In the world of cryptocurrency and blockchain, Decentralized Physical Infrastructure Networks (DePIN) hold the potential to revolutionize how miners and artificial intelligence (AI) developers source their physical infrastructure. Standing out in this space is PinLink (PIN), the first RWA-tokenized DePIN protocol, which reduces costs for miners and AI developers while offering new revenue streams for DePIN asset owners. So, what exactly is PinLink, how does it work, and why is it gaining attention? Let’s dive in and explore in detail!

What is PinLink (PIN)?

PinLink is a decentralized platform operating on the Ethereum network, tokenizing real-world assets (RWA) to bring together miners, AI developers, and DePIN asset owners. DePINs use token rewards to connect owners of physical infrastructure assets like GPUs, TPUs, CPUs, or cloud storage with users looking to rent these resources. However, existing DePINs have struggled to deliver significant cost savings compared to centralized models, leading to limited adoption in the AI market. PinLink addresses this issue with its RWA-tokenized DePIN model, reducing costs and providing flexible revenue opportunities for asset owners.

PinLink’s innovative approach allows DePIN asset owners to not only rent out their assets but also mint ERC-1155 tokens representing those assets, which can be sold to third parties seeking passive income. This enhances capital efficiency and introduces a new revenue source to the ecosystem. The $PIN token serves as the platform’s payment and governance token, offering a staking mechanism to incentivize users.

PinLink’s Key Features

PinLink stands out in the DePIN ecosystem with its RWA-tokenized model and PinAI performance optimization suite. Here are the protocol’s core features:

1. RWA-Tokenized DePIN Model

PinLink enables DePIN assets to be tokenized as ERC-1155 tokens. Asset owners can sell all or part of these tokens to generate income. For example, a GPU owner can earn regular income by renting out their asset or sell portions of the ERC-1155 tokens for immediate capital. This model offers asset owners flexibility between short-term capital and long-term rental income.

2. Service User Rebate Fund

PinLink takes a 20% commission on RWA ERC-1155 token sales and invests it into the Service User Rebate Fund. This fund is deployed in low-risk, yield-bearing strategies such as DAI Savings Rate, Ondo US Dollar Yield, or Pendle PT-YT. The yields are used as rebates to reduce the rental costs for AI developers, providing a cost advantage.

3. PinAI Performance Optimization Suite

PinLink’s PinAI suite enhances DePIN asset performance using machine learning tools. Neural networks learn from historical data to ensure tasks are distributed efficiently. Adaptive load balancing prevents assets from being overworked or underutilized. Task and data parallelism, along with optimized computational kernels, enable PinLink to deliver enterprise-grade, scalable solutions for AI developers.

4. Dual Revenue Model

PinLink offers DePIN asset owners two revenue streams: rental income and RWA token sales. Asset owners can dynamically balance these options based on their financial goals. For instance, an owner looking to acquire more assets can sell RWA token portions to raise capital, creating an asset accumulation flywheel.

5. Enterprise-Grade Solutions

Unlike existing DePIN marketplaces that rely on idle consumer device capacity, PinLink acquires its own DePIN assets and applies a rigorous vetting process for third-party assets. This ensures low-latency, high-reliability, and energy-efficient computing power tailored to AI developers’ needs.

6. AiFi Ecosystem

PinLink allows DePIN asset owners to use their ERC-1155 tokens as collateral in DeFi protocols. For example, while earning rental income from a GPU, owners can use its token to borrow ETH. PinLink aims to expand the AiFi (AI + DeFi) ecosystem by partnering with lending, yield, and perpetuals platforms.

How PinLink (PIN) Works

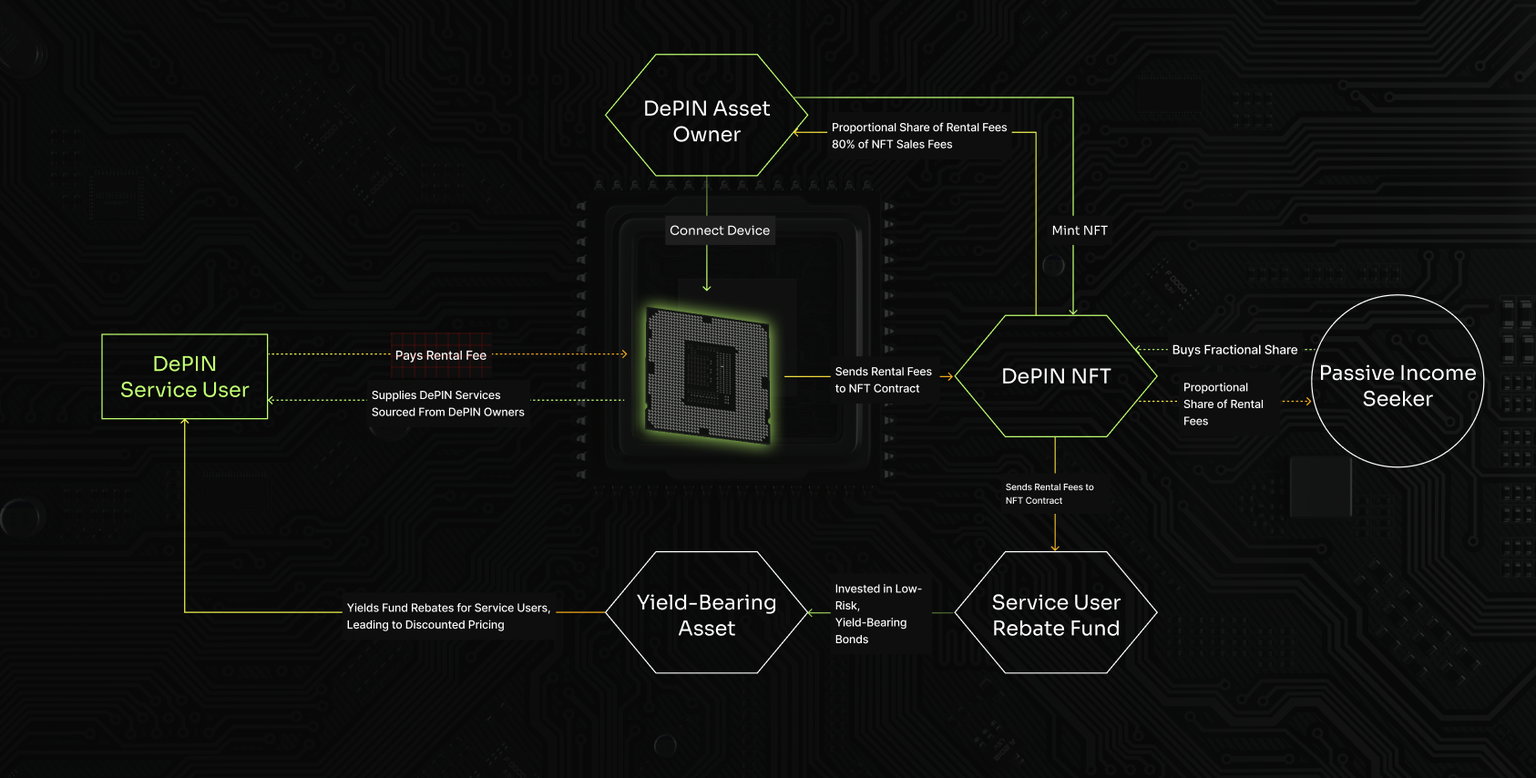

PinLink’s operations are optimized for stakeholders’ needs. The process works as follows:

-

Asset Connection: A DePIN asset owner (e.g., Bob) connects their asset, such as a GPU, to the PinLink network.

-

RWA Token Minting: An ERC-1155 token representing the asset is minted and transferred to Bob.

-

Renting: AI developers rent the asset’s capacity using $PIN tokens. Rental income goes to a contract tied to the RWA token.

-

Revenue Distribution: If Bob owns the entire RWA token, he receives all rental income. If he sells shares (e.g., 30% to Mike, 30% to Julia), the income is distributed proportionally.

-

RWA Sales: Bob can sell portions of the RWA token for ETH or USDT. A 20% commission goes to the Service User Rebate Fund.

-

Rebate Fund: The fund is invested in low-risk yield strategies, and the returns are distributed as discounts to AI developers.

PinLink’s Benefits to Stakeholders

AI Developers

-

Goal: Access low-cost, enterprise-grade computing power.

-

Benefit: Discounted access to low-latency, scalable infrastructure optimized by PinAI.

DePIN Asset Owners

-

Goal: Monetize assets with flexible revenue options.

-

Benefit: Flexibility to earn short-term capital or long-term rental income.

Passive Income Seekers

-

Goal: Earn income without purchasing an entire DePIN asset.

-

Benefit: Purchase RWA token shares for perpetual passive income.

PinLink

-

Benefit: Earns 2% from rental payments and RWA sales, and 20% from rebate fund yields. The protocol acquires DePIN assets to create a capital accumulation flywheel.

PinLink’s Staged Rollout Plan

PinLink follows a two-stage rollout plan:

-

Stage One: Only protocol-owned DePIN assets are accepted, allowing optimization of the RWA-tokenized model and ensuring enterprise-grade solutions.

-

Stage Two: Third-party DePIN asset owners can join after passing a rigorous vetting process.

PinLink initially focuses on GPU/CPU/TPU and cloud storage capacity for AI developers, later expanding to miners and dApp developers. Long-term, it plans to extend its RWA-tokenized DePIN model to all industries needing physical infrastructure, from IoT sensors to consumer wireless networks.

PinLink (PIN) Tokenomics

$PIN is the core token of the PinLink ecosystem with two main functions:

-

DePIN Output Payment: AI developers use $PIN to rent asset capacity.

-

Staking Revenue: $PIN holders can stake tokens to earn a share of protocol fees.

Token Details:

-

Symbol: PIN

-

Total Supply: 100,000,000

-

Network: Ethereum

-

Token Standard: ERC-20 (RWAs use ERC-1155)

-

Distribution:

-

80% Uniswap Liquidity Pool

-

10% Staking rewards (vested over 24 months)

-

10% PinLink treasury (CEX and partnerships)

-

Revenue Model:

-

2% platform fee (Pinshop purchases)

-

2% RWA sales fee (USDCshop)

-

20% rebate fund yield fee

PinLink Team

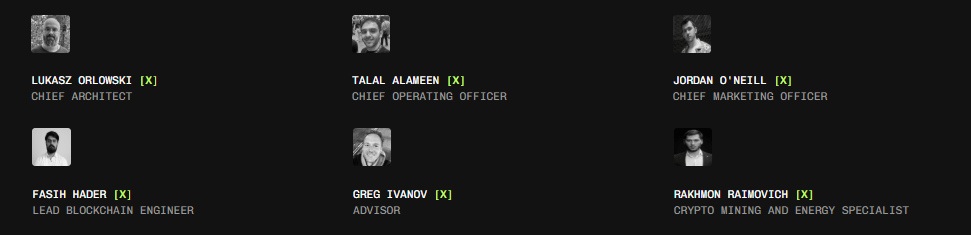

PinLink is led by a team of blockchain and infrastructure experts. Lukasz Orlowski (Chief Architect), previously VP of Engineering at Enjin, led a $1B+ blockchain venture and developed enterprise solutions at Intel.

Talal AlAmeen (COO) managed retail operations in Bahrain and specializes in mining and hardware deployment.

Jordan O’Neill (CMO) scaled a Web3 marketing agency to $7M ARR and has experience in AI and RWA fundraising.

Fasih Hader (Lead Blockchain Engineer) is a Solidity expert with 6+ years in DeFi and DApps.

Greg Ivanov (Advisor) spent 12 years at Google in product strategy and developer ecosystems.

Rakhmon Raimovich (Crypto Mining and Energy Specialist) shapes strategic goals with 8+ years of experience in mining and renewable energy.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.