Cyber is a prominent Ethereum Layer 2 blockchain focused on social applications and artificial intelligence. The CYBER token serves as the cornerstone of this ecosystem, functioning as both a governance and utility token. Additionally, Cyber AI offers a crypto-specific artificial intelligence model, enabling users and developers to create innovative solutions based on crypto data. In this article, we will explore what Cyber is, how it works, its token economics, staking mechanisms, and its investors in detail.

What is Cyber?

The project is a Layer 2 blockchain that integrates social dynamics into on-chain experiences. Built on the Optimism Superchain, Cyber L2 is designed specifically for social applications, prioritizing user experience with low transaction fees, fast finality, and built-in social features. Its compatibility with the Ethereum Virtual Machine (EVM) ensures that any Solidity-based smart contract or tool running on Ethereum can operate seamlessly on Cyber. This allows developers to leverage existing modules to rapidly scale the ecosystem.

The project was built by the CyberConnect team, which has been developing decentralized social networks, consumer applications, and innovative on-chain infrastructure since 2021. The team has a strong track record, with products recording tens of millions of transactions from millions of users.

Cyber L2 Features

-

Modular OP Stack: Cyber offers a modular and interoperable infrastructure. Developers can quickly build applications using existing modules.

-

User Experience Focused: Low fees, fast transaction finality, and social features provide a user-friendly experience.

-

EVM Compatibility: Ethereum-based applications can run on Cyber without modifications.

What is Cyber AI?

Cyber AI is an artificial intelligence model tailored for the crypto world. Unlike general-purpose models, it is trained exclusively on crypto data, ensuring high accuracy. It pulls data from reliable sources such as CoinGecko, RootData, Snapshot, and hundreds of thousands of crypto-focused X accounts. Cyber AI combines both on-chain and off-chain data to create a comprehensive knowledge base.

AI Use Cases

-

Building agents, dashboards, or products that require consistent answers and insights from crypto data.

-

Creating real-time crypto alerts.

-

Surf, a crypto assistant powered by the same APIs as Cyber AI, demonstrates the technology’s scalability.

Cyber AI Design Principles

-

Focused and Specific: Trained solely on crypto data, the model is unaffected by unrelated topics like sports or weather.

-

Constantly Updated: New crypto data is regularly indexed, eliminating the need to manage your own data pipelines.

CYBER Tokenomics

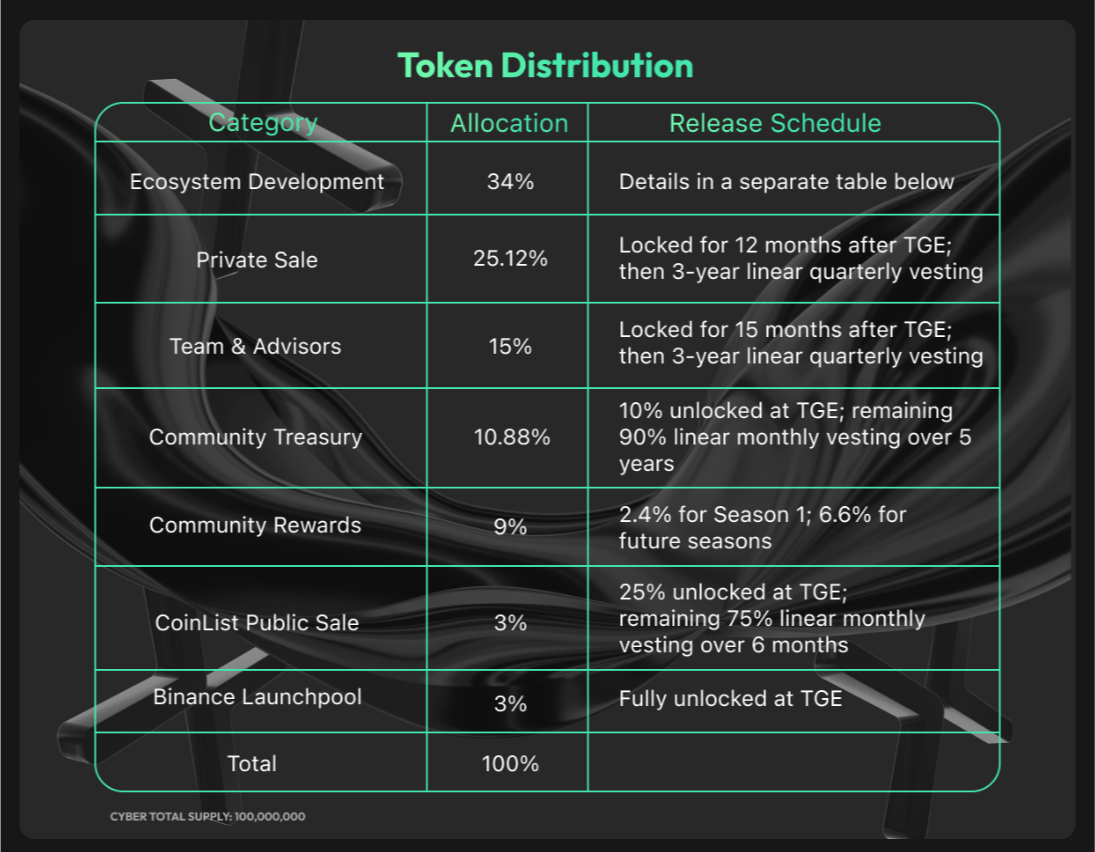

The CYBER token is the core governance and utility token of the Cyber ecosystem. Using LayerZero’s OFT (Omnichain Fungible Token) standard, it is usable across multiple chains. With a total supply of 100 million tokens, Project is utilized for governance, staking, and accessing ecosystem products.

Token Distribution

-

Ecosystem Development: 34%

-

Private Sale: 25.12%

-

Team & Advisors: 15%

-

Community Treasury: 10.88%

-

Community Rewards: 9%

-

Coinlist Public Sale: 3%

-

Binance Launchpool: 3%

Cyber Staking

Token holders can stake their tokens to contribute to network security, earn economic rewards, and participate in governance processes. Staking is conducted through two methods: Vault and Staking Pool.

Cyber Vault

-

An EIP-4626 compliant contract.

-

Offers advantages like auto-compounding rewards and no minimum stake requirement.

-

cCYBER tokens are transferable and provide instant liquidity.

-

A 10% fee on rewards is charged to support the treasury.

Cyber Staking Pool

-

Designed for holders with at least 1,000 CYBER tokens.

-

Offers a more technical staking experience without auto-compounding or instant liquidity.

-

stCYBER tokens are non-transferable.

Unstaking

-

cCYBER and stCYBER holders typically face a 7-day unstaking period.

-

cCYBER can be swapped on a DEX for instant liquidity, while stCYBER does not offer this option.

Staking Rewards

-

5.5 million tokens are allocated for stakers in the initial years.

-

Rewards are determined through DAO governance, aiming for long-term sustainability.

CyberDAO and Governance

CyberDAO is a community-driven structure governing the ecosystem. Token holders can submit proposals and vote using cCYBER or stCYBER tokens. The CyberDAO “Working Constitution” defines the governance framework and is reviewed annually. Constitutional amendments require a 30% participation rate (quorum) and a two-thirds majority to pass.

Governance Process

-

Proposal Submission and Feedback (12 Days): Proposals are discussed on the Forum (forum.cyber.co) and must be approved by at least two delegates.

-

Voting Delay (2 Days): Delegates can delegate tokens before voting.

-

Voting: Conducted on the Agora platform (gov.cyber.co). Different approval thresholds apply based on proposal type:

-

Community Treasury: 30% quorum, 51% approval

-

Protocol Upgrades: 30% quorum, 76% approval

-

Council Appointments: 30% quorum, 51% approval

-

Constitutional Amendments: 30% quorum, 67% approval

-

-

Timelock (3 Days): A future Security Council can block harmful proposals.

Delegates

Token holders can delegate voting power to a delegate or become a delegate themselves. Delegates represent the community’s interests and must adhere to CyberDAO’s constitution and code of conduct.

Cyber Foundation

The Cyber Foundation, a Cayman Islands-based foundation company, acts as the legal representative of CyberDAO. It handles contracts, monitors governance processes, and develops frameworks like the Working Constitution. In the long term, the foundation’s role will decentralize, transferring responsibilities to the community.

Investors

Project boasts a strong investor portfolio: Animoca Brands, The Spartan Group, Delphi Ventures, IOSG Ventures, Amber Group, Tribe Capital, Polygon Studios, Sky9 Capital, SevenX Ventures, Protocol Labs, GGV Capital, Multicoin Capital, Hashed, Mask Network, Draper Dragon, Smrti Lab, Zoo Capital.

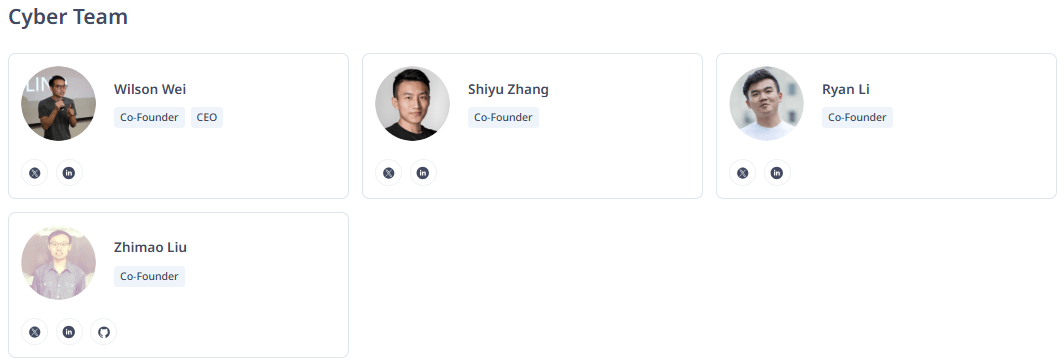

Founder Team

-

Wilson Wei – Co-Founder and CEO

-

Shiyu Zhang – Co-Founder

-

Ryan Li – Co-Founder

-

Zhimao Liu – Co-Founder

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.