As the decentralized finance (DeFi) ecosystem becomes increasingly complex every day, serious problems continue in areas such as user experience, liquidity management, cross-chain operations, and transaction optimization. Mantis ($M) stands out as a next-generation protocol that aims to bring radical simplification and automation to DeFi through a combination of artificial intelligence, intent-based transaction architecture, and a competitive solver network.

What is Mantis ($M)? What Does It Aim For?

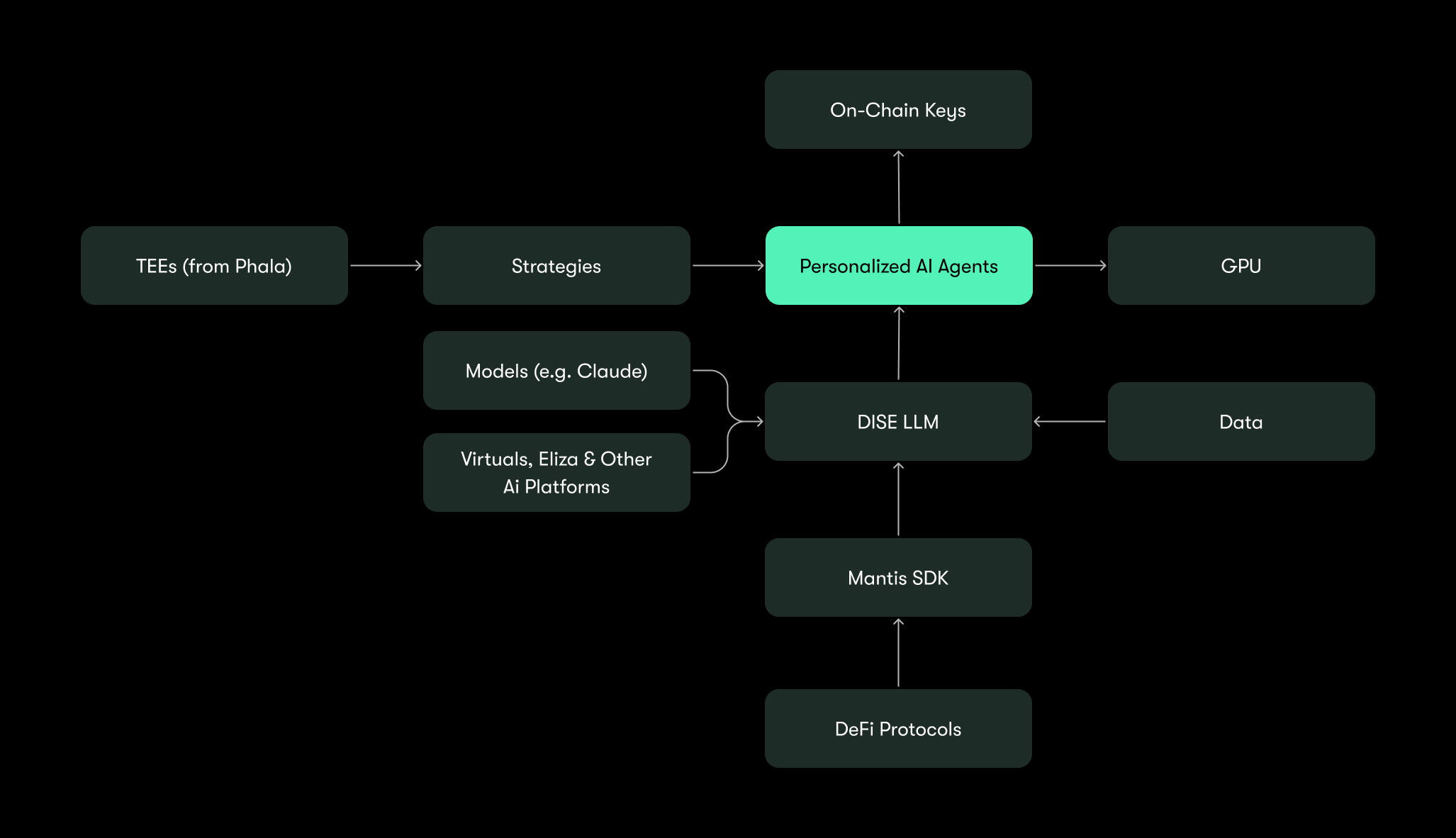

Mantis offers a financial infrastructure where users only need to state what they want to do, and the transaction is executed in the most efficient way possible — powered by its proprietary large language model called DISE, AI agents, chain abstraction layer, cross-chain intent mechanism, and a competitive solver network.

Mantis’s core goal is to make DeFi transactions as simple and intuitive as banking apps. It completely eliminates the need for users to:

- Search for the best swap rates,

- Compare liquidity pools,

- Manually set up cross-chain transfers,

- Optimize gas fees.

The user simply declares their intent, and the entire execution process is automatically optimized by AI and the solver network.

Mantis Product Ecosystem

- Personalized AI Agents (Live) Currently active: Users can use personalized AI agents tailored to their needs. These agents can automatically and optimally perform:

- Swaps on Ethereum

- Swaps on Solana

- Cross-chain swaps between Ethereum and Solana

- Conditional Agents (Coming Soon) Planned for the near future:

- Automated portfolio management

- Time-based buying/selling

- Price-triggered orders

- Stop-loss and DCA strategies

- Vault Strategies (Future) Community-shaped, AI-powered shared investment vaults offering:

- Multi-strategy management

- Automated risk distribution

- Institutional-grade portfolio optimization

What is Intent and Solver Architecture?

Intent Intent is the user’s declaration of what they want to achieve. Examples:

- “Convert my ETH on Ethereum to SOL on Solana.”

- “Convert token X to token Y at a minimum price of Z.”

Unlike traditional transactions, it defines what needs to be done, not how it should be done.

Solver

Solvers are specialized nodes that monitor user intents and compete with each other to offer:

- The best price

- The lowest cost

- The fastest execution

CoWs (Coincidence of Wants)

When two users want the opposite trade (one wants A→B, another wants B→A), they are matched directly without an intermediary exchange. This results in:

- Reduced fees

- No liquidity drain

- Minimal slippage

OFA (Order Flow Auction) Mechanism

In Mantis, solvers enter an auction to fulfill the user’s intent. The solver offering the best solution wins. This ensures:

- Users always get the optimal outcome

- Hidden routing is prevented

- Transparent and competitive execution

How Does Mantis Work?

- User enters their intent.

- Funds are locked in an escrow contract.

- Auctioneer forwards the intent to solvers.

- Solvers submit bids.

- The best bid is selected.

- The winning solver executes the transaction.

- Funds are securely delivered to the user.

If the transaction fails, funds are automatically returned to the user.

Core Advantages Mantis Brings to DeFi

- Cross-chain abstraction

- AI-powered transaction optimization

- Best price guarantee

- Frontrunning protection

- Automated portfolio management

- Low transaction costs

- High capital efficiency

Mantis Use Cases

- Perpetual Futures Optimal position-opening routes are automatically found.

- Digital Wallets With Mantis SDK integration, cross-chain swaps can be done from a single screen.

- AI Trading Bots All bot systems, including Telegram bots, execute the best trade via Mantis.

- Gaming and NFT Ecosystems In-game assets can be managed cross-chain and automatically.

Mantis Protocol Architecture

- Separate escrow smart contracts on each chain

- Intents are initiated on-chain

- Auction process runs off-chain

- Final result is written back on-chain

This design provides both speed and security.

Mantis V1 Features

Supported operations in V1:

- Intra-Ethereum swaps

- Intra-Solana swaps

- Ethereum ↔ Solana cross-chain swaps

Mantis Security Structure

- All funds are locked in escrow contracts

- Solvers are required to stake collateral

- Unauthorized fund access is impossible

- Timeout mechanism automatically refunds funds

Mantis Decentralization Roadmap

In the initial phase, the Auctioneer is centralized. However:

- It will move to a rollup system

- Slashing will be implemented via EigenLayer

- Fully trust-minimized structure is the ultimate goal

Mantis ($M) Tokenomics

$M token utilities:

- Governance voting

- Solver collateral

- AI agent onboarding fees

- Ecosystem incentives

- Slashing mechanism

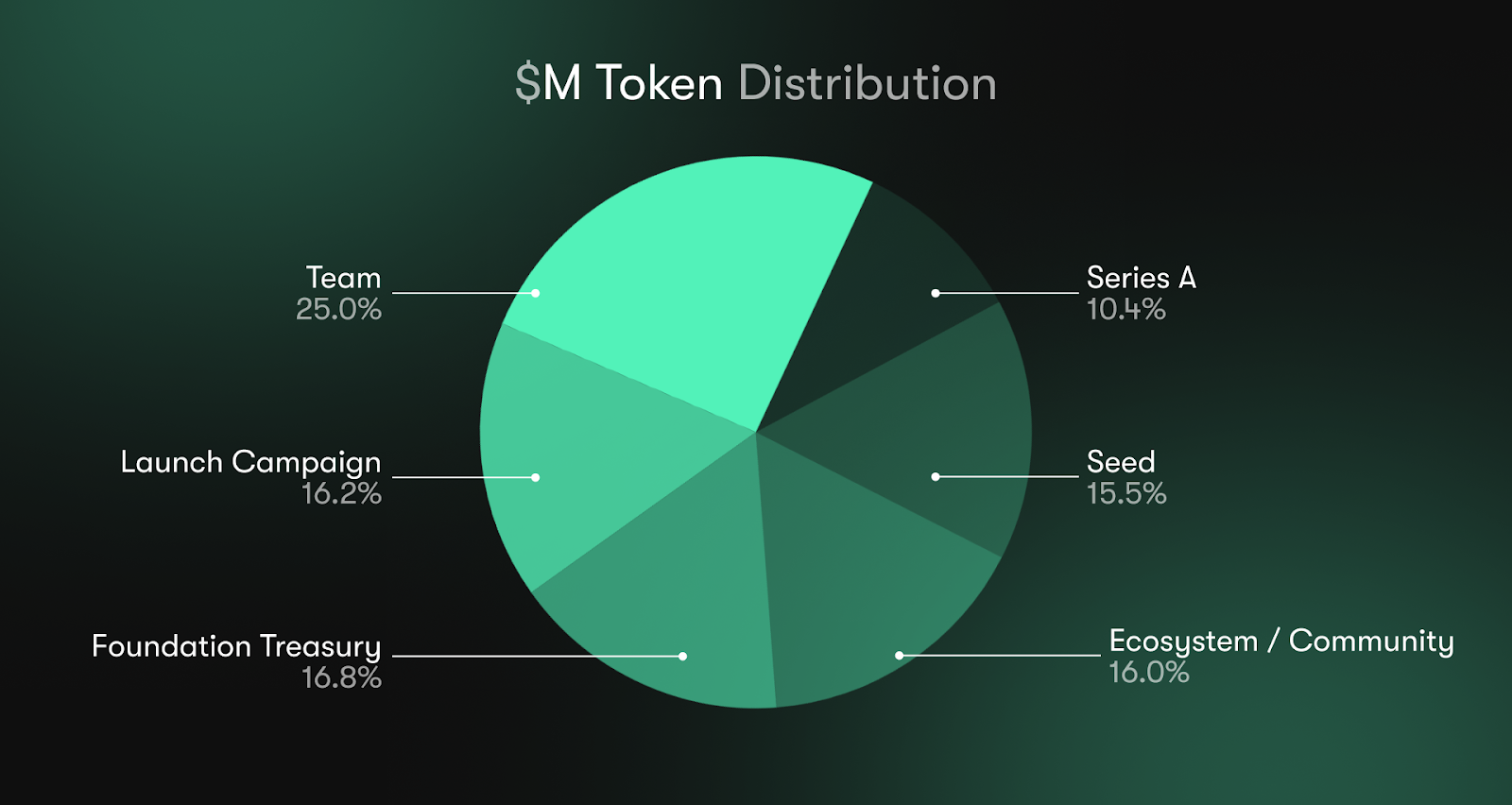

$M Token Distribution

- Launch Campaign & Airdrop: 16.2%

- Ecosystem & Community: 16%

- Foundation Treasury: 16.8%

- Seed Backers: 15.5%

- Series A Backers: 10.4%

- Team: 25%

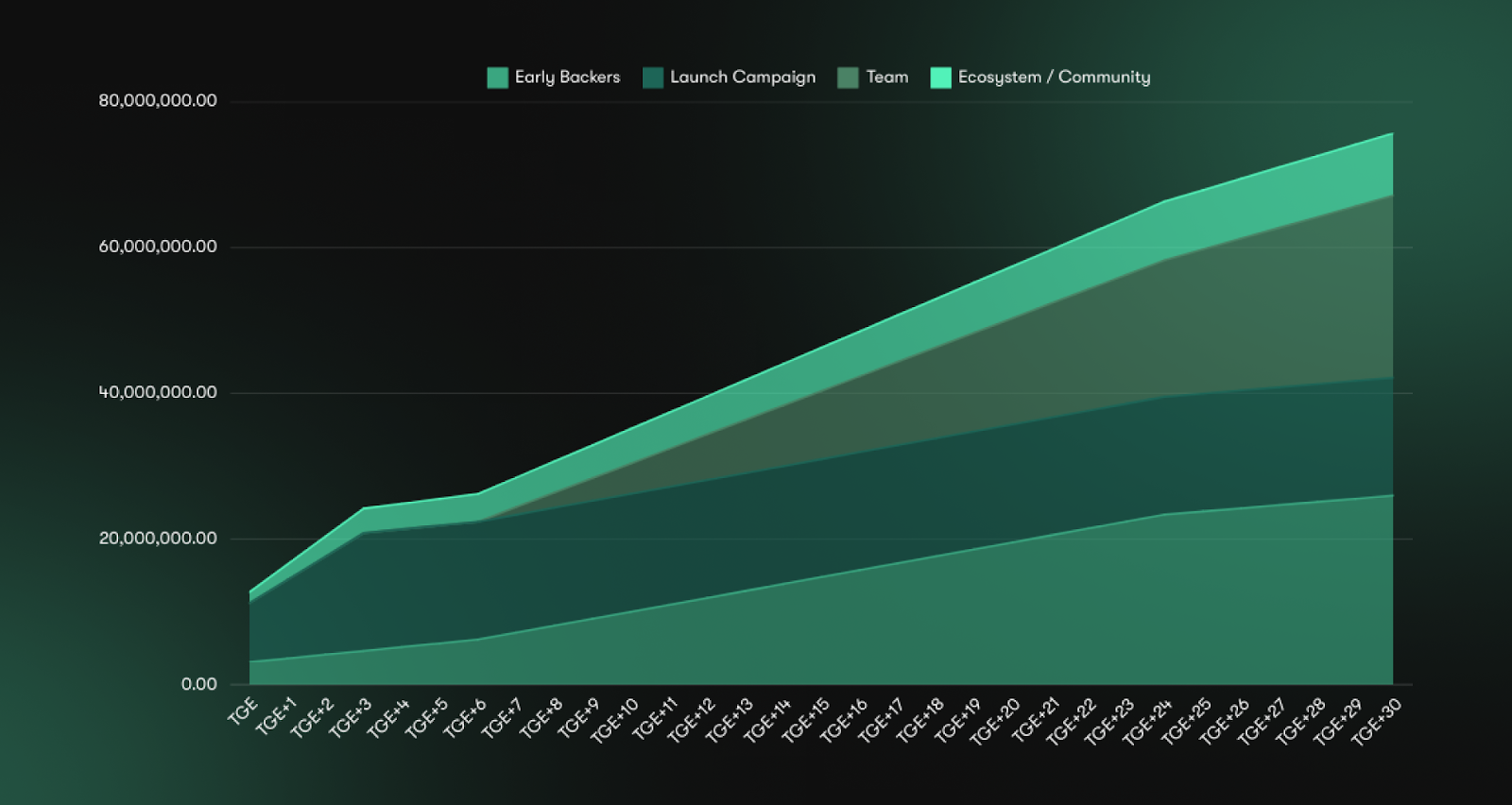

Vesting:

Mantis Investors

Among Mantis’s investors, CertiK Ventures is one of the notable institutional investors that supported the project at an early stage. CertiK Ventures’ investment was made in an undisclosed round classified as Tier 4 in the venture capital category. This support contributes to Mantis growing on a strong foundation in terms of security and infrastructure.

Mantis ($M) Team

Omar Zaki (0xbrainjar): Co-Founder & CEO Founder of Composable Finance and CEO of Mantis. He is actively working on blockchain infrastructure, cross-chain systems, and modular finance architectures.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.