real estate, or bonds on the Chintai platform. Issuance fees are calculated at rates like 2.5% based on asset value.

-

Trading: Users trade tokens via the order book or AMM. Transaction fees, determined by trading volume, are typically paid in USD and converted to $CHEX.

-

Staking and Rewards: $CHEX token holders stake their tokens to share 90% of transaction fees for AMM liquidity providers and 10% for those solely staking.

-

Compliance and Management: Automated KYC/AML, transaction monitoring, and market surveillance systems maintain platform reliability. White-label solutions and APIs allow businesses to customize the platform.

-

Cross-Chain Integration: Chintai Nexus connects with blockchains like Ethereum, EOS, and Binance Smart Chain via Fireblocks, enabling tokens to be used across different chains.

Benefits of Chintai (CHEX) to Stakeholders

-

Financial Institutions: 30-70% cost savings, fast transaction finality, and regulatory compliance.

-

SMEs: Cost-effective and accessible platform for capital raising.

-

Investors: Access to previously inaccessible assets (e.g., real estate, bonds) at lower costs.

-

Liquidity Providers: Earn rewards from transaction fees by staking $CHEX.

Chintai (CHEX) Tokenomics

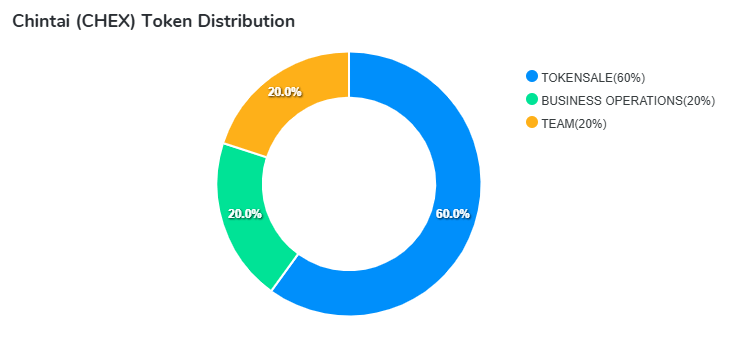

$CHEX is the platform’s core utility token with a total supply of 1 billion:

-

Token Distribution:

-

60%: Token sale (distributed via 2019 Dutch Auction).

-

20%: Business operations.

-

20%: Team (the founding team holds approximately 92 million $CHEX, with 124 million $CHEX in reserve).

-

-

Buyback-and-Burn: 5% of platform revenue is used for $CHEX buybacks and burns, reducing the token supply.

-

Listings: Available on exchanges like Aerodrome, Bitfinex, Bitmart, DefiBox, GATE, Newdex, MEXC, Pancakeswap, Raydium, and Uniswap.

Chintai Roadmap

Chintai has achieved significant milestones since 2018:

-

2018: Launch of the first on-chain order book exchange.

-

2019: KYC/AML-compliant $CHEX token distribution.

-

2021: $7.5 million investment.

-

2025: Thought leadership events on tokenization in Asia and the UAE, and licensing efforts for the U.S. market.

Chintai (CHEX) Partners

Chintai collaborates with key partners such as Bovill, Asia Carbon Institute, SFA, and Blockchain Association. These partnerships strengthen the platform’s regulatory compliance and ecosystem impact.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.